Florida Assignment of Overriding Royalty Interest with Proportionate Reduction

Description

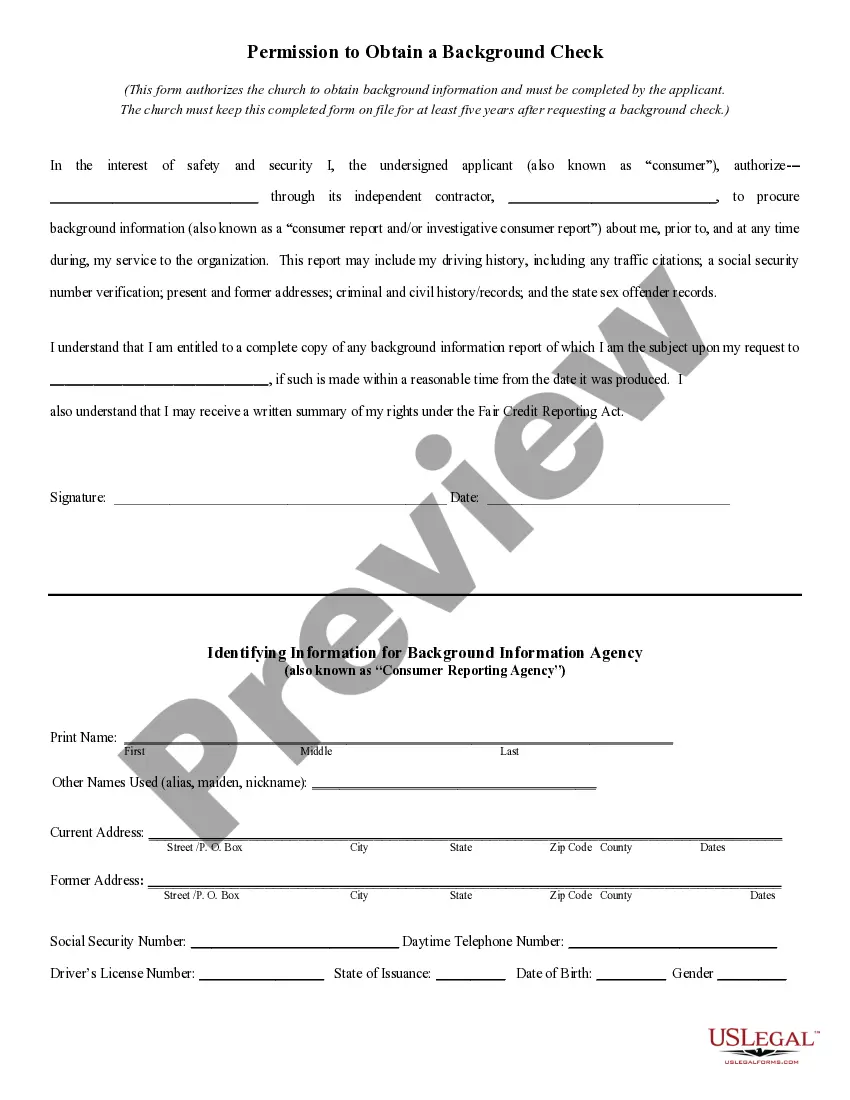

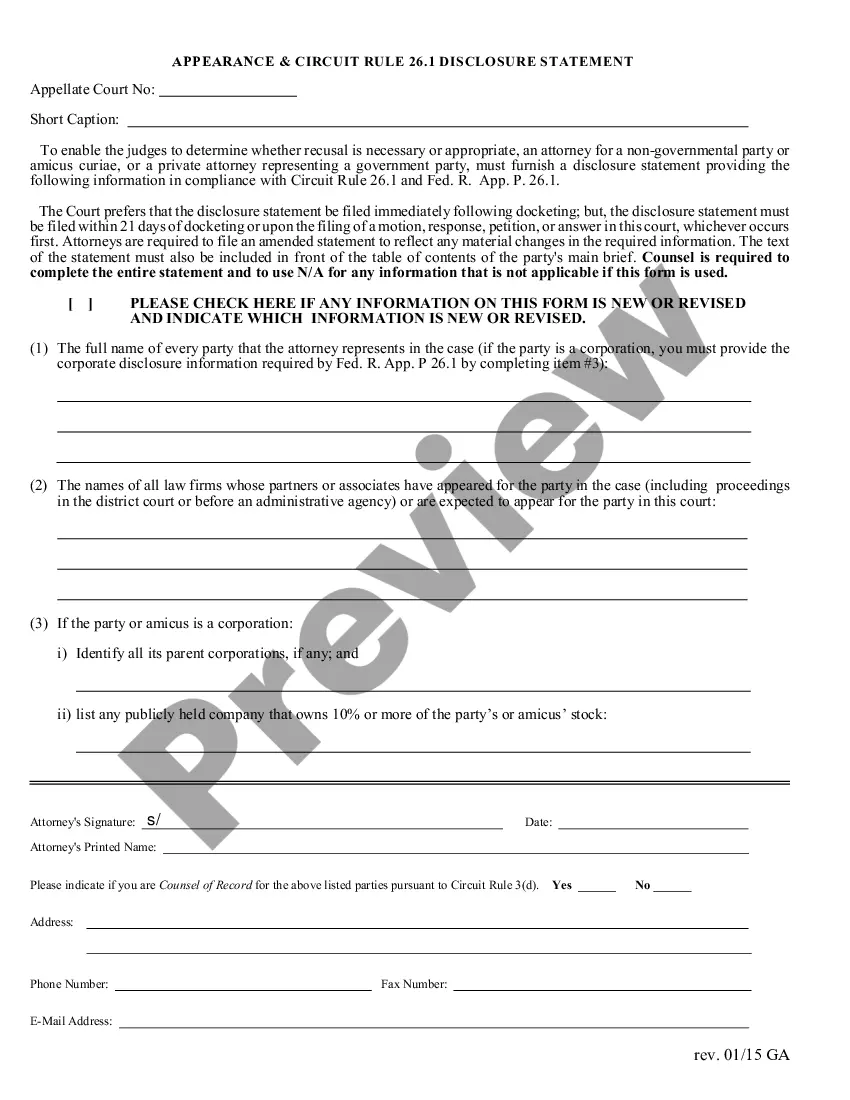

How to fill out Assignment Of Overriding Royalty Interest With Proportionate Reduction?

