Florida Aircraft Affidavit

Description

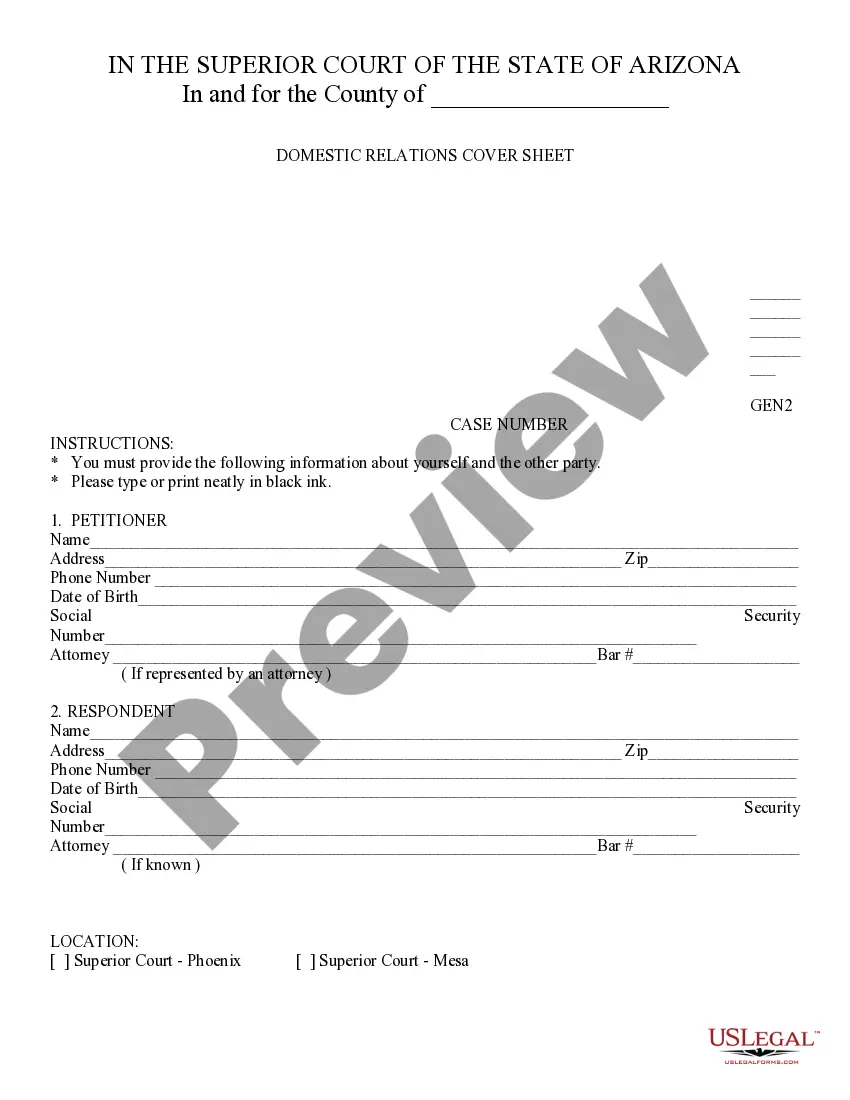

How to fill out Aircraft Affidavit?

Are you in a place where you need to have files for possibly organization or individual functions just about every time? There are a variety of lawful file themes available on the Internet, but locating kinds you can rely on is not easy. US Legal Forms provides 1000s of kind themes, much like the Florida Aircraft Affidavit, which can be composed in order to meet federal and state demands.

If you are presently informed about US Legal Forms web site and get your account, merely log in. Following that, you are able to obtain the Florida Aircraft Affidavit web template.

Should you not provide an bank account and wish to begin to use US Legal Forms, follow these steps:

- Obtain the kind you will need and ensure it is for your correct city/county.

- Take advantage of the Review key to review the form.

- Read the description to actually have chosen the proper kind.

- In the event the kind is not what you`re looking for, use the Look for area to discover the kind that fits your needs and demands.

- Once you obtain the correct kind, just click Buy now.

- Choose the rates plan you desire, fill out the desired info to create your bank account, and pay money for an order with your PayPal or credit card.

- Pick a practical document format and obtain your version.

Get all of the file themes you might have bought in the My Forms food list. You can get a further version of Florida Aircraft Affidavit at any time, if required. Just click the required kind to obtain or print the file web template.

Use US Legal Forms, the most considerable assortment of lawful types, to save lots of time and avoid faults. The assistance provides skillfully created lawful file themes that you can use for a selection of functions. Generate your account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

When buying an aircraft in Texas, you will pay between 6.25 percent and 8.25 percent sales and use tax on the aircraft's sales price, less the value of any trade-in. In most cases, the total tax paid is based on the rate in effect at the seller's place of business. The state sales and use tax rate is 6.25 percent.

The aircraft must be located in a different state when the bill of sale is filed with the Federal Aviation Administration and title (and funds) changes hands from seller to buyer. Ensuring delivery outside of California also ensures that California sales tax is not assessable on the purchase of the aircraft.

What is Taxable? All aircraft sold, delivered, used, or stored in Florida are subject to Florida's sales and use tax, plus any applicable discretionary sales surtax, unless exempt. Florida aircraft dealers and brokers are required to collect tax from the purchaser at the time of sale or delivery.

In addition to the interstate and foreign commerce exemption, if the aircraft is leased to an aircraft charter company, or a 'common carrier,' California regulations also provide for an exemption to the sales and use tax.

An aircraft owned by a nonresident of Florida is exempt from use tax if the aircraft enters and remains in Florida exclusively for flight training, repairs, alterations, refitting, or modifications. The days the aircraft remains in Florida for these purposes are not included in the nonresident's 20-day period.

All aircraft sold and/or delivered in Florida are subject to Florida's 6 percent sales tax plus any applicable discretionary sales surtax, unless the transaction is exempt by law.

Besides, an over-ocean closing for a U.S. aircraft is unnecessary. Several states (Alaska, Connecticut, Delaware, Massachusetts, Montana, New Hampshire, Oregon and Rhode Island) have basically no sales tax on business jet sales.