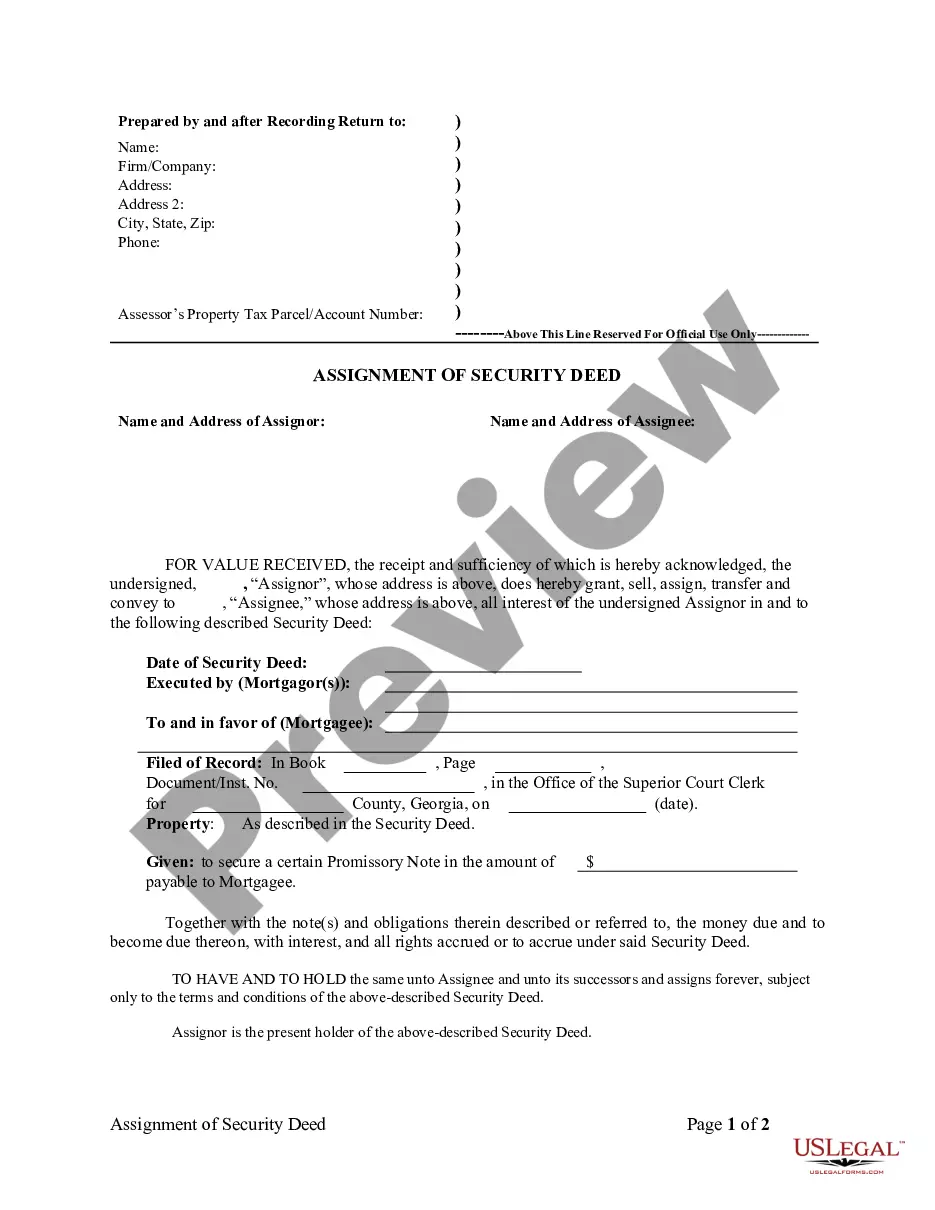

Georgia Assignment of Security Deed from Individual Mortgage - Holder

About this form

The Assignment of Security Deed from Individual Mortgage-Holder is a legal document used to transfer the owner's interest in a deed of trust or mortgage to a third party. This form is specifically designed for individual holders of the mortgage, allowing for a clear and legal assignment of their rights and responsibilities. It differs from similar forms by focusing exclusively on individual rather than organizational holders, making it essential for personal real estate transactions.