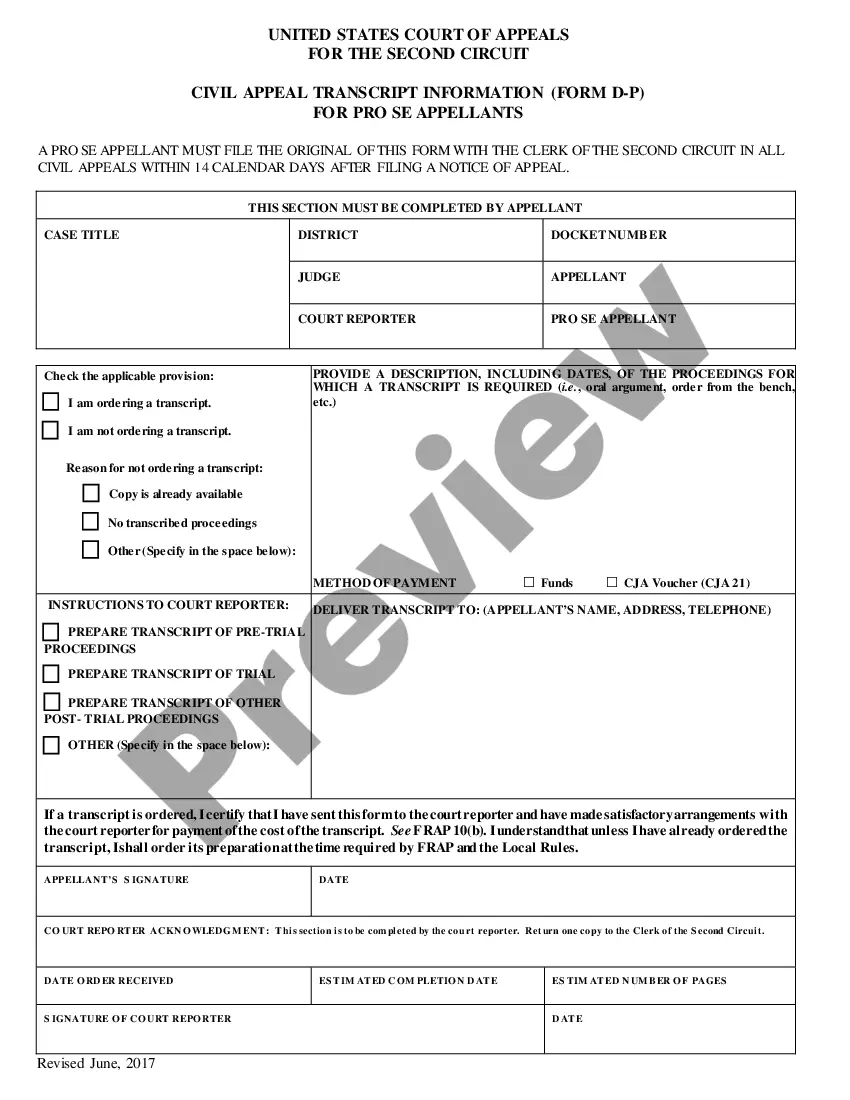

US Legal Forms - one of several biggest libraries of legitimate types in the United States - provides an array of legitimate papers layouts it is possible to down load or printing. Utilizing the website, you may get 1000s of types for organization and specific functions, categorized by types, suggests, or keywords.You can get the newest versions of types much like the Florida Assignment of Overriding Royalty Interest with Proportionate Reduction within minutes.

If you already have a monthly subscription, log in and down load Florida Assignment of Overriding Royalty Interest with Proportionate Reduction in the US Legal Forms collection. The Down load key can look on each type you view. You gain access to all formerly delivered electronically types from the My Forms tab of your respective profile.

In order to use US Legal Forms initially, listed here are straightforward guidelines to help you get began:

- Ensure you have chosen the proper type to your area/area. Click on the Review key to examine the form`s content. Read the type explanation to ensure that you have selected the correct type.

- In case the type does not satisfy your requirements, make use of the Search industry near the top of the display to discover the the one that does.

- Should you be satisfied with the form, affirm your decision by visiting the Get now key. Then, opt for the prices plan you favor and give your credentials to register for an profile.

- Method the purchase. Make use of bank card or PayPal profile to complete the purchase.

- Pick the format and down load the form on your own gadget.

- Make adjustments. Fill out, edit and printing and sign the delivered electronically Florida Assignment of Overriding Royalty Interest with Proportionate Reduction.

Every template you added to your money does not have an expiration day and is also your own property forever. So, in order to down load or printing another backup, just proceed to the My Forms area and then click around the type you will need.

Obtain access to the Florida Assignment of Overriding Royalty Interest with Proportionate Reduction with US Legal Forms, probably the most considerable collection of legitimate papers layouts. Use 1000s of expert and state-specific layouts that satisfy your business or specific needs and requirements.

