Florida IRS 20 Quiz to Determine 1099 vs Employee Status

Description

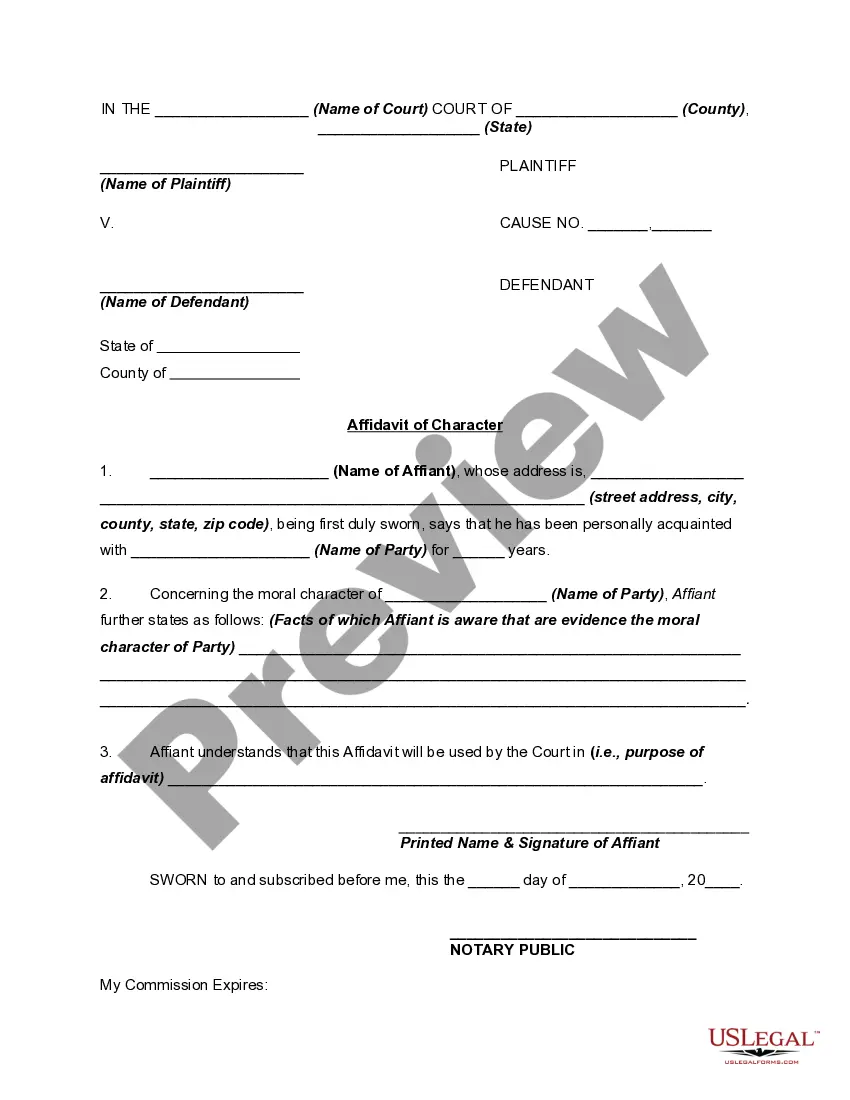

How to fill out IRS 20 Quiz To Determine 1099 Vs Employee Status?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

While utilizing the site, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the Florida IRS 20 Quiz to Determine 1099 vs Employee Status in just a few minutes.

If the form doesn’t meet your needs, utilize the Search field at the top of the screen to find one that does.

If you are happy with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your credentials to register for the account.

- If you are a member, Log In and download the Florida IRS 20 Quiz to Determine 1099 vs Employee Status from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your area/state.

- Click the Review button to assess the content of the form.

Form popularity

FAQ

To determine if someone is a W-2 employee or a 1099 independent contractor, you should consider the nature of their work relationship. The Florida IRS 20 Quiz to Determine 1099 vs Employee Status offers guidance on this topic. Generally, if you have control over how they perform their tasks, they are likely a W-2 employee. Conversely, if they operate independently and set their hours, they are likely a 1099 contractor. Utilizing resources like the Florida IRS 20 Quiz can help clarify your situation and ensure compliance.

Understanding the difference between a contractor and an employee is essential for compliance. The Florida IRS 20 Quiz to Determine 1099 vs Employee Status can guide you through the key factors to consider, such as behavioral control, financial control, and the type of relationship. Contractors typically work independently and have more freedom in how they complete tasks, while employees are usually directed by the employer. To clarify this distinction further, consider using the resources available on the UsLegalForms platform for the most accurate and comprehensive information.

To determine independent contractor status, ask questions about the level of control exerted by the employer, how the worker is compensated, and the nature of their work relationship. Additionally, inquire if the worker can offer services to other clients. The Florida IRS 20 Quiz to Determine 1099 vs Employee Status provides a comprehensive framework to address these questions effectively.

Determining a person's status as an employee or independent contractor involves analyzing factors such as who controls the work, the nature of the relationship, and the financial setup. It's crucial to examine all circumstances surrounding the role to avoid misclassification. The Florida IRS 20 Quiz to Determine 1099 vs Employee Status offers a structured approach to making this determination.

The IRS employs specific criteria to classify a worker as an independent contractor. They evaluate the degree of control the employer has, the worker's ability to manage their own schedule, and the financial aspects of the relationship. The Florida IRS 20 Quiz to Determine 1099 vs Employee Status can simplify this evaluation process.

There are three primary tests used to determine employee status: the common law test, the economic realities test, and the IRS twenty-factor test. Each test evaluates different aspects of the relationship, such as control and financial dependence. For easier understanding and application, consult the Florida IRS 20 Quiz to Determine 1099 vs Employee Status.

The IRS assesses various factors when determining if a worker is an independent contractor. These factors include the degree of control the business has over the worker, the relationship's nature, and any written agreements. To navigate this complex process, consider the Florida IRS 20 Quiz to Determine 1099 vs Employee Status for valuable guidance.

In Florida, the primary difference lies in the level of control exerted by the employer. Employees typically have set work hours, receive training, and have their tools provided by the employer, while independent contractors enjoy more freedom in how tasks are completed. Utilizing the Florida IRS 20 Quiz to Determine 1099 vs Employee Status can provide insights into these distinctions.

The classification of a person as an employee or independent contractor hinges on several key factors. These factors include the level of control the employer has over the worker, the independence of the worker in performing tasks, and the nature of the relationship between both parties. The Florida IRS 20 Quiz to Determine 1099 vs Employee Status can help clarify these distinctions.