This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a diverse range of legal document types available for purchase or printing.

Through the website, you can access thousands of forms for business and personal needs, categorized by type, state, or keywords. You can obtain the most recent updates of forms like the Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property in a matter of minutes.

If you are a subscriber, Log In to download the Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property from the US Legal Forms collection. The Download button will be visible on every form you review. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Utilize a Visa or Mastercard or PayPal account to finalize the purchase.

Select the format and download the form to your device. Modify the form as needed, then complete, print, and sign the downloaded Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property.

Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print an additional version, simply navigate to the My documents section and click on the form you require.

Access the Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property via US Legal Forms, the most extensive repository of legal document templates. Utilize countless professional and state-specific templates that cater to your business or personal requirements and specifications.

- Ensure you have selected the correct form for your area/region.

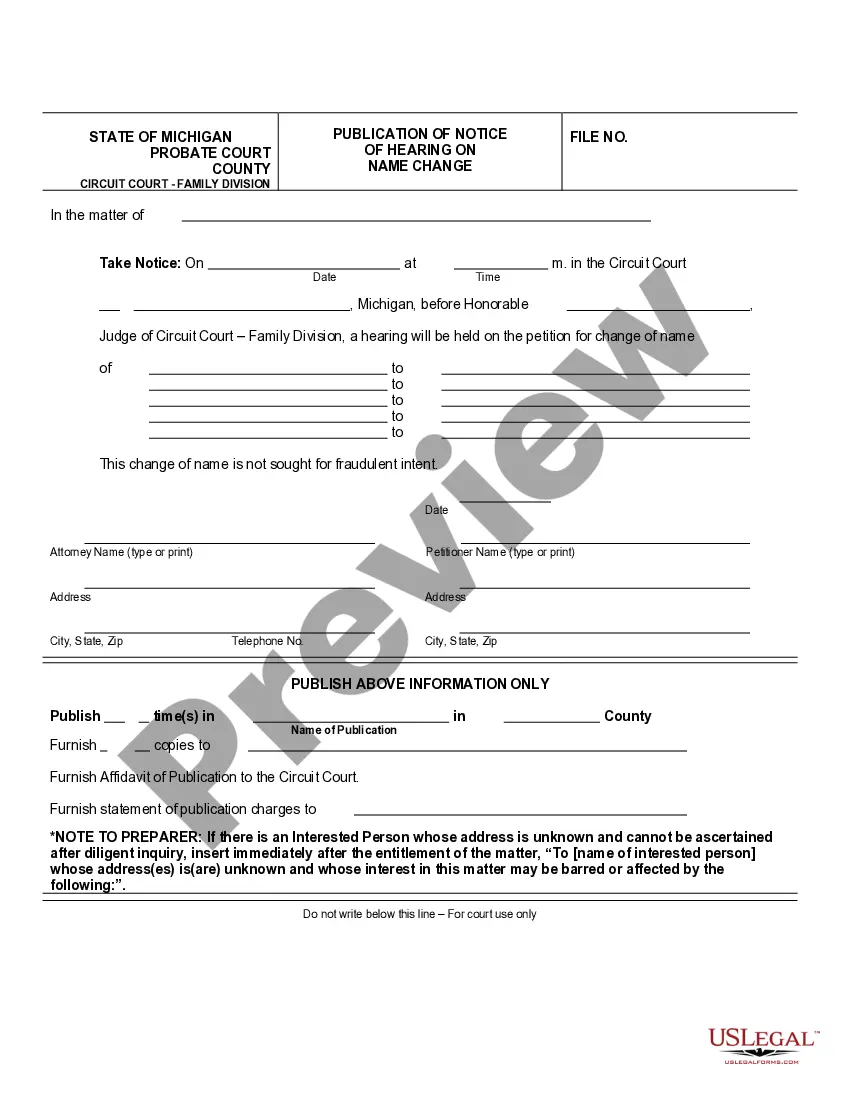

- Click the Preview button to examine the content of the form.

- Review the form description to confirm you have selected the right one.

- If the form does not meet your needs, utilize the Search field at the top of the page to locate the appropriate one.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Next, select your desired pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Property owned by a dissolved company may be subject to sale or transfer based on legal requirements and the provisions detailed in the Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property. If the company has remaining obligations, the property may be used to satisfy debts before any distribution occurs. Engaging with legal experts can help you navigate this complex scenario effectively.

The property owned by a company that is dissolving usually needs to be handled according to applicable laws and the terms set forth in the Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property. In many cases, this property must be sold or transferred, allowing for the settlement of any outstanding liabilities. Ultimately, it is essential to manage this process thoughtfully to avoid complications during the dissolution.

When a company is dissolved, its assets are typically liquidated or distributed among its owners and creditors. This process often requires compliance with state laws and obligations outlined in the Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property. It is crucial to follow the proper procedures to ensure that all debts are settled and remaining assets are fairly allocated.

In Georgia law, a conflict of interest refers to a situation where a person's professional duties conflict with their personal interests. For example, entering into a Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property can trigger scrutiny if undisclosed motivations exist. The law mandates individuals and entities to disclose any potential conflicts to promote fairness and transparency. Consulting with legal experts, such as those at US Legal Forms, can provide clarity on navigating these complex scenarios.

The four main types of conflict of interest include personal, professional, institutional, and financial conflicts. Personal conflicts arise from relationships, professional conflicts concern job responsibilities, institutional conflicts relate to organizational interests, and financial conflicts involve monetary gains. In scenarios involving a Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property, recognizing these types can prevent disputes. Using clear agreements and disclosures helps maintain integrity and fosters positive business relationships.

A conflict of interest occurs when an individual has competing interests that can influence their decision-making. For instance, if a real estate agent has a personal stake in a property subject to a Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property, they may face a conflict. It is essential to disclose any such interests to avoid legal complications. Addressing conflicts proactively can enhance trust and transparency among parties involved.

Legal conflicts of interest arise when an individual's responsibilities are compromised by personal interests. For instance, if a business owner enters a Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property while having an undisclosed financial stake in a competing venture, this creates a conflict. Other examples include representing clients with opposing interests and engaging in business transactions that benefit friends or family over the company. Identifying these conflicts early can save both time and resources.

To dissolve a business in Georgia, you must follow a series of steps that comply with state law. First, members should agree to the dissolution and document this decision. Then, file the necessary forms, such as the Articles of Dissolution, with the Georgia Secretary of State. A Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property can simplify the process, especially when dealing with real property distributions. You can find essential resources on uslegalforms to ensure you meet all legal requirements.

A judicial dissolution of an LLC in Georgia occurs when a court orders the termination of the business entity. This process typically happens when members of the LLC cannot agree on key issues, or there is misconduct affecting the business. It's essential to understand how a Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property plays a role in this process, as it may help in clarifying property interests among members. Seeking guidance from platforms like uslegalforms can provide the necessary documents and support for a smooth dissolution.

Dissolving a business in Georgia involves several key steps, including obtaining necessary approvals and properly filing administrative documents with the state. You will need to address any debts, settle outstanding obligations, and follow your business's operating agreement guidelines. A Georgia Agreement Dissolving Business Interest in Connection with Certain Real Property helps clarify these steps and ensures your assets are managed appropriately during dissolution.