Georgia Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Discovering the right legitimate document template can be a have a problem. Needless to say, there are plenty of themes accessible on the Internet, but how can you obtain the legitimate kind you want? Utilize the US Legal Forms internet site. The service offers a large number of themes, such as the Georgia Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), which can be used for company and personal requirements. All the types are checked out by specialists and fulfill state and federal demands.

In case you are previously signed up, log in for your bank account and click the Obtain option to obtain the Georgia Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Make use of bank account to appear throughout the legitimate types you have purchased previously. Go to the My Forms tab of your own bank account and have yet another duplicate from the document you want.

In case you are a whole new end user of US Legal Forms, listed here are basic directions for you to stick to:

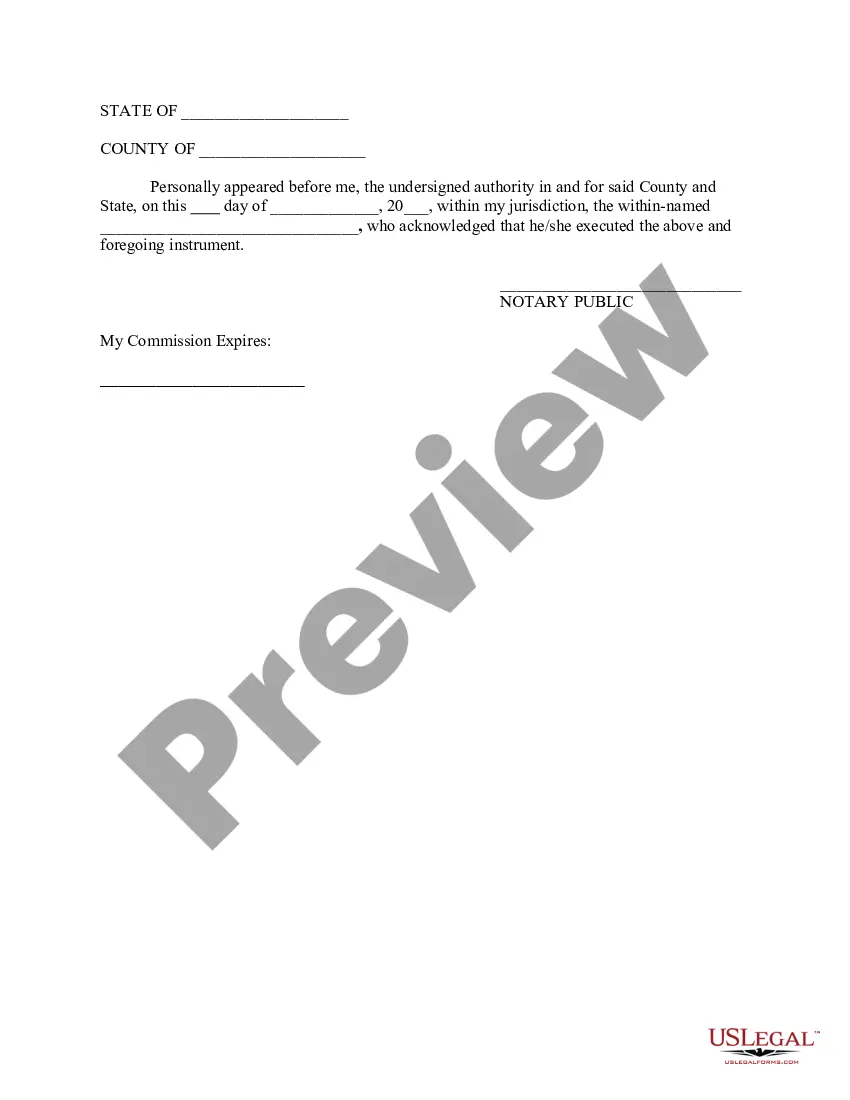

- Very first, be sure you have selected the proper kind for your personal area/county. It is possible to look over the form making use of the Review option and study the form outline to ensure this is the best for you.

- When the kind does not fulfill your expectations, use the Seach field to find the proper kind.

- Once you are positive that the form is acceptable, click on the Purchase now option to obtain the kind.

- Select the rates prepare you need and type in the needed information and facts. Design your bank account and pay for an order utilizing your PayPal bank account or charge card.

- Choose the document formatting and download the legitimate document template for your system.

- Full, modify and produce and sign the acquired Georgia Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

US Legal Forms will be the greatest collection of legitimate types where you will find a variety of document themes. Utilize the company to download expertly-produced papers that stick to condition demands.

Form popularity

FAQ

The following: Completed and signed Form T-20 Affidavit of Inheritance in the inheritor's full legal name. ... Certified copy of the deceased's death certificate. If the vehicle is inherited by a family member, Form MV-16 Affidavit to Certify Immediate Family Relationship may be required.

Once you have the legal authority to transfer the car's ownership, you'll need to complete the process through the state department of motor vehicles (DMV), including providing documentation such as a death certificate, your photo identification, and a letter from the court.

In most cases, the spouse's will determines what happens to their property. So, you must look over the will with an attorney to see if you're entitled to their property. However, if your husband didn't have a will, you may automatically inherit the property, depending on your state's laws.

While you can transfer the title of a car in Georgia to a relative without selling it, you will still have to pay the ad valorem taxes. You will need the Declaration of Immediate Family along with the Application for Title. Ask the clerk whether to write ?gift? or ?$0? in the sales price section of the title.

The executor of your dad's estate should see to it that ownership is transferred to you under the terms of his will. Once it is, then you can register it. If there was no will and no court awarded you ownership of the car your best bet would be to consult an attorney.

Georgia law requires that the vehicle be titled in the purchaser's name even if there is a lien (loan) against it. The requirement to have a vehicle titled is the same for all lenders, whether they are banks, car dealerships or individuals.

If a person dies intestate, and the person owned a vehicle, the person's spouse automatically becomes the owner of the vehicle. If the decedent owned more than one vehicle, the surviving spouse may choose one of the vehicles.

A surviving spouse who isn't in a community property state and whose name isn't on the car loan isn't responsible for the loan. So, it may be your choice whether to assume payments if the car goes to you after probate. This is also true for any other beneficiary whose name is not on the loan.