Form popularity

FAQ

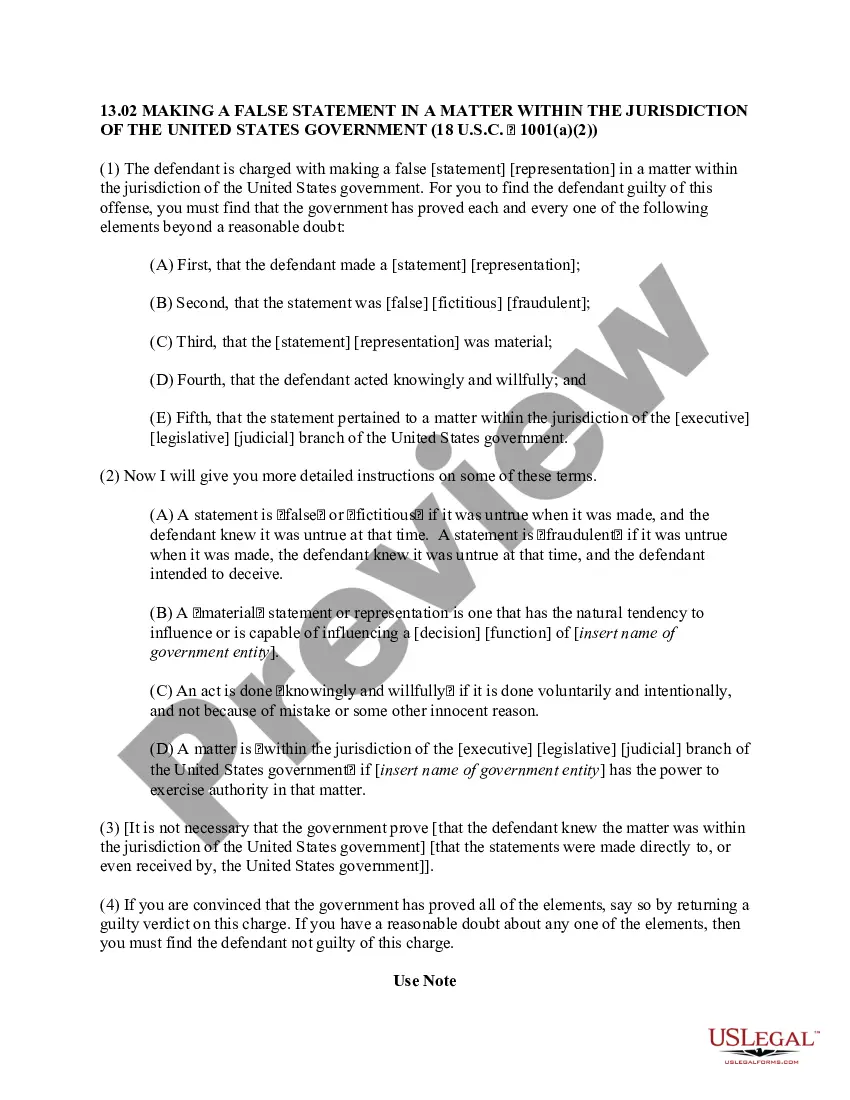

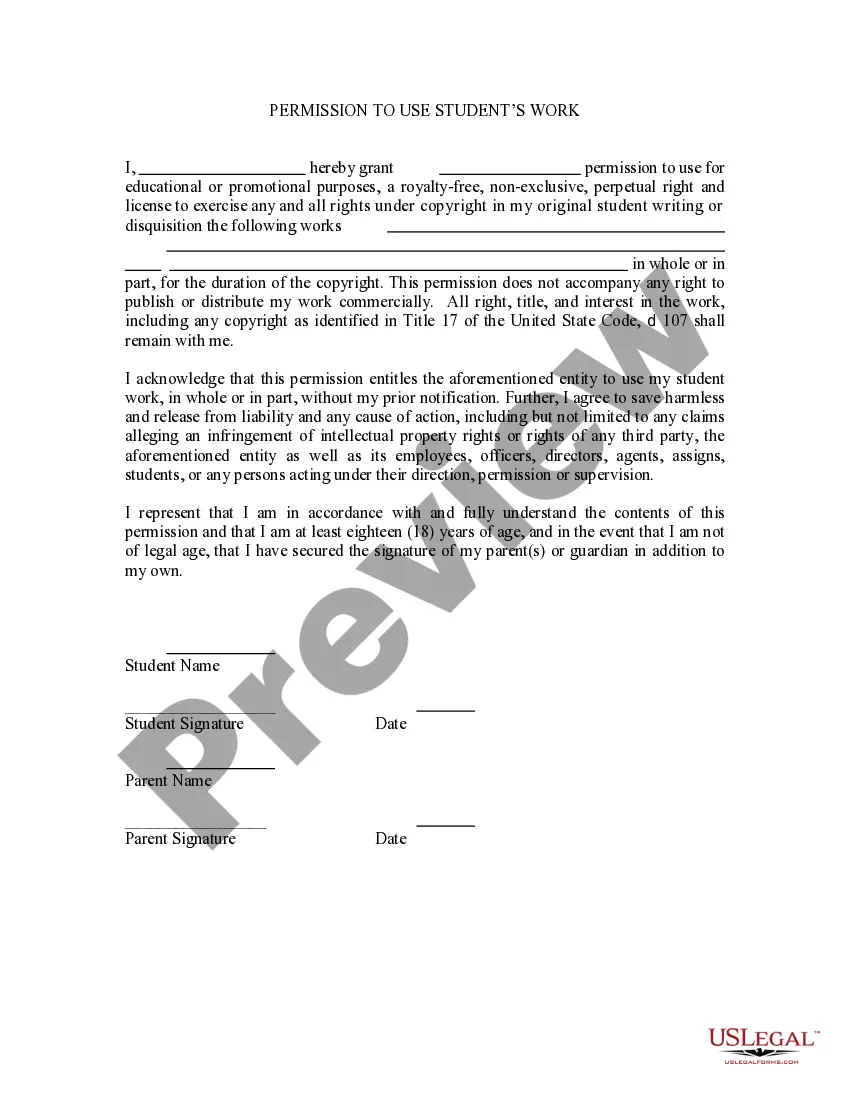

What Is Working Interest? Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.

What is the difference between working interest and net revenue interest? The difference between the Net Revenue Interest and Working Interest is simple: While the NRI is the income, the Working Interest is the expenses.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

