Are you within a position the place you require papers for sometimes company or individual reasons nearly every time? There are plenty of lawful document templates accessible on the Internet, but getting types you can trust isn`t simple. US Legal Forms delivers a large number of form templates, much like the Georgia Plan of Liquidation and Dissolution of a Corporation, which are published in order to meet federal and state needs.

If you are currently informed about US Legal Forms website and get a merchant account, just log in. After that, you are able to download the Georgia Plan of Liquidation and Dissolution of a Corporation format.

Should you not come with an profile and wish to start using US Legal Forms, follow these steps:

- Find the form you want and make sure it is for your correct city/county.

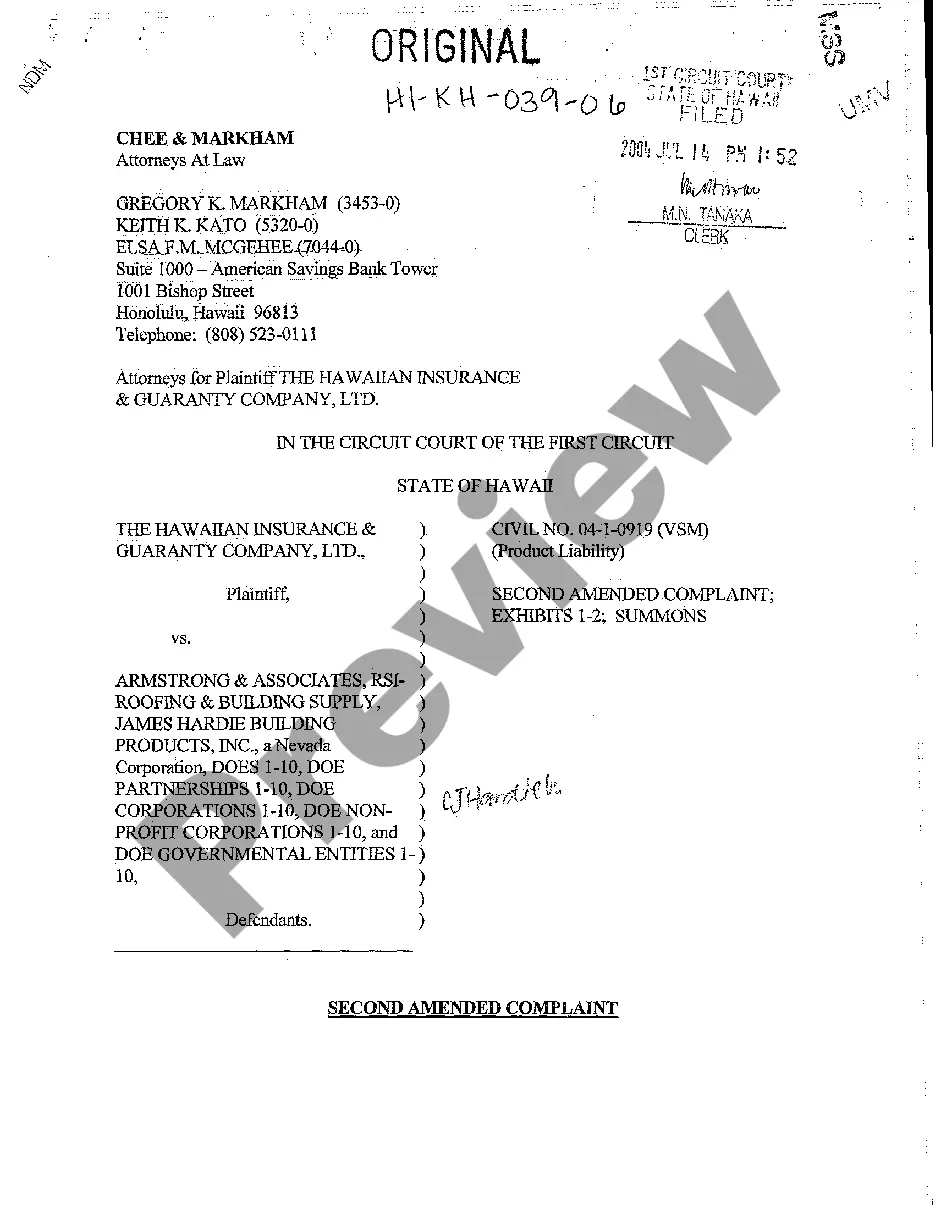

- Utilize the Review option to examine the shape.

- Look at the information to ensure that you have selected the appropriate form.

- In case the form isn`t what you`re trying to find, take advantage of the Research discipline to get the form that fits your needs and needs.

- Whenever you obtain the correct form, just click Acquire now.

- Select the rates program you need, fill in the necessary details to create your bank account, and pay for the transaction utilizing your PayPal or charge card.

- Pick a handy paper format and download your copy.

Find every one of the document templates you have bought in the My Forms menu. You can obtain a more copy of Georgia Plan of Liquidation and Dissolution of a Corporation anytime, if necessary. Just select the needed form to download or produce the document format.

Use US Legal Forms, by far the most substantial assortment of lawful kinds, to conserve time as well as stay away from faults. The support delivers skillfully manufactured lawful document templates that can be used for a selection of reasons. Make a merchant account on US Legal Forms and initiate making your daily life a little easier.