Georgia Receipt as Payment in Full

Description

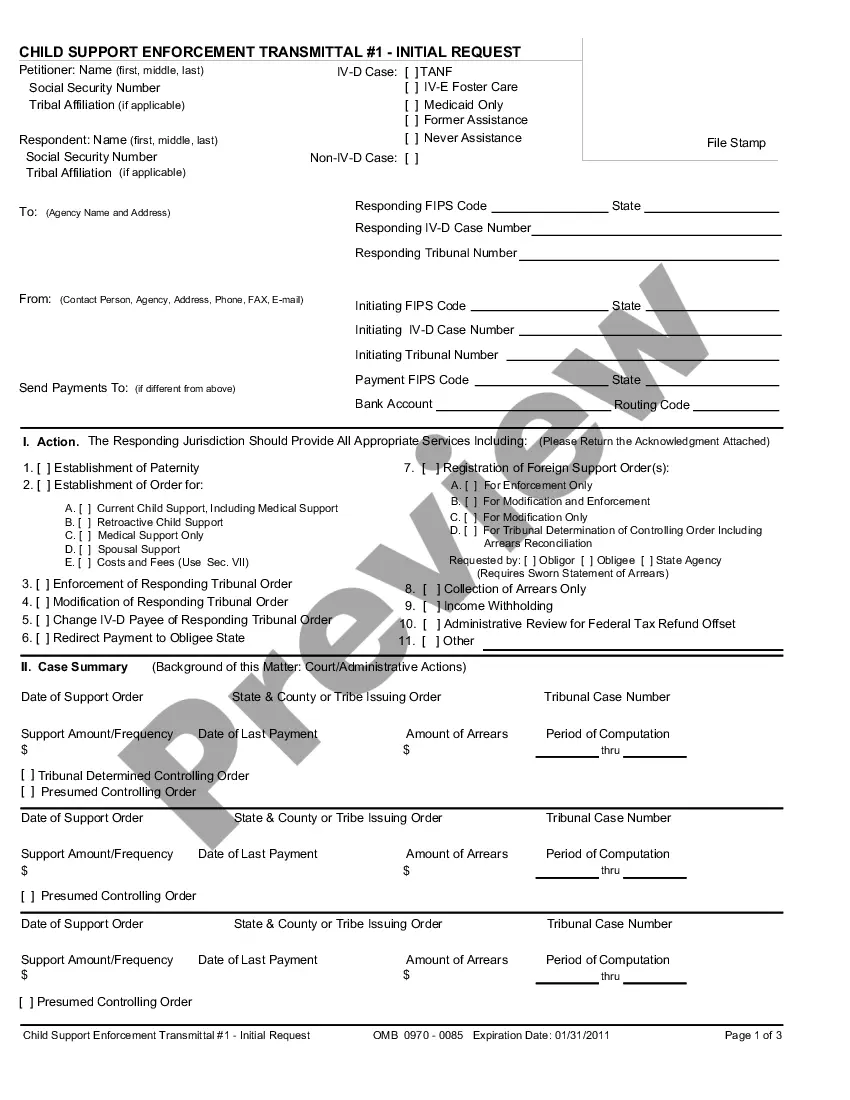

How to fill out Receipt As Payment In Full?

It is feasible to devote numerous hours online attempting to locate the legal document format that meets the federal and state requirements you require.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can easily obtain or print the Georgia Receipt as Payment in Full from their service.

If available, use the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Georgia Receipt as Payment in Full.

- Each legal document format you acquire is yours permanently.

- To obtain another copy of a purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your state/city of preference.

- Review the form outline to verify you have chosen the appropriate form.

Form popularity

FAQ

You can file GA Form 500 either by mail or online, depending on your preference. If you opt to file by mail, be sure to send it to the appropriate address listed on the form. To simplify your process, uslegalforms provides resources tailored for understanding the Georgia Receipt as Payment in Full requirement.

For mailing your federal tax return in Georgia, consult the IRS website for the most current address. Ensure to send it to the correct location based on the form you are filing. If you also need assistance with your Georgia Receipt as Payment in Full, uslegalforms can empower you with easy-to-follow recommendations.

Yes, you can file your Georgia income tax online using the Georgia Department of Revenue's e-file services. This method allows you to complete your filing from the comfort of your home. By using online services, you can ensure your Georgia Receipt as Payment in Full is processed quickly and accurately.

GA 500 NOL should be mailed to the Georgia Department of Revenue as well. Check the specific mailing address on the form to avoid delays. For streamlined assistance with filing, consider using uslegalforms, which can help you manage your Georgia Receipt as Payment in Full obligations seamlessly.

You should send your GA Form 500 to the Georgia Department of Revenue. Utilize the address provided on the form to ensure it reaches the right department. If you are unsure about the process, uslegalforms can guide you through submitting your Georgia Receipt as Payment in Full efficiently.

In Georgia, taxpayers can enter into a payment plan to manage their tax debts over time. Typically, these plans allow payments over several months based on owed amounts. If you have a Georgia Receipt as Payment in Full, it can support your request for a payment plan, showing that you are actively engaged in settling your tax obligations.

The IRS typically accepts payments based on the type of tax owed and the taxpayer's financial situation. Generally, the minimum payment amount is often $25, but this can vary. If you receive a Georgia Receipt as Payment in Full, it demonstrates your intent to make full payments, which can help with assessing your payment plan with the IRS.

A receipt acknowledging payment in full is a document that verifies a payment has been made in its entirety, leaving no balance owed. This receipt not only serves as proof of the transaction but also protects both the payer and payee in case of future disputes. By acquiring a Georgia Receipt as Payment in Full, you establish a clear record that can be crucial for legal or financial purposes. This is especially important in both personal and business dealings.

A receipt of payment in full serves as a document that confirms a debtor has fulfilled their financial obligation toward a creditor. Essentially, it marks the end of a payment agreement, acknowledging that the amount owed has been completely settled. It’s vital for personal and business transactions because it provides legal proof of payment. Understanding the significance of a Georgia Receipt as Payment in Full can protect you from future claims or disputes.

To make an estimated tax payment in Georgia, use Form 500-ES, which can be filed directly through the Georgia Department of Revenue's website. Payments can be submitted electronically or by mail, depending on your preference. Make sure to request a Georgia Receipt as Payment in Full to maintain accurate records of your estimated payments.