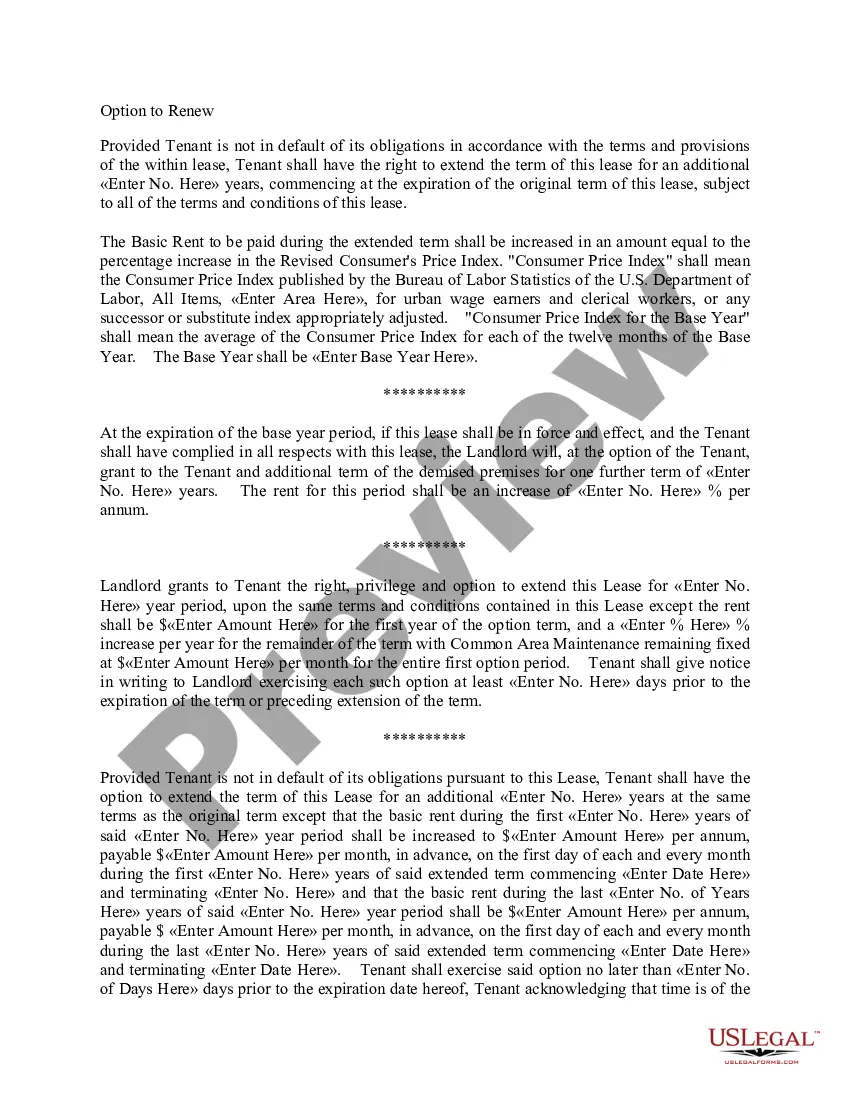

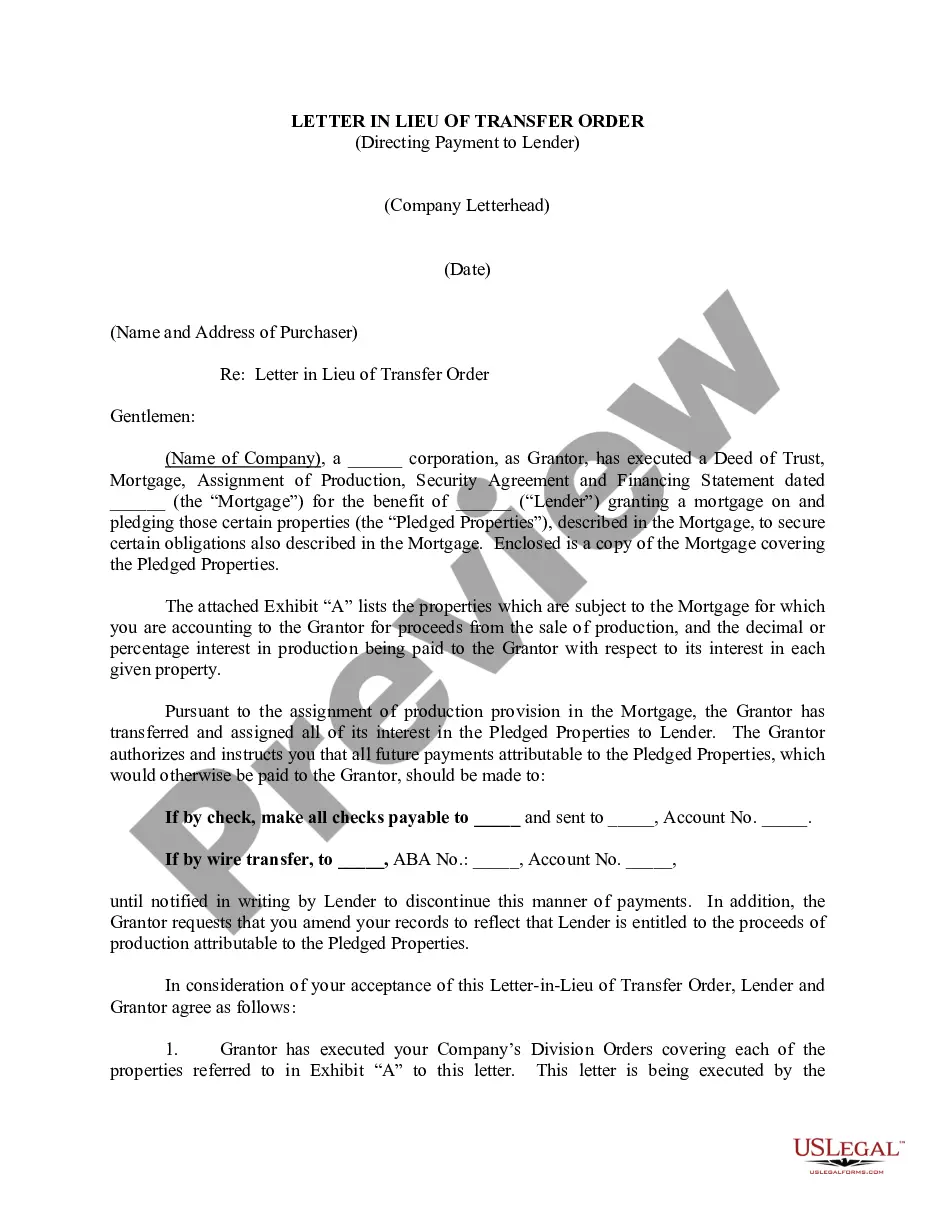

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

The owner of a working interest, also called an operating interest, bears the costs of developing and operating the natural resource property. The most common form of working interest is a leasehold estate held by an operator that exploits another person's property.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.