Main sections of this form

- Date of security deed execution.

- Details of the mortgagor(s) and mortgagee involved in the assignment.

- Information regarding the county and state where the deed is filed.

- Description of the property secured by the deed of trust or mortgage.

- Reference to the promissory note secured by the deed.

Situations where this form applies

This form is needed when an individual mortgage-holder wishes to transfer their rights and interests in a mortgage or deed of trust to another party. Common scenarios include selling a property, refinancing, or settling debts where the mortgage is no longer needed or held by the original mortgagor.

Who this form is for

- Individual mortgage-holders who want to assign their mortgage rights.

- Property owners who are transferring their mortgage to a buyer or third party.

- Real estate professionals assisting clients in mortgage assignment transactions.

Instructions for completing this form

- Identify the date when the security deed was executed.

- Fill in the names of the mortgagor(s) and the mortgagee receiving the assignment.

- Provide the filing details, including book, page, and document numbers.

- Clearly describe the property securing the mortgage.

- State the amount of the promissory note being secured by this deed.

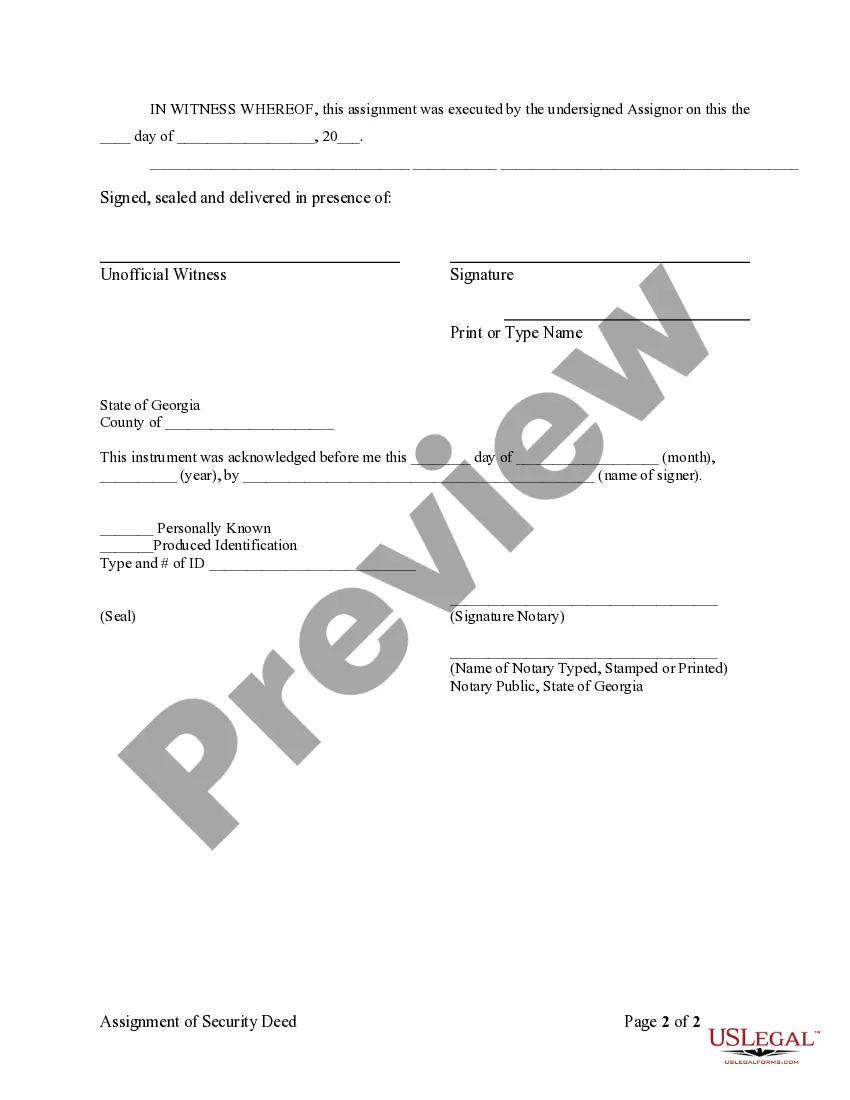

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include the correct filing information, which can render the assignment void.

- Not clearly describing the property involved in the assignment.

