Georgia Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

If you require to summarize, acquire, or generate authentic document templates, utilize US Legal Forms, the largest assemblage of authentic documents accessible online.

Leverage the site's user-friendly search functionality to locate the documents you need. Numerous templates for business and personal purposes are categorized by types and regions, or keywords.

Utilize US Legal Forms to locate the Georgia Simple Equipment Lease with just a few clicks.

Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Georgia Simple Equipment Lease.

- You can also access documents you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other models of the legal form template.

- Step 4. Once you have identified the form you need, click the Get now button.

Form popularity

FAQ

Yes, many equipment leases are classified as operating leases. A Georgia Simple Equipment Lease often falls into this category, allowing businesses to use the equipment without owning it. This type of lease usually provides tax advantages and keeps equipment off the balance sheet. Understanding lease structures can help you choose the best option for your business needs.

No, a lease agreement does not need to be notarized in Georgia for it to be valid. However, for your peace of mind and to bolster your Georgia Simple Equipment Lease, considering notarization can be beneficial. It offers a layer of protection and can streamline enforcement of the lease should any issues arise down the line.

A good equipment lease rate in Georgia typically depends on several factors, including the type of equipment, its condition, and the lease duration. On average, rates can range from 1% to 3% of the equipment's value per month. To find the best deal, researching comparable leases and consulting a professional can help you determine a fair rate for your Georgia Simple Equipment Lease.

In Georgia, notarization is not a legal requirement for a lease agreement to be enforceable. However, having your Georgia Simple Equipment Lease notarized can provide additional security and clarity, especially in disputes. It strengthens the document's credibility and can facilitate easier enforcement if challenges arise later.

A lease can be considered invalid in Georgia if it lacks essential elements such as mutual consent, a lawful purpose, and defined terms. Additionally, if the lease fails to specify key details like duration or payment terms, it may not hold up in court. To ensure your Georgia Simple Equipment Lease is valid, it is wise to carefully draft the agreement and include all necessary information.

In Georgia, notarization is not mandatory for a lease agreement, including a Georgia Simple Equipment Lease. However, having the lease notarized can strengthen its enforceability in case of disputes. It adds a layer of professionalism and verifies the identities of the parties involved. You can find detailed templates and guidance on USLegalForms that help ensure your lease meets any necessary legal standards.

Getting out of an equipment lease depends on the lease terms and conditions. Many leases have specific clauses that outline early termination fees or options available to the lessee. Reviewing your Georgia Simple Equipment Lease can provide insights into your options and potential consequences.

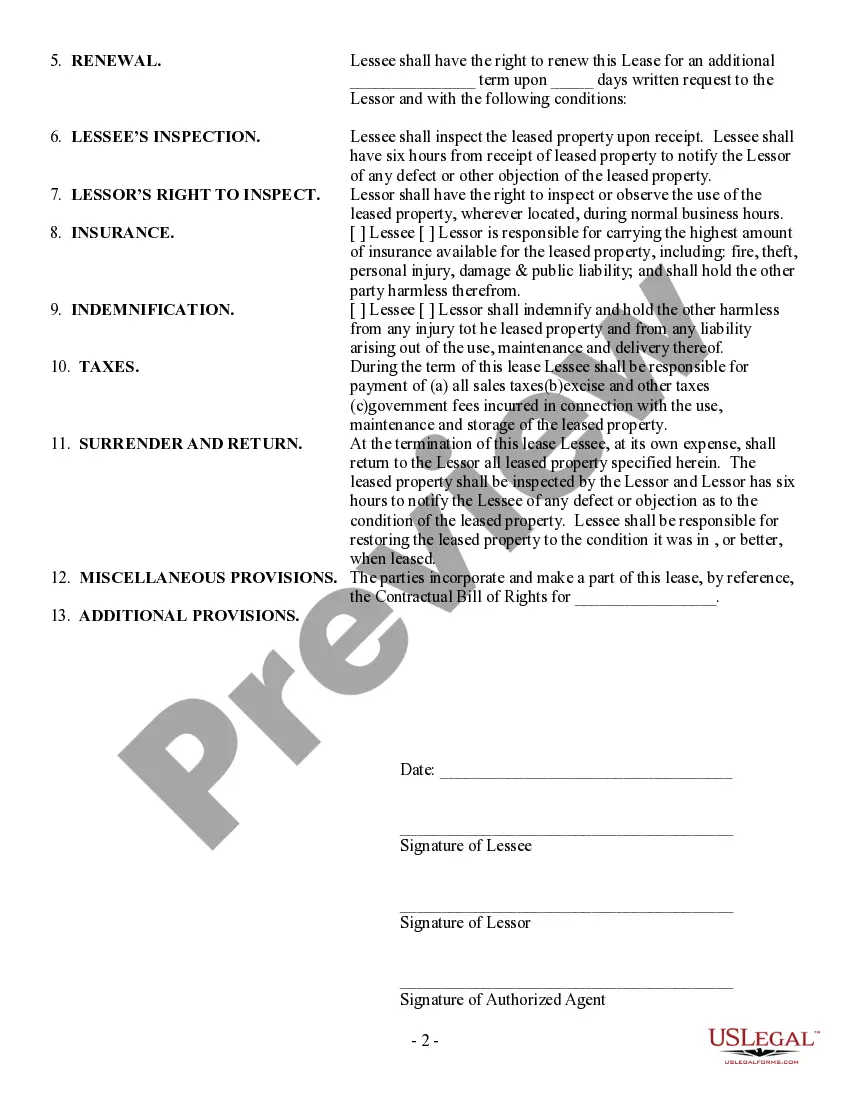

Writing a lease agreement for equipment involves clear definitions of the equipment, terms of use, payment arrangements, and liability clauses. Consider using a Georgia Simple Equipment Lease template to ensure no critical aspect is overlooked. Clarity in terms will protect both parties involved in the lease.

A master lease agreement for equipment is a comprehensive document that allows a lessee to lease multiple pieces of equipment under one contract. This simplifies the management process and may offer more favorable terms over time. For businesses looking for flexibility, a Georgia Simple Equipment Lease might be a great option.

Leasing equipment to your LLC requires creating a formal agreement that specifies the equipment, lease term, and payment terms. A Georgia Simple Equipment Lease can provide a structured approach, ensuring compliance with state laws. It is advisable to consult a legal expert to confirm that the lease serves the best interests of the LLC.