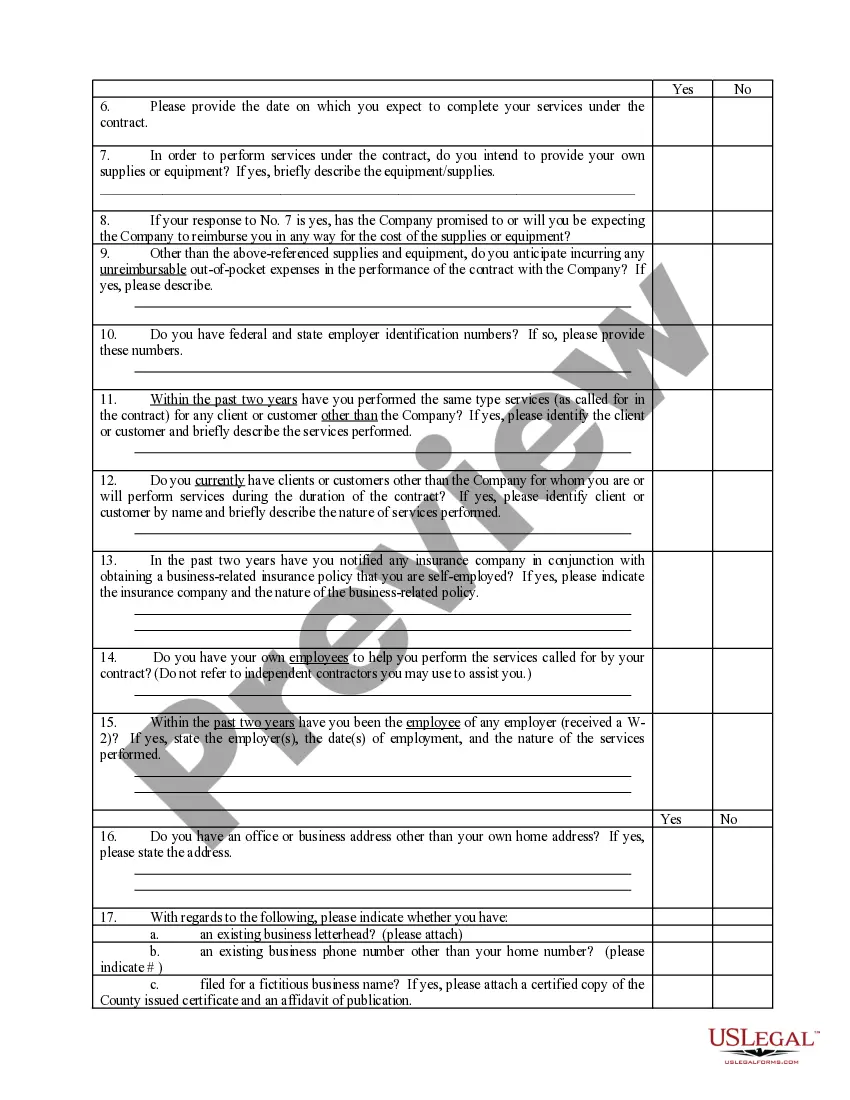

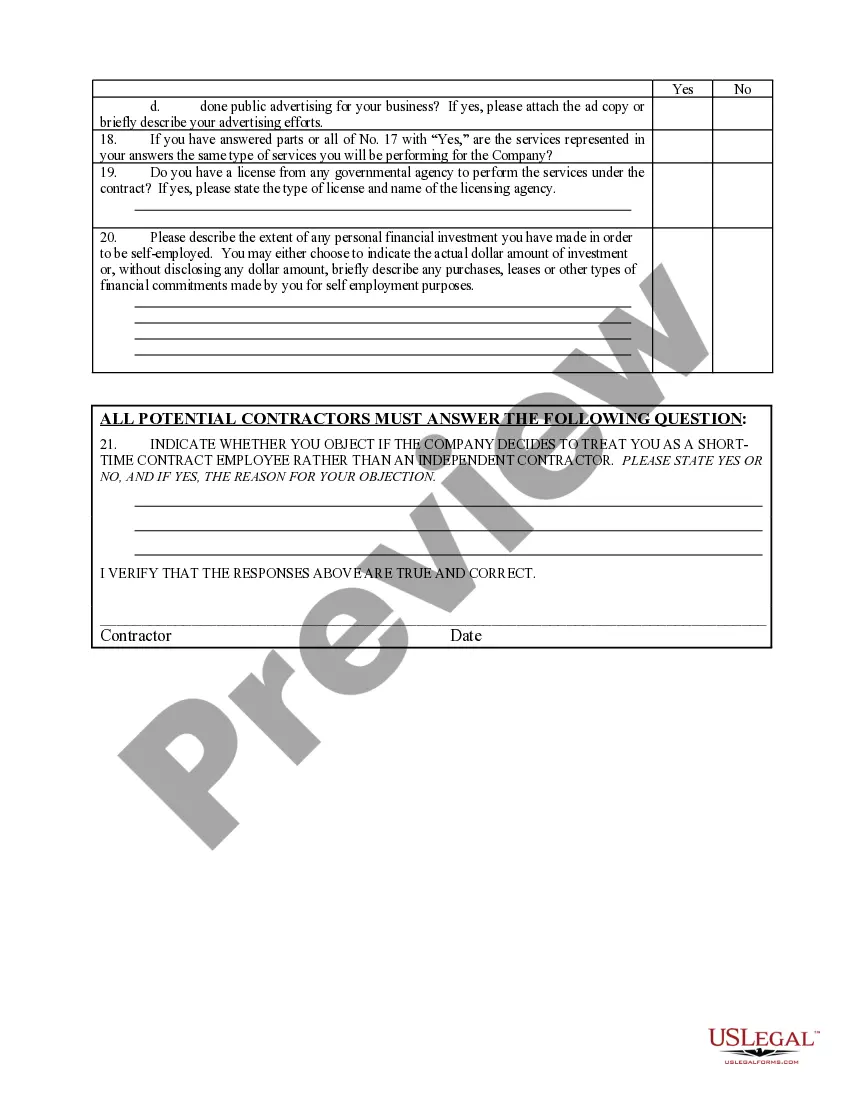

Florida Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

You have the capability to dedicate multiple hours online searching for the legal document template that fulfills the federal and state requirements you are looking for.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can obtain or print the Florida Self-Employed Independent Contractor Questionnaire through their service.

If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Acquire button.

- Subsequently, you can complete, modify, print, or sign the Florida Self-Employed Independent Contractor Questionnaire.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of the acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area of your choice.

- Check the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Do you need a business license in Florida? Florida doesn't require or issue a state-wide business operating license. That means you don't have to have a license from the state of Florida just to run your business in the state.

State's General TestFlorida uses a right of control test to determine whether a worker is an employee or independent contractor in most areas of the law.

Do you need a business license in Florida? Florida doesn't require or issue a state-wide business operating license. That means you don't have to have a license from the state of Florida just to run your business in the state.

(I) The independent contractor performs or agrees to perform specific services or work for a specific amount of money and controls the means of performing the services or work. (II) The independent contractor incurs the principal expenses related to the service or work that he or she performs or agrees to perform.

Yes! Many self-employed individuals, especially those who work from home, do not obtain a business license from the state or local government in Florida.

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

The major difference between those workers and Independent Contractors is that the contractors are actually W-2 employees, but they are employed by a staffing agency or a back-office service provider such as FoxHire instead of by the company they are performing work for.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

2714 Independent contractor in Florida reports payments of $600 or more in a calendar year on a IRS Form 1099 2714 Compensation may be a total amount for a specific task completed or in the form of hourly, daily, or weekly rates and is typically paid when work is complete 2714 Payment is due after an invoice is sent by the