Iowa Partnership Agreement - Short Form

Description

How to fill out Partnership Agreement - Short Form?

If you need to comprehensive, acquire, or print out lawful record themes, use US Legal Forms, the greatest selection of lawful types, that can be found on the web. Make use of the site`s basic and handy look for to find the files you require. A variety of themes for enterprise and individual reasons are sorted by types and says, or key phrases. Use US Legal Forms to find the Iowa Partnership Agreement - Short Form with a few click throughs.

When you are currently a US Legal Forms customer, log in for your profile and click the Obtain switch to have the Iowa Partnership Agreement - Short Form. You can even entry types you previously downloaded from the My Forms tab of the profile.

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form to the correct metropolis/region.

- Step 2. Make use of the Review option to examine the form`s content. Do not forget about to learn the explanation.

- Step 3. When you are unhappy with all the type, take advantage of the Research area towards the top of the display screen to find other versions in the lawful type format.

- Step 4. After you have discovered the form you require, select the Acquire now switch. Select the costs prepare you choose and put your accreditations to register for the profile.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal profile to finish the purchase.

- Step 6. Choose the structure in the lawful type and acquire it on the device.

- Step 7. Comprehensive, change and print out or indicator the Iowa Partnership Agreement - Short Form.

Every single lawful record format you acquire is your own property permanently. You have acces to every type you downloaded within your acccount. Click on the My Forms section and pick a type to print out or acquire again.

Remain competitive and acquire, and print out the Iowa Partnership Agreement - Short Form with US Legal Forms. There are thousands of professional and status-certain types you may use to your enterprise or individual requires.

Form popularity

FAQ

