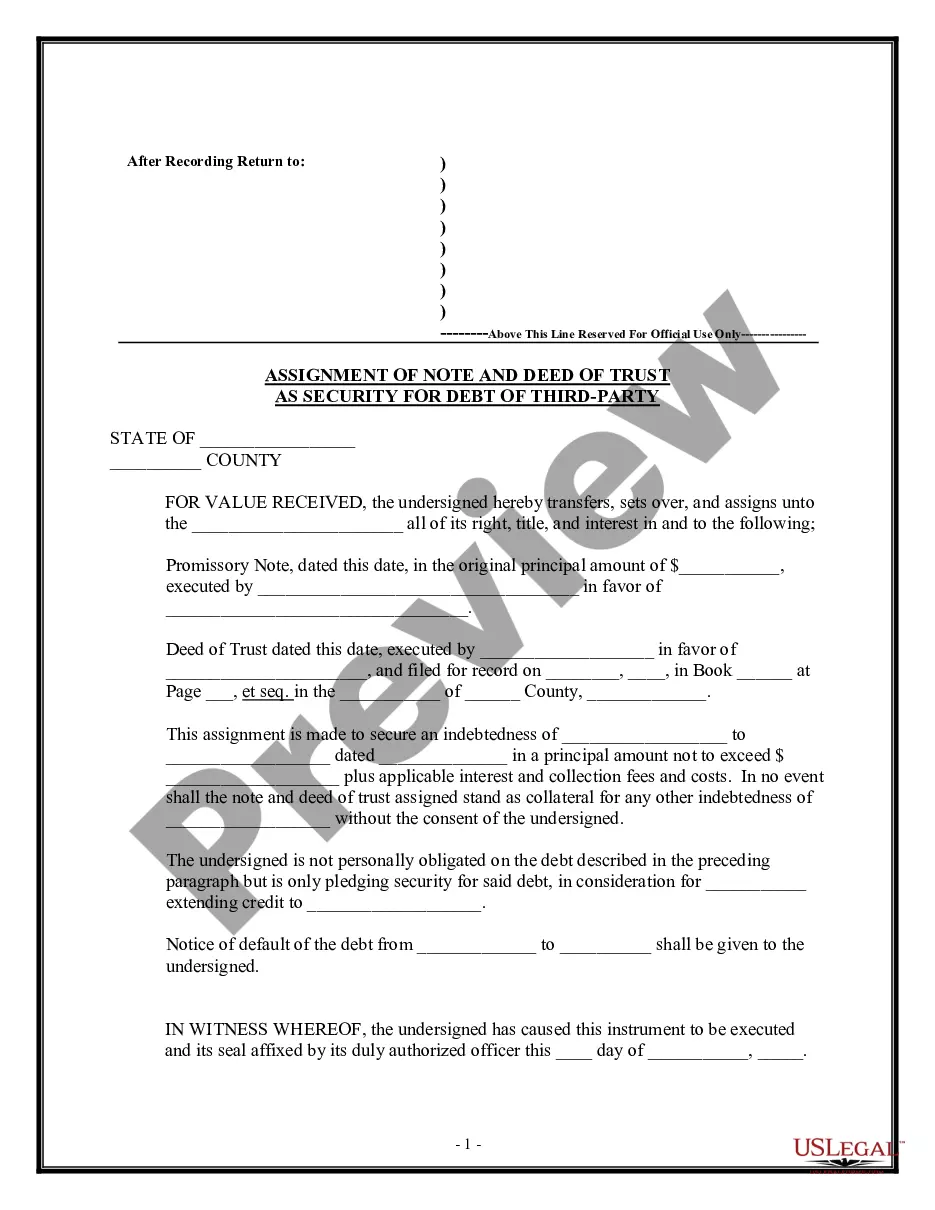

Florida Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

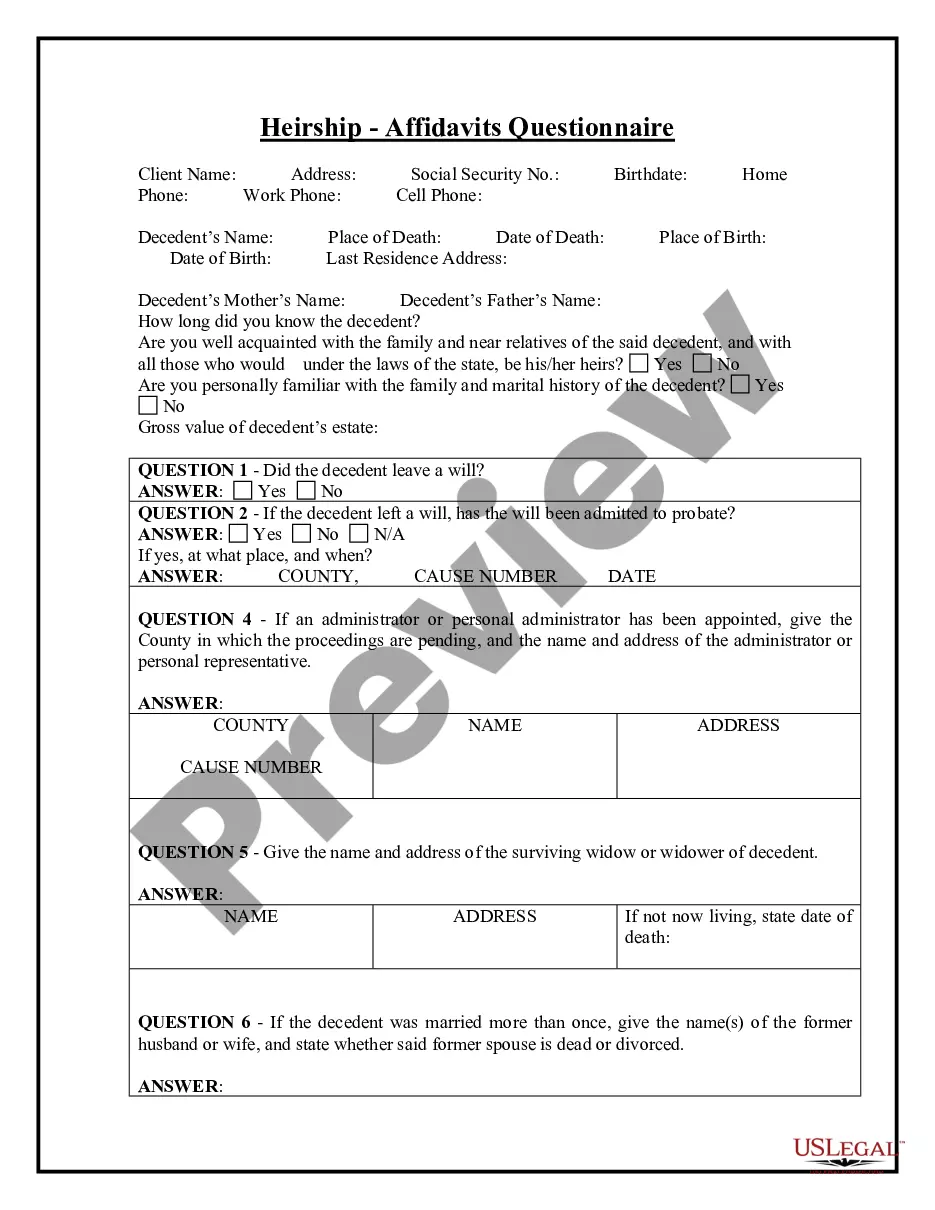

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

Choosing the right authorized document template can be a have difficulties. Of course, there are plenty of web templates available on the Internet, but how would you obtain the authorized kind you will need? Make use of the US Legal Forms internet site. The support delivers a large number of web templates, for example the Florida Assignment of Note and Deed of Trust as Security for Debt of Third Party, that you can use for company and personal demands. All the types are inspected by pros and fulfill federal and state requirements.

If you are presently authorized, log in for your account and then click the Down load button to obtain the Florida Assignment of Note and Deed of Trust as Security for Debt of Third Party. Utilize your account to appear with the authorized types you might have bought formerly. Check out the My Forms tab of your respective account and get another duplicate of your document you will need.

If you are a new consumer of US Legal Forms, here are basic directions so that you can stick to:

- First, be sure you have selected the proper kind to your area/area. It is possible to look through the form while using Preview button and look at the form outline to make sure it is the right one for you.

- If the kind will not fulfill your preferences, use the Seach discipline to obtain the correct kind.

- Once you are certain the form is suitable, select the Acquire now button to obtain the kind.

- Opt for the costs plan you need and type in the necessary info. Build your account and buy the order using your PayPal account or charge card.

- Choose the document formatting and acquire the authorized document template for your system.

- Comprehensive, modify and printing and indicator the attained Florida Assignment of Note and Deed of Trust as Security for Debt of Third Party.

US Legal Forms may be the most significant collection of authorized types for which you can discover different document web templates. Make use of the company to acquire skillfully-created papers that stick to condition requirements.

Form popularity

FAQ

Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee. Only after the borrower has satisfied the terms of their debt to the lender will the property be fully transferred to the borrower.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Essentially, a deed of trust provides a lender with security for the repayment of the loan and effectively functions similarly to a mortgage. A deed of trust is a deed that transfers a legal interest in a piece of real property owned by the lendee to the lender, or trustee, in order to secure the debt owed on the loan.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

Full reconveyance. document stating debt secured by the deed of trust has been discharged, releases security property from lien created by deed of trust, trustee must record this when borrower has paid debt within 21 days.

This is a standard form security trust deed. It creates a single security trust specifically for use in syndicated finance or other finance transactions where security is held on trust by a security trustee for the benefit of a group of secured finance parties (the beneficiaries).

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.