- Omitting signatures from both parties involved in the assignment.

Benefits of using this form online

- Convenience of downloading forms directly from home.

- Editable fields allow for customization to fit specific transaction needs.

- Access to forms prepared by licensed attorneys ensures legal reliability.

Legal use & context

- The assignment must be made in writing to be enforceable.

- Proper filing with local authorities is necessary to protect the rights contained within the document.

- Both parties should retain copies of the assignment for their records.

Quick recap

- The Assignment of Security Deed is crucial for transferring mortgage rights from an individual holder.

- Accurate completion and filing of the form are key to maintaining legal enforceability.

- Always verify if local laws affect the notarization or filing process.

Looking for another form?

Form popularity

FAQ

A deed in Georgia must be in writing, signed by the grantor, and include a legal description of the property. For a Georgia Assignment of Security Deed from Individual Mortgage - Holder, additional requirements include the need for notarization and, preferably, recording in the county where the property is located. It's essential to ensure that all details are accurate to avoid legal complications. You can utilize resources from platforms like US Legal Forms to guide you through these requirements.

Yes, in Georgia, an assignment of mortgage should be recorded to protect the rights of the new mortgage holder. Recording the Georgia Assignment of Security Deed from Individual Mortgage - Holder ensures that the transaction is publicly documented, which can prevent potential disputes about ownership. Recording is a crucial step in making sure that the assignment is legally valid and enforceable. To complete this process seamlessly, you might consider using services like US Legal Forms.

An attorney does not have to prepare a deed in Georgia, but having one can be advantageous. While anyone can draft a deed, lawyers bring expertise to ensure the Georgia Assignment of Security Deed from Individual Mortgage - Holder is executed correctly. This reduces the chances of mistakes that could lead to legal issues later. Consider using platforms such as US Legal Forms for additional guidance and resources.

In Georgia, it is not mandatory for an attorney to prepare a deed, including the Georgia Assignment of Security Deed from Individual Mortgage - Holder. Many individuals choose to prepare deeds themselves, especially for straightforward transactions. Nevertheless, involving a legal professional can provide peace of mind and ensure compliance with state laws. Services like US Legal Forms can also assist you in drafting a deed correctly.

Generally, a deed can be written by various individuals, including the property owner or an attorney. However, when it comes to a Georgia Assignment of Security Deed from Individual Mortgage - Holder, it is often beneficial to consult an attorney for clarity. This ensures that the deed meets all legal requirements and is properly formatted. Using a reliable service, like US Legal Forms, can simplify the process of preparing a deed.

An assignment of security deed refers to the transfer of a security interest in real property from one party to another. This means the original mortgage holder transfers their rights and obligations under the mortgage contract. Understanding this process is vital in Georgia, particularly when discussing the transition between individual mortgage holders. It's beneficial to use platforms like US Legal Forms to ensure all documents are handled correctly during the Georgia Assignment of Security Deed from Individual Mortgage - Holder.

If you are on the deed but not the mortgage, you have ownership rights to the property. This means you can live in and use the property as you see fit. However, if the mortgage goes into default, you won't be liable for those payments. It’s crucial to understand your position, especially when considering mechanisms like the Georgia Assignment of Security Deed from Individual Mortgage - Holder.

If your husband dies and your name is not on the mortgage, you may still have rights to the property if your name is on the deed. The mortgage technically remains the responsibility of the estate, which may require further action to resolve. You might need legal assistance to ensure your rights are protected under Georgia's property laws. Consulting with a professional can clarify how the Georgia Assignment of Security Deed from Individual Mortgage - Holder impacts your situation.

Yes, a person's name can be on a deed without being on the mortgage. In this scenario, the individual has ownership rights to the property but is not responsible for the mortgage payments. This situation can arise when one party contributes to the down payment or holds the title, while another party takes out the mortgage. Understanding the implications of this arrangement is important, especially in the context of the Georgia Assignment of Security Deed from Individual Mortgage - Holder.

A recorded assignment of a mortgage is a formal document that transfers the rights of the mortgage from one lender to another. This document is filed in public records and is crucial for any Georgia Assignment of Security Deed from Individual Mortgage - Holder. By recording this assignment, you create a clear chain of title, providing protection and clarity on who owns the mortgage.