Georgia Home Equity Line of Credit Security Deed

Description

What is a Home Equity Line of Credit Security Deed?

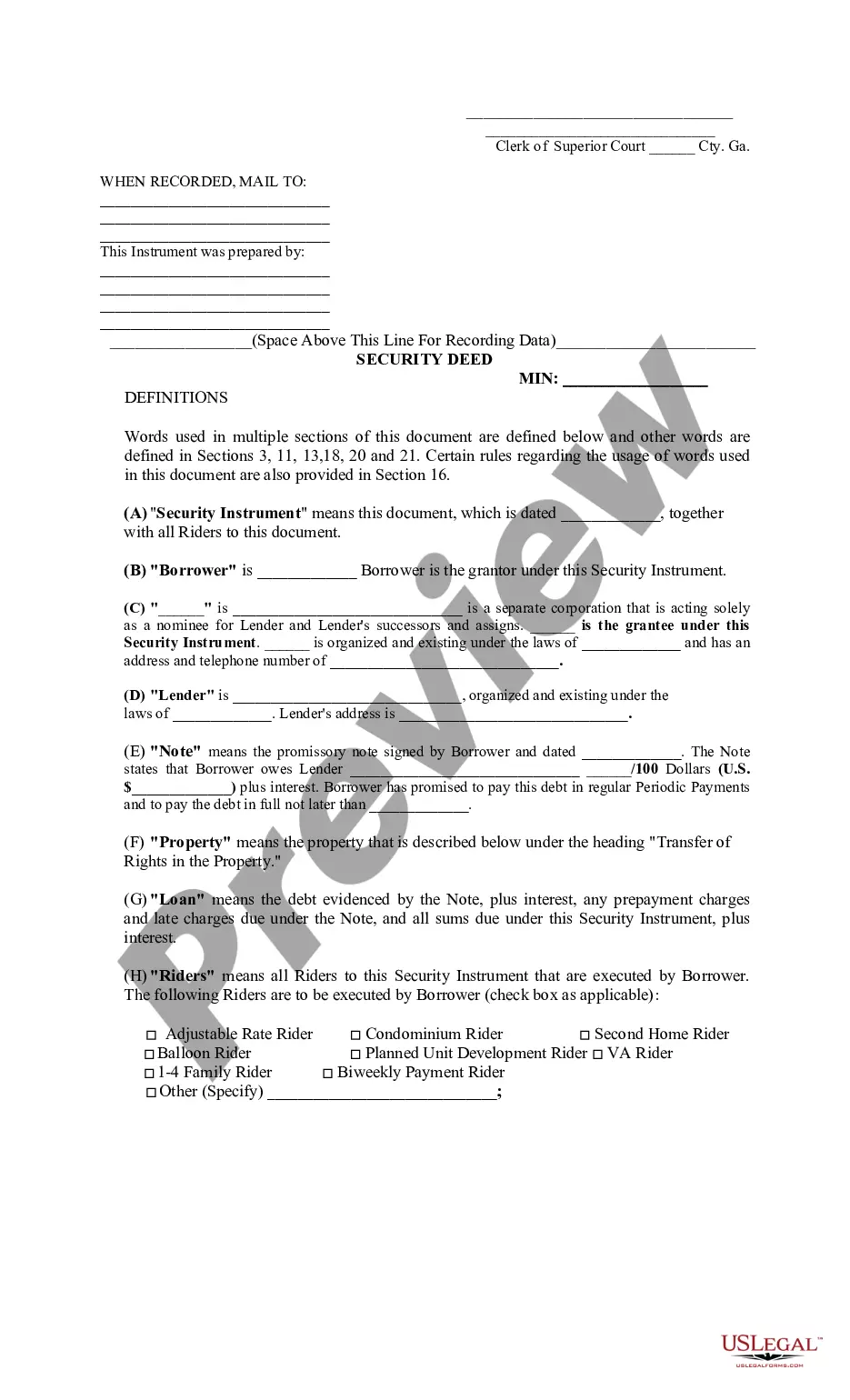

A Home Equity Line of Credit Security Deed (typically abbreviated as HELOC Security Deed) is a legal document that secures a line of credit by using the borrower's home as collateral. This deed is recorded in the public records as a lien against the property, ensuring that the lender can potentially foreclose on the property if the borrower defaults on the loan.

