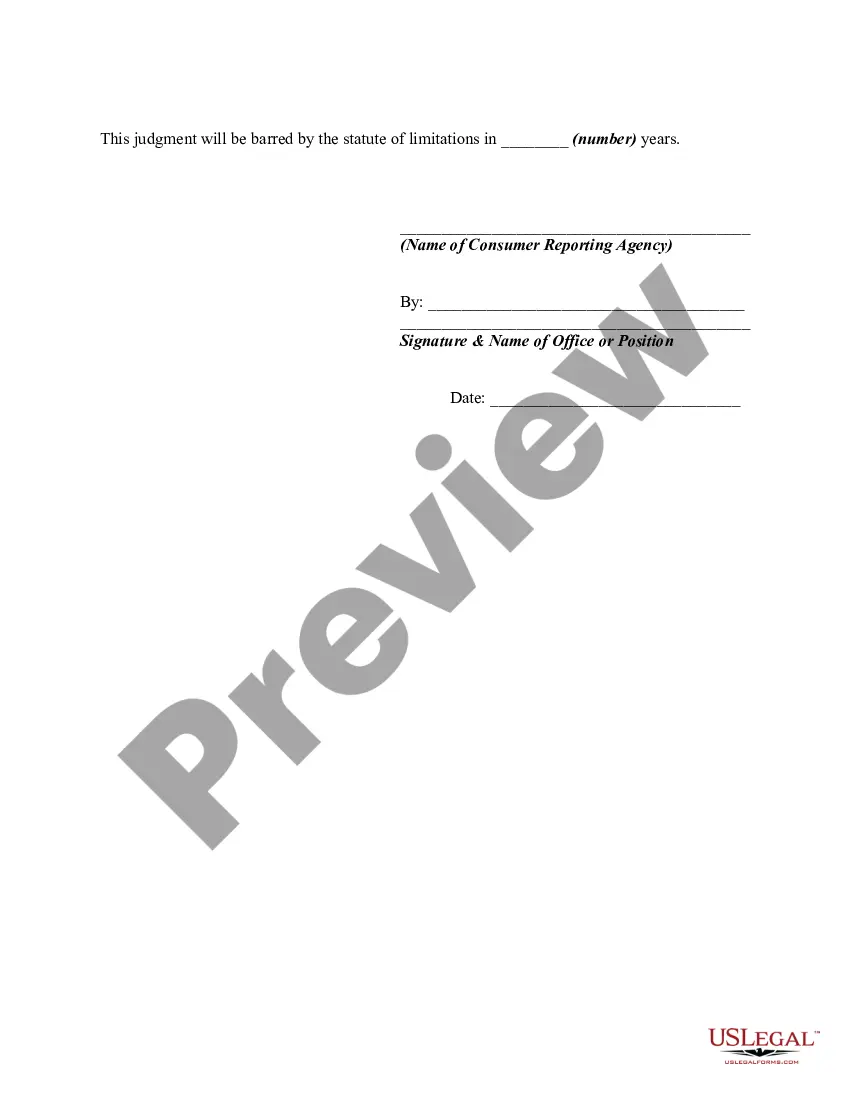

No particular language is necessary for this type of report so long as the report clearly conveys the necessary information.

Georgia Report to Creditor by Collection Agency Regarding Judgment Against Debtor

Description

How to fill out Report To Creditor By Collection Agency Regarding Judgment Against Debtor?

If you have to full, obtain, or print lawful file templates, use US Legal Forms, the greatest collection of lawful kinds, that can be found on the web. Use the site`s simple and easy handy research to get the files you require. A variety of templates for organization and individual uses are categorized by types and says, or search phrases. Use US Legal Forms to get the Georgia Report to Creditor by Collection Agency Regarding Judgment Against Debtor in a handful of mouse clicks.

In case you are already a US Legal Forms client, log in to the accounts and click the Down load option to have the Georgia Report to Creditor by Collection Agency Regarding Judgment Against Debtor. Also you can entry kinds you earlier acquired from the My Forms tab of your own accounts.

If you are using US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form for your right town/nation.

- Step 2. Take advantage of the Review option to examine the form`s information. Do not forget about to read the explanation.

- Step 3. In case you are not satisfied using the form, take advantage of the Search field towards the top of the monitor to discover other variations in the lawful form web template.

- Step 4. Once you have located the form you require, go through the Buy now option. Pick the prices prepare you prefer and add your credentials to register on an accounts.

- Step 5. Procedure the purchase. You should use your credit card or PayPal accounts to complete the purchase.

- Step 6. Choose the formatting in the lawful form and obtain it on the product.

- Step 7. Total, change and print or signal the Georgia Report to Creditor by Collection Agency Regarding Judgment Against Debtor.

Each lawful file web template you get is your own permanently. You might have acces to each and every form you acquired with your acccount. Click the My Forms segment and decide on a form to print or obtain once again.

