Florida Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

Have you encountered a scenario where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but discovering ones you can rely on is not simple.

US Legal Forms offers a vast array of form templates, like the Florida Carrier Services Contract - Self-Employed Independent Contractor, that are designed to comply with state and federal regulations.

Once you have the correct form, click Acquire now.

Select the pricing plan you desire, fill in the necessary information to set up your account, and purchase an order using your PayPal or Visa or Mastercard. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Florida Carrier Services Contract - Self-Employed Independent Contractor at any time, if needed. Click on the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Florida Carrier Services Contract - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you require and confirm it is for the correct region/state.

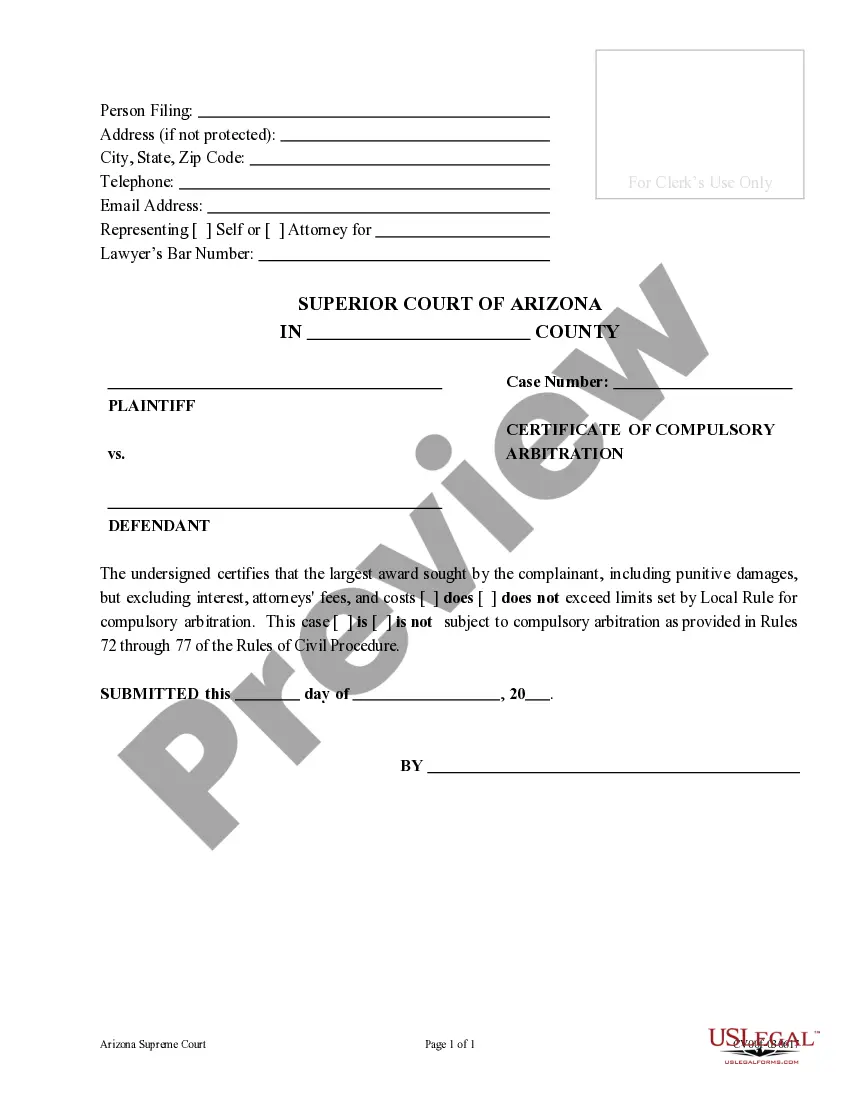

- Utilize the Preview button to examine the form.

- Review the details to ensure you have chosen the right form.

- If the form does not meet your needs, use the Lookup field to find the form that fits your specifications.

Form popularity

FAQ

In Florida, an independent contractor is an individual who offers services to businesses without being an employee. This arrangement provides flexibility and often involves a contract that outlines the terms of work. To formalize this relationship, many use a Florida Carrier Services Contract - Self-Employed Independent Contractor to ensure clarity and legality.

An independent contractor in Florida may need a business license based on their specific industry. Regulations vary, so it's vital to check your local county rules. As you secure your Florida Carrier Services Contract - Self-Employed Independent Contractor, being compliant with licensing will bolster your credibility in the marketplace.

In Florida, whether independent contractors need a business license depends on the type of work they perform. Some counties may require a license, while others do not. To navigate these requirements effectively, consider utilizing services from uslegalforms to ensure your Florida Carrier Services Contract - Self-Employed Independent Contractor aligns with local laws.

Yes, you can issue a 1099 form to someone without a business license. However, it is wise to ensure that the individual meets the criteria for independent contractors. For instance, using a Florida Carrier Services Contract - Self-Employed Independent Contractor can help clarify the terms of your engagement, providing a solid foundation.

Yes, registering your business as an independent contractor is essential for a legitimate operation. It establishes your presence in the market and can provide legal protection. Most importantly, it helps in meeting requirements, especially when working with Florida Carrier Services Contracts as a Self-Employed Independent Contractor.

Getting contracts as an independent courier involves actively marketing your services and showcasing your reliability. Attend local business events and connect with companies that may require courier services. Also, consider online platforms dedicated to freelancers seeking contract work. Always present a professional Florida Carrier Services Contract - Self-Employed Independent Contractor to facilitate clear expectations and terms with your clients.

To get clients for your courier business, start by promoting your services through social media and local advertisements. You can implement promotional offers to attract new customers while building relationships through excellent service. Additionally, creating a professional website can enhance your visibility. Remember, providing a solid Florida Carrier Services Contract - Self-Employed Independent Contractor can also instill confidence in your clients.

To secure contracts as a courier, networking is vital. Engage with local businesses and join courier networks to establish connections. Consider leveraging digital platforms and marketing your services online to attract potential clients. Additionally, using a Florida Carrier Services Contract - Self-Employed Independent Contractor can help formalize agreements once you land contracts.

Being an independent courier can be worthwhile if you value flexibility and control over your schedule. You set your hours and can choose the routes that work best for you. Plus, as a self-employed independent contractor under a Florida Carrier Services Contract, you may enjoy tax benefits that traditional employees do not. However, like any business, success depends on your dedication.

An independent contractor agreement in Florida is a legal document that outlines the terms between the contractor and the client. This agreement covers job expectations, payment details, and any other specific duties. Having a clear contract helps protect both parties and establishes a transparent working relationship. Using a Florida Carrier Services Contract - Self-Employed Independent Contractor template simplifies this process.