Key Concepts & Definitions

- Home Equity Line of Credit (HELOC): A line of credit that allows homeowners to borrow money against the equity of their home.

- Security Deed: A legal document that grants a lender a security interest in the titled property of the borrower as security for a loan.

- Equity: The difference between the current market value of a property and the amount the owner still owes on the mortgage.

Step-by-Step Guide to Obtaining a HELOC Security Deed

- Determine Eligibility: Assess whether you have sufficient equity in your home to qualify for a HELOC.

- Apply for a HELOC: Submit an application with a lender who offers HELOCs.

- Property Appraisal: Undergo a property appraisal that the lender will arrange to confirm your home's market value.

- Closing the HELOC: Sign the security deed and other necessary paperwork to secure the line of credit with your property.

Risk Analysis of HELOC Security Deeds

- Foreclosure Risk: Failure to meet repayment obligations can lead to foreclosure on your home.

- Interest Rate Fluctuations: Most HELOCs have variable interest rates, which can increase repayment amounts unexpectedly.

- Market Risks: A decline in the housing market could reduce your home's value, impacting your equity and potentially leading to an 'underwater' mortgage situation.

Best Practices for Managing a HELOC

- Regular Repayment: Establish a consistent repayment schedule to avoid accruing too much interest and to prevent ballooning payments.

- Understanding Terms: Fully understand the terms of your HELOC, including the interest rate, repayment period, and any potential fees.

- Risk Buffer: Maintain an emergency fund to buffer against market fluctuations and personal financial crises.

Common Mistakes & How to Avoid Them

- Overborrowing: Avoid borrowing more than you need or can reasonably afford to repay, to prevent financial strain or loss of your home.

- Neglecting HELOC Terms: Always read and understand the full terms of your HELOC to avoid surprises related to variable rates and balloon payments.

- Inadequate Planning: Ensure you have a financial strategy for using and repaying the HELOC funds.

