Georgia Financial Website Disclaimer

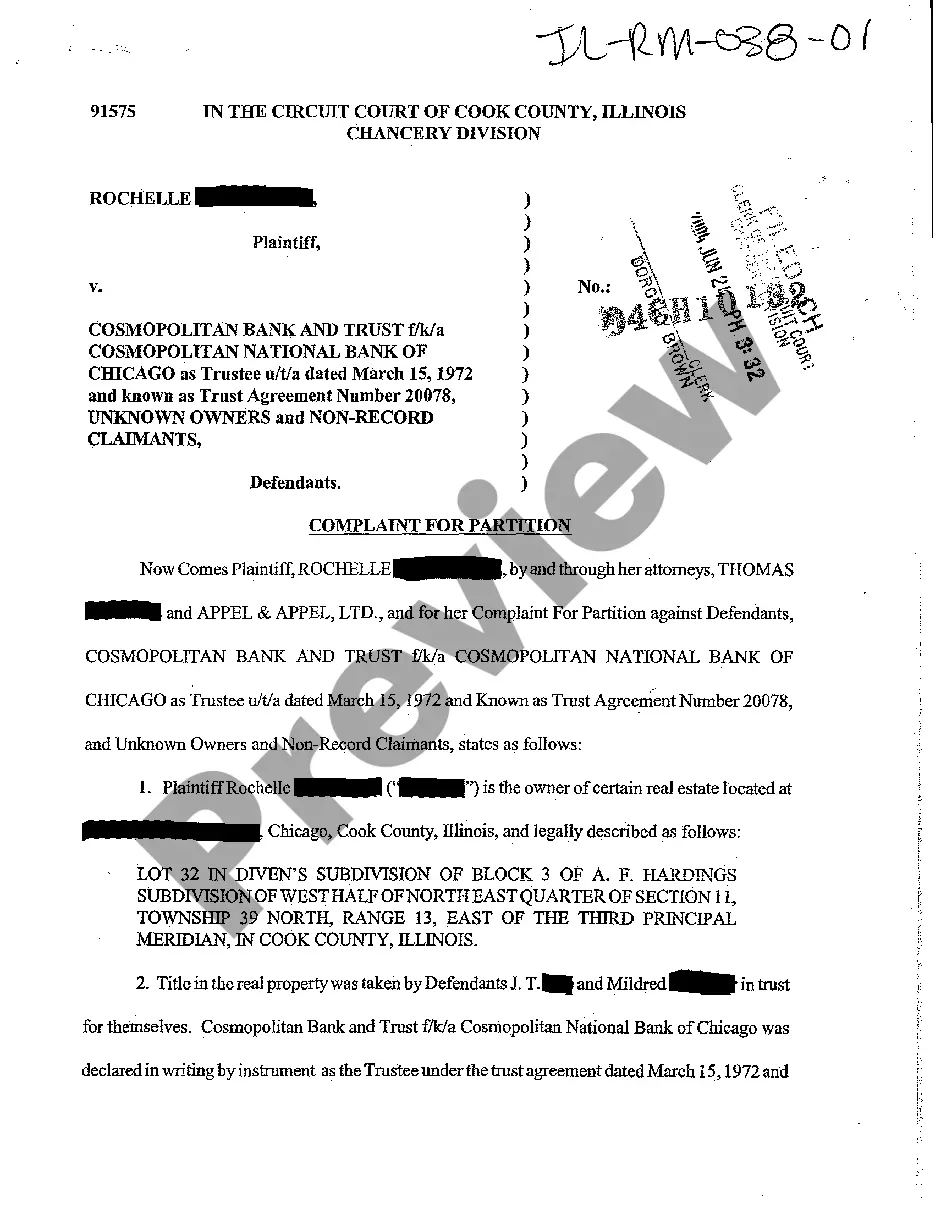

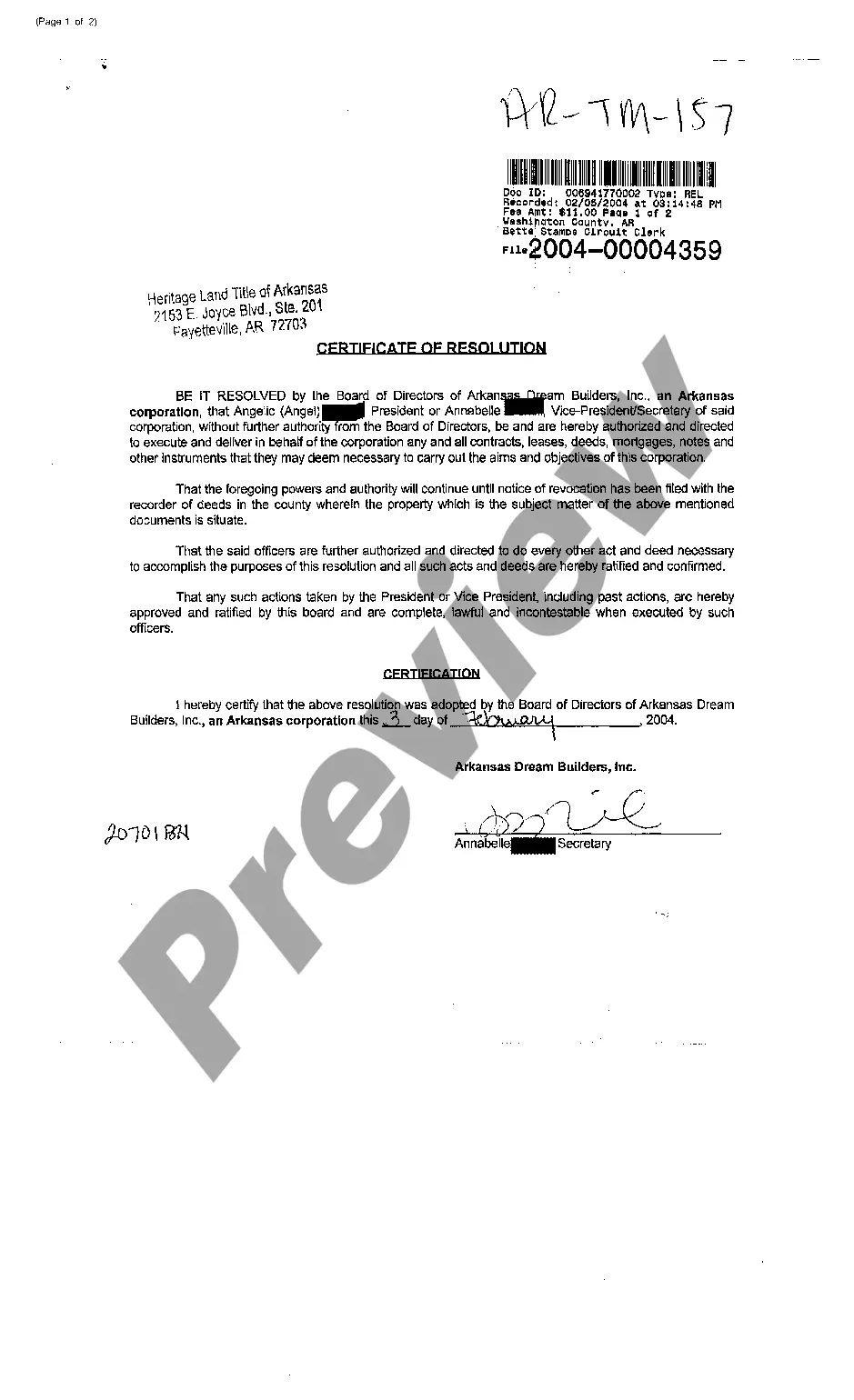

Description

How to fill out Financial Website Disclaimer?

Have you ever found yourself in a situation where you require documents for various business or personal needs almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Georgia Financial Website Disclaimer, tailored to meet state and federal requirements.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, complete the required information to create your account, and purchase your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Financial Website Disclaimer template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Review button to examine the form.

- Check the details to ensure you have selected the right form.

- If the form does not meet your requirements, use the Search box to find the form that fits your needs.

Form popularity

FAQ

Yes, you may still need to file Georgia state taxes even if you owe nothing. Filing can help you maintain accurate records and claim any potential refunds. Staying informed about your tax responsibilities is crucial for smooth financial management. The Georgia Financial Website Disclaimer provides resources to help you navigate these requirements effectively.

The minimum income requirement for filing taxes in Georgia varies by your filing status and age. For instance, single filers under a certain age might only need to file if their income exceeds the standard deduction. For accurate information tailored to your situation, refer to the Georgia Financial Website Disclaimer to fully understand your obligations.

Generally, if you made less than $5000, you might not be required to file a tax return in Georgia. However, the requirement may vary based on your age, filing status, and any tax credits you wish to claim. It's wise to check the specific guidelines to ensure compliance. The Georgia Financial Website Disclaimer offers valuable information on these topics.

In Georgia, the minimum income level that requires filing a tax return depends on your filing status and age. Typically, if your income is below the standard deduction amount, you may not need to file. However, specific exceptions exist, especially if you qualify for certain credits. For clarity on your situation, consult the Georgia Financial Website Disclaimer.

Yes, you are required to file a Georgia tax return if you meet the income thresholds established by the state. Even if you earned only a small amount, certain circumstances may still obligate you to file. It's essential to understand these requirements to avoid penalties. For detailed guidance, refer to our Georgia Financial Website Disclaimer.