Be competitive and obtain, and print the Georgia Report to Creditor by Collection Agency Regarding Judgment Against Debtor with US Legal Forms. There are millions of expert and state-particular kinds you may use for your organization or individual demands.

Form popularity

FAQ

The Official Code of Georgia Annotated 9-12-60 addresses the general terms and conditions of judgments in the State of Georgia. This statute was designed to clearly define the force an effect of a judgment taken within Georgia. In Georgia, a judgment is valid and enforceable for seven years from the date it is granted.

Summary: You can pay off a debt to the original creditor if they haven't sold the account to a debt collection agency yet. There is a chance the debt may have been transferred to collections, but that doesn't mean it's too late to reach out to your creditor and settle the debt once and for all.

If you've already paid the debt Don't send original documents ? only copies ? so you can keep the originals as proof. If you don't have documentation of your payments or letters saying you've paid off the debt, you can contact the creditor who you originally paid to get this information.

Here are a few suggestions that might work in your favor: Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing. ... Dispute the debt on your credit report. ... Lodge a complaint. ... Respond to a lawsuit. ... Hire an attorney.

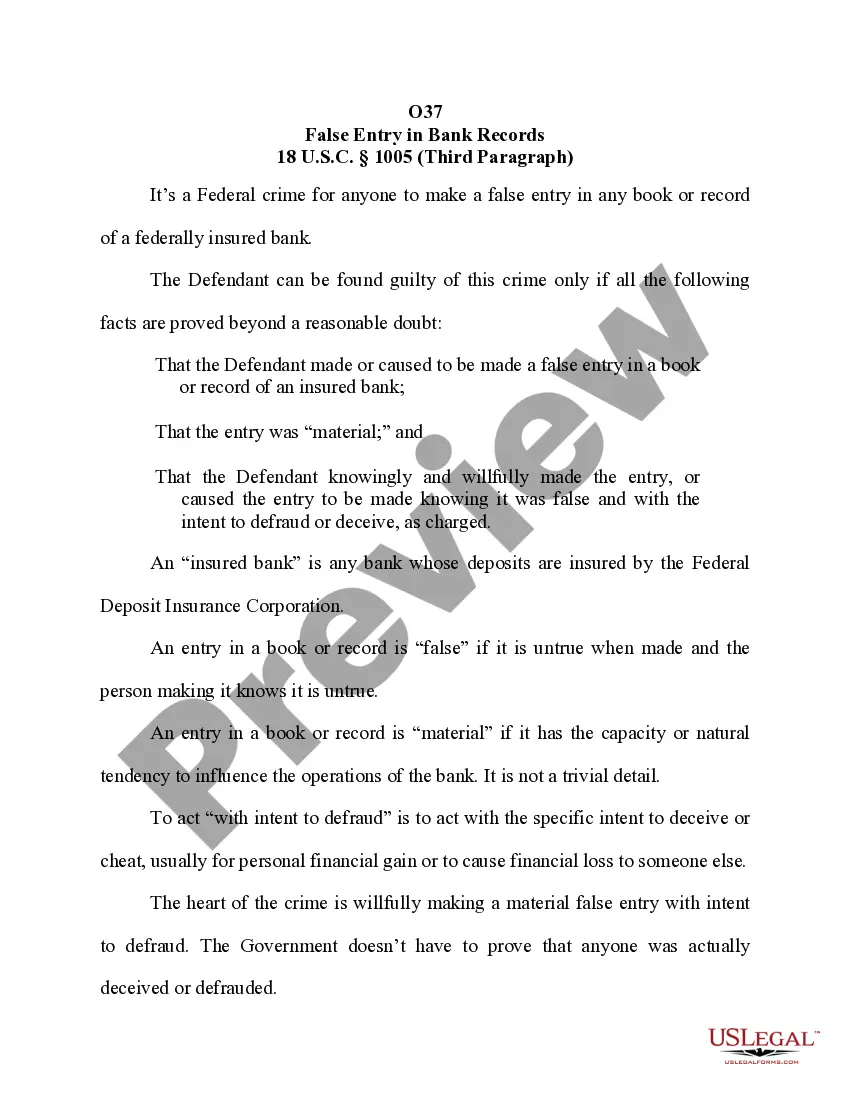

While debt collectors are not prohibited from making reasonable attempts to collect legitimate debts or from suing you, consumer protection laws do prohibit deceptive and unfair debt collection practices and protect you from harassment, abuse and invasion of privacy.

If a collection is on your report in error, dispute it But that doesn't always happen. For debts that linger longer than they should, file a dispute with any credit bureau that still lists the debt.

Until the debt is either paid or forgiven, you still owe the money. This is true even if it's a credit card debt that is sold to a collection agency and even if you think it's unfair.

Therefore, even if collection agencies came under the umbrage of the law, they can still report to the credit bureau without notifying you. This would cause the debt to appear on your credit report, which will cause your credit score to drop.