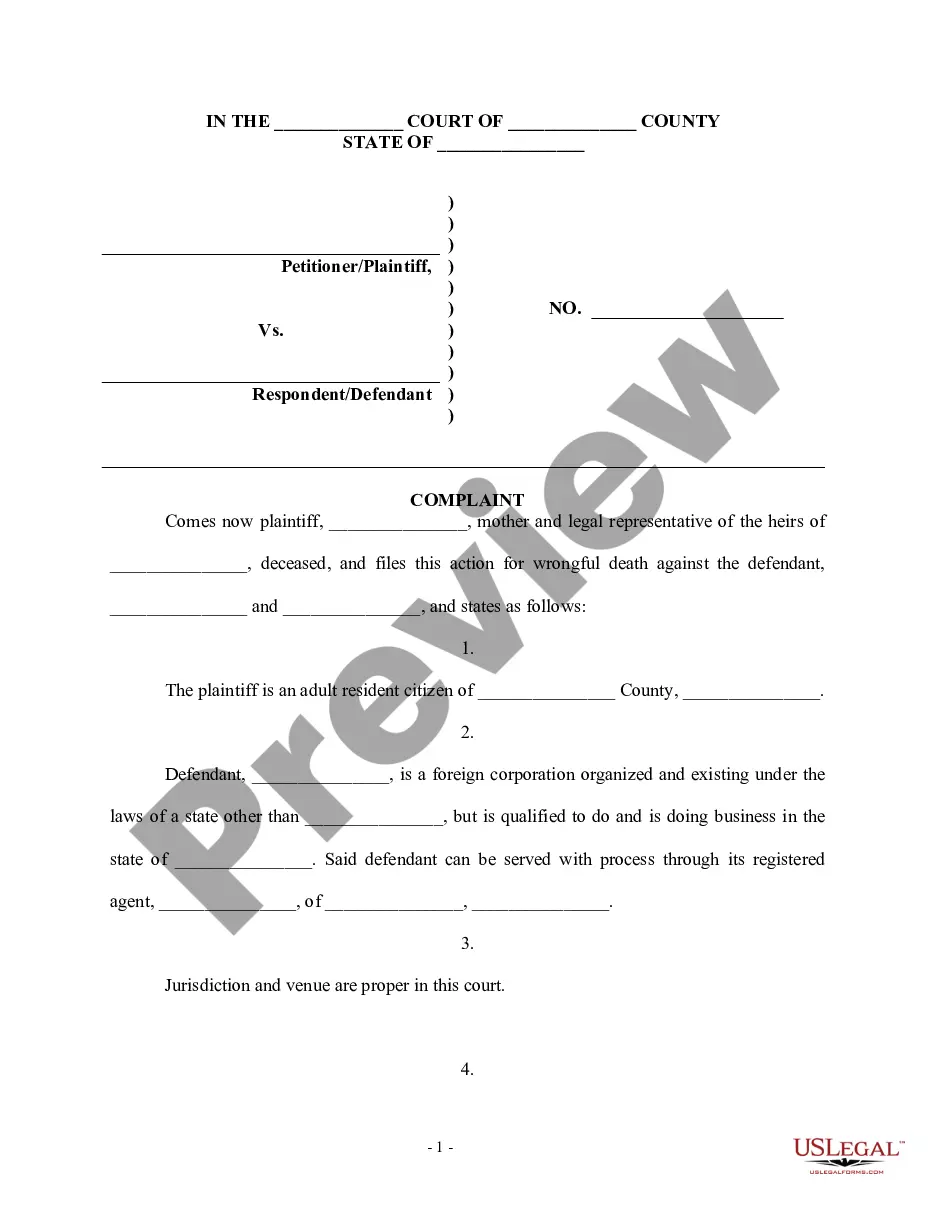

How to fill out Georgia Home Equity Line Of Credit Security Deed?

Obtain one of the most comprehensive collections of legal documents.

US Legal Forms is a platform to locate any state-specific document in a few clicks, including examples of Georgia Home Equity Line of Credit Security Deeds.

No need to squander hours searching for a court-admissible template.

- To utilize the document library, choose a subscription and create an account.

- If you have already registered, simply Log In and click Download.

- The Georgia Home Equity Line of Credit Security Deed file will be quickly saved in the My documents section (a section for all documents you store on US Legal Forms).

- To register a new account, refer to the quick instructions provided below.

- When using a state-specific document, ensure to specify the correct state.

- If possible, read the description to understand all the details of the form.

- Use the Preview feature if available to view the content of the document.

- If everything appears accurate, click Buy Now.

- After selecting a pricing plan, create your account.

Form popularity

FAQ

No, a security deed is not the same as a property deed. A property deed, also known as a title deed, transfers ownership of property from one party to another. In contrast, a Georgia Home Equity Line of Credit Security Deed primarily grants the lender a security interest in your property without transferring ownership. Therefore, it’s essential to understand the difference as you navigate your borrowing options.

In Georgia, to record a security deed, you must provide a legal property description, the names of all parties involved, and the signature of the grantor. Additionally, ensure that the deed is notarized before submission. It's important to submit this document to the appropriate county clerk's office to establish public notice. Utilizing a platform like uslegalforms can help streamline this process.

To gain approval for a Georgia Home Equity Line of Credit Security Deed, you generally need to meet certain benchmarks, including a robust credit score and a low debt-to-income ratio. Lenders also assess the amount of equity in your home, so understanding your property's value is essential. Preparation is critical, so gather all necessary financial documentation before approaching your lender. You can take advantage of our resources to make the process smoother.

The approval process for a Georgia Home Equity Line of Credit Security Deed can vary based on your financial history and the lender's criteria. While it may seem challenging, many borrowers with decent credit scores and sufficient home equity find them accessible. The key is to showcase your financial stability during the application process. Consider using our platform to gather the necessary documents and guidance to enhance your chances of approval.

The monthly payment on a $50,000 Georgia Home Equity Line of Credit Security Deed generally depends on the interest rate and the terms of the agreement. Most lenders offer interest-only payments during the draw period, which can be appealing, but keep in mind that you will need to repay the principal later. It's essential to check with your lender for specific calculations based on their rate offerings. Consider using our platform to help you understand your options and find competitive rates.

Since HELOCs typically do not require title insurance, no title company was used for the new HELOC, and Bank A never bothered to release the original HELOC.Typically issues with HELOCs can be resolved, but they do often cause settlement delays.

In Georgia, can a security interest in real estate expire? Yes. A security interest in real estate expires (in other words, become unenforceable) seven years after expiration of the maturity of the debt.

A deed of trust is similar to a mortgage in that it establishes security interest in your home. A deed of trust (sometimes called a trust deed) has three parties involved: the borrower, the lender and a trustee.The first trust deed secures your primary home loan, and a second trust deed secures additional loans.

