Florida Angel Fund Promissory Note Term Sheet

Description

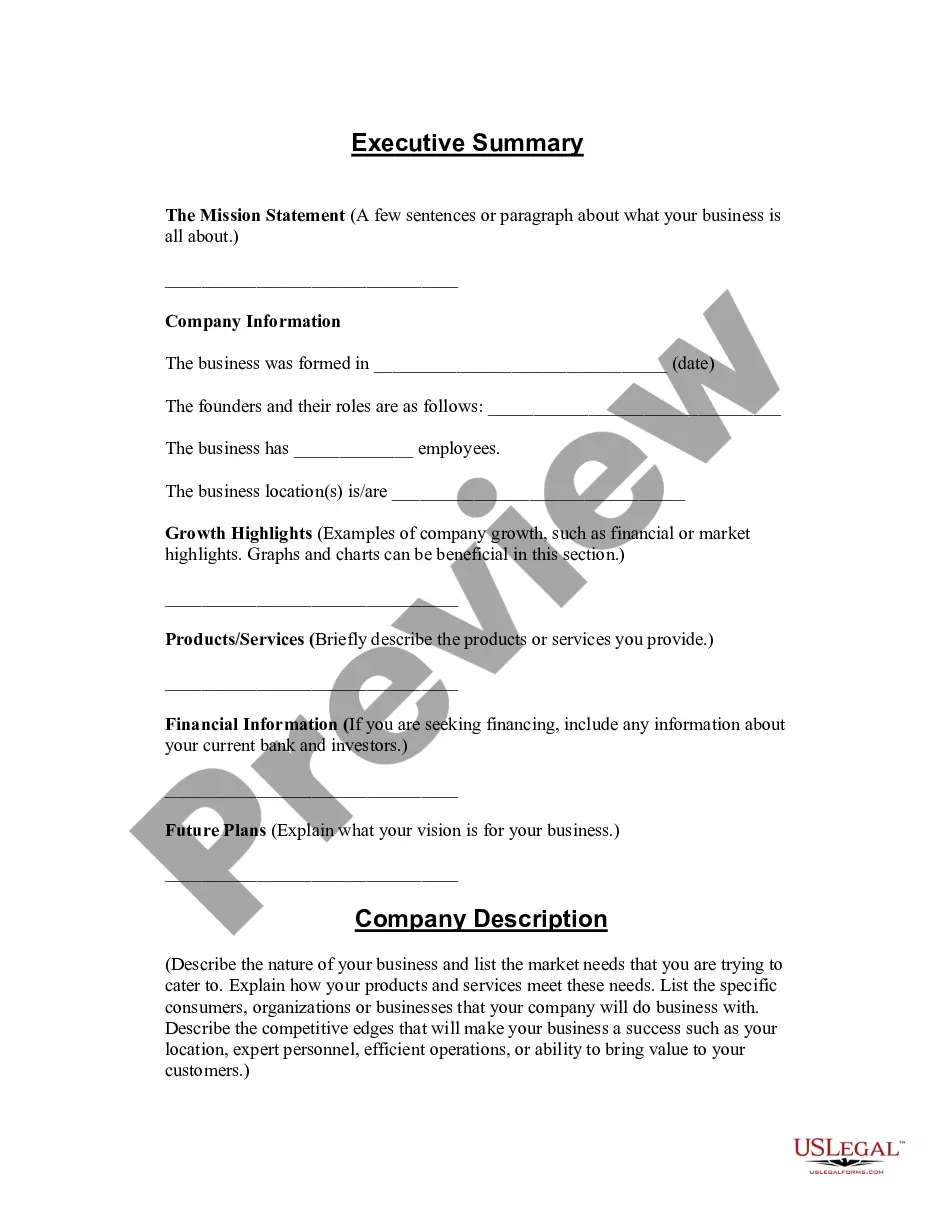

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

How to fill out Angel Fund Promissory Note Term Sheet?

If you want to full, down load, or printing legal record themes, use US Legal Forms, the greatest collection of legal varieties, which can be found on-line. Use the site`s simple and easy practical lookup to obtain the documents you will need. A variety of themes for enterprise and person functions are sorted by types and claims, or keywords. Use US Legal Forms to obtain the Florida Angel Fund Promissory Note Term Sheet in a couple of click throughs.

If you are presently a US Legal Forms consumer, log in to the accounts and then click the Obtain option to obtain the Florida Angel Fund Promissory Note Term Sheet. You can also accessibility varieties you in the past saved in the My Forms tab of your respective accounts.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape to the appropriate town/land.

- Step 2. Use the Preview choice to look over the form`s content. Never neglect to read the description.

- Step 3. If you are not satisfied using the type, utilize the Lookup industry on top of the monitor to discover other models in the legal type design.

- Step 4. Once you have located the shape you will need, go through the Get now option. Choose the costs program you like and put your qualifications to register on an accounts.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal accounts to finish the purchase.

- Step 6. Select the format in the legal type and down load it on your own system.

- Step 7. Complete, edit and printing or indication the Florida Angel Fund Promissory Note Term Sheet.

Every single legal record design you get is your own eternally. You possess acces to each type you saved with your acccount. Click on the My Forms segment and choose a type to printing or down load yet again.

Be competitive and down load, and printing the Florida Angel Fund Promissory Note Term Sheet with US Legal Forms. There are thousands of professional and express-particular varieties you can utilize for the enterprise or person needs.

Form popularity

FAQ

An angel investment deal typically has three components: an equity investment, a convertible note, and a warrant. The equity investment is a simple purchase of shares in the company. The convertible note is a loan that converts to equity at a later date, typically when the company raises additional capital.

The term sheet is the document that outlines the terms by which an investor (angel or venture capital investor) will make a financial investment in your company. Term sheets tend to consist of three sections: funding, corporate governance and liquidation.

Similar to investing in the stock market, angel investing has its own language with terms like ?cap table,? ?dilution,? ?drag-along rights,? and ?pro-rata rights?. Part of being an effective investor is learning this language so you can communicate with other investors and founders.

A term sheet can be defined as a non-binding agreement that sets out the basic conditions for making an investment. It serves as a template for developing more detailed documents that are legally binding.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

After agreement on the terms has been reached and formalized in a signed term sheet, legal documents (commonly called ?long-form docs? or ?final docs?) are prepared, reviewed, and executed to finalize the investment.

Common Angel Investment Terms Seed Capital (Stage) Just like it sounds, seed capital is the initial capital that funds a business. ... Valuation. The startup valuation of your company represents how much someone other than you thinks it's worth. ... Term Sheet. ... Convertible Note. ... Dilution. ... Cap Table. ... Common & Preferred Stock. ... Vesting.

The general rule of thumb for angel/seed stage rounds is that founders should sell between 10% and 20% of the equity in the company. These parameters weren't plucked out of thin air, they're based on what an early equity investor is looking for in terms of return.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

Simply put, term sheets are non-legally binding documents whereas contracts are legally binding definitive agreements. A term sheet usually lays the foundation for a contract. It ensures that the parties agree to the terms before entering a definitive agreement to avoid any potential conflict.