Georgia Building Loan Agreement between Lender and Borrower

Description

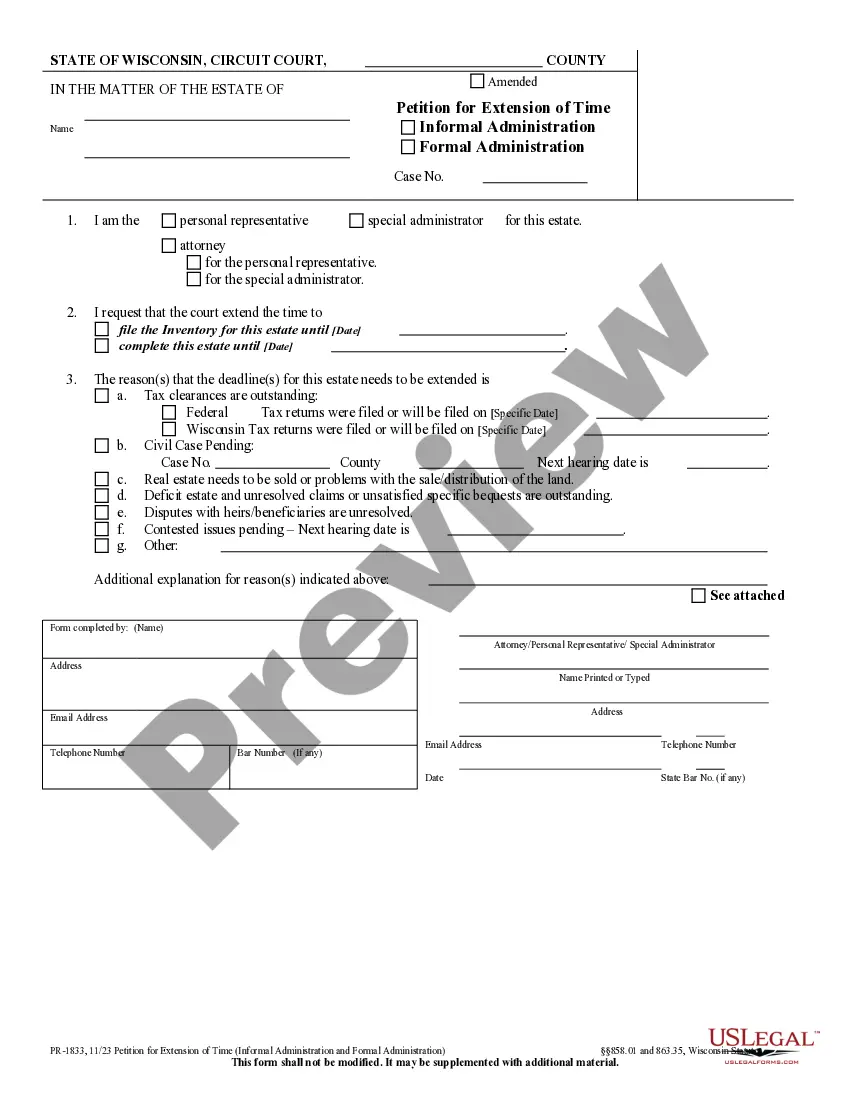

How to fill out Building Loan Agreement Between Lender And Borrower?

US Legal Forms - among the biggest libraries of lawful forms in the United States - offers a wide array of lawful document layouts you may download or print. Making use of the website, you will get thousands of forms for enterprise and specific functions, sorted by groups, suggests, or keywords.You will discover the most recent variations of forms just like the Georgia Building Loan Agreement between Lender and Borrower in seconds.

If you already possess a monthly subscription, log in and download Georgia Building Loan Agreement between Lender and Borrower from the US Legal Forms catalogue. The Obtain key will show up on each form you see. You get access to all in the past saved forms in the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, listed here are straightforward instructions to help you started:

- Ensure you have picked the right form for the area/state. Click on the Preview key to check the form`s information. Browse the form information to actually have selected the right form.

- When the form doesn`t fit your needs, use the Lookup area on top of the display screen to find the one who does.

- If you are content with the shape, affirm your selection by visiting the Buy now key. Then, select the rates program you like and provide your credentials to register for an accounts.

- Method the purchase. Use your Visa or Mastercard or PayPal accounts to complete the purchase.

- Find the file format and download the shape on your own device.

- Make alterations. Load, change and print and sign the saved Georgia Building Loan Agreement between Lender and Borrower.

Each and every format you put into your account lacks an expiry date and it is your own for a long time. So, in order to download or print yet another duplicate, just check out the My Forms section and click on around the form you want.

Gain access to the Georgia Building Loan Agreement between Lender and Borrower with US Legal Forms, one of the most considerable catalogue of lawful document layouts. Use thousands of skilled and state-distinct layouts that fulfill your organization or specific demands and needs.

Form popularity

FAQ

A loan agreement is a legally binding contract between the borrower(s) and the lender that states the terms of borrowing the loan, including the amount to be repaid, the interest rate, and any other conditions.

Loan agreement - Typically refers to a written agreement between a lender and borrower stipulating the terms and conditions associated with a financing transaction and in addition to those included to accompanying note, security agreement and other loan documents.

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.

A credit agreement is a legally binding agreement entered into between a lender and a borrower. It outlines all of the terms of the borrowing relationship, such as the interest rate, costs of originating the loan, and other borrower and lender rights and obligations.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

A Loan Agreement, also known as a term loan, demand loan, or a loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the amount of the loan, any interest charges, the repayment plan, and payment dates.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.