An equity line is essentially a revolving line of credit secured by a mortgage Deed of Trust against a piece of property.Sometimes the seller doesn't realize a HELOC attaches to the property and is a lien that has to be paid off in order to sell the property.

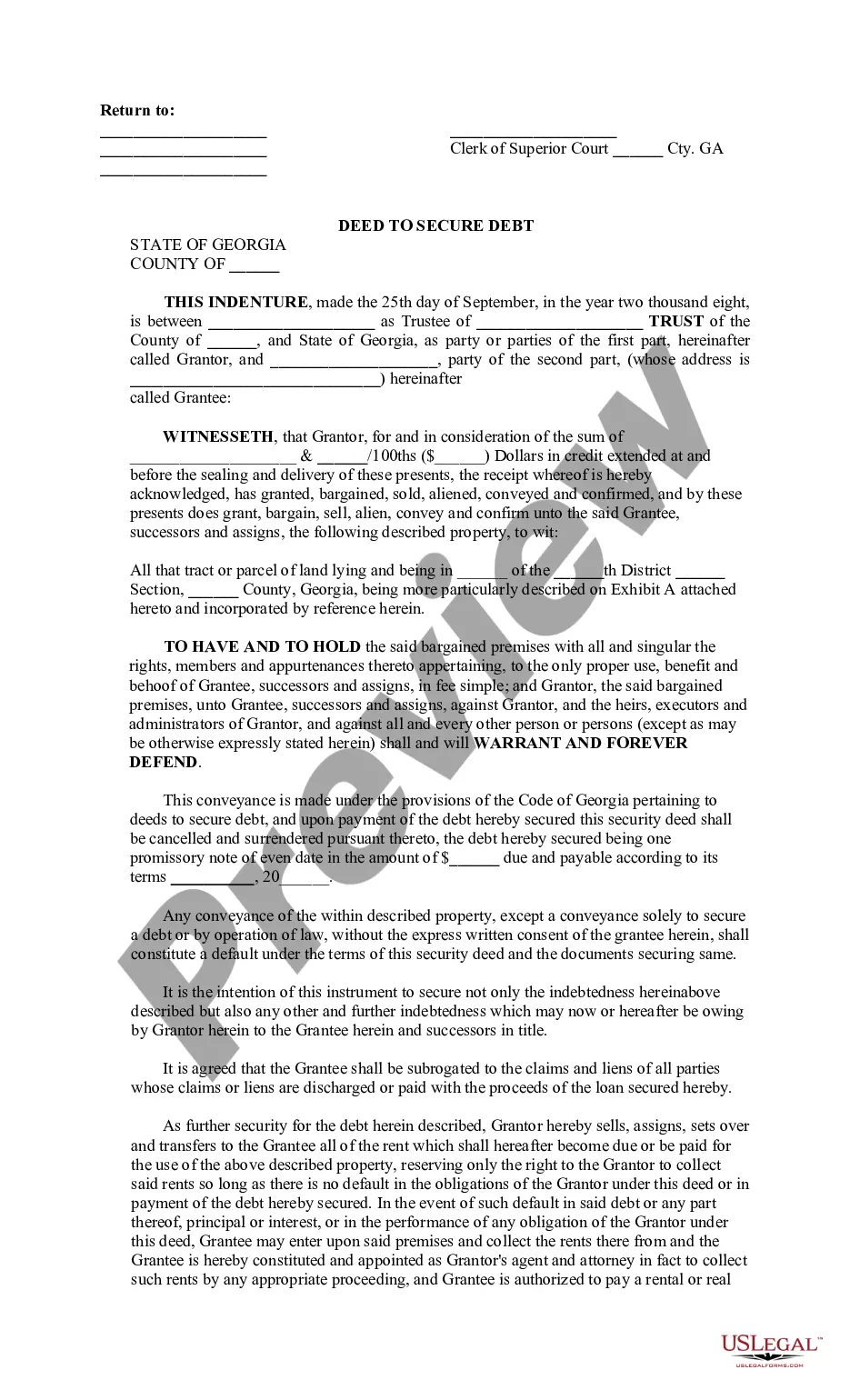

A "Deed to Secure Debt" often called a "Security Deed" that is protected by a "Promissory Note" is the preferred method of financing by Lenders in Georgia.It being intended by the parties that this document shall operate as a deed, not as a mortgage and is made under those provisions of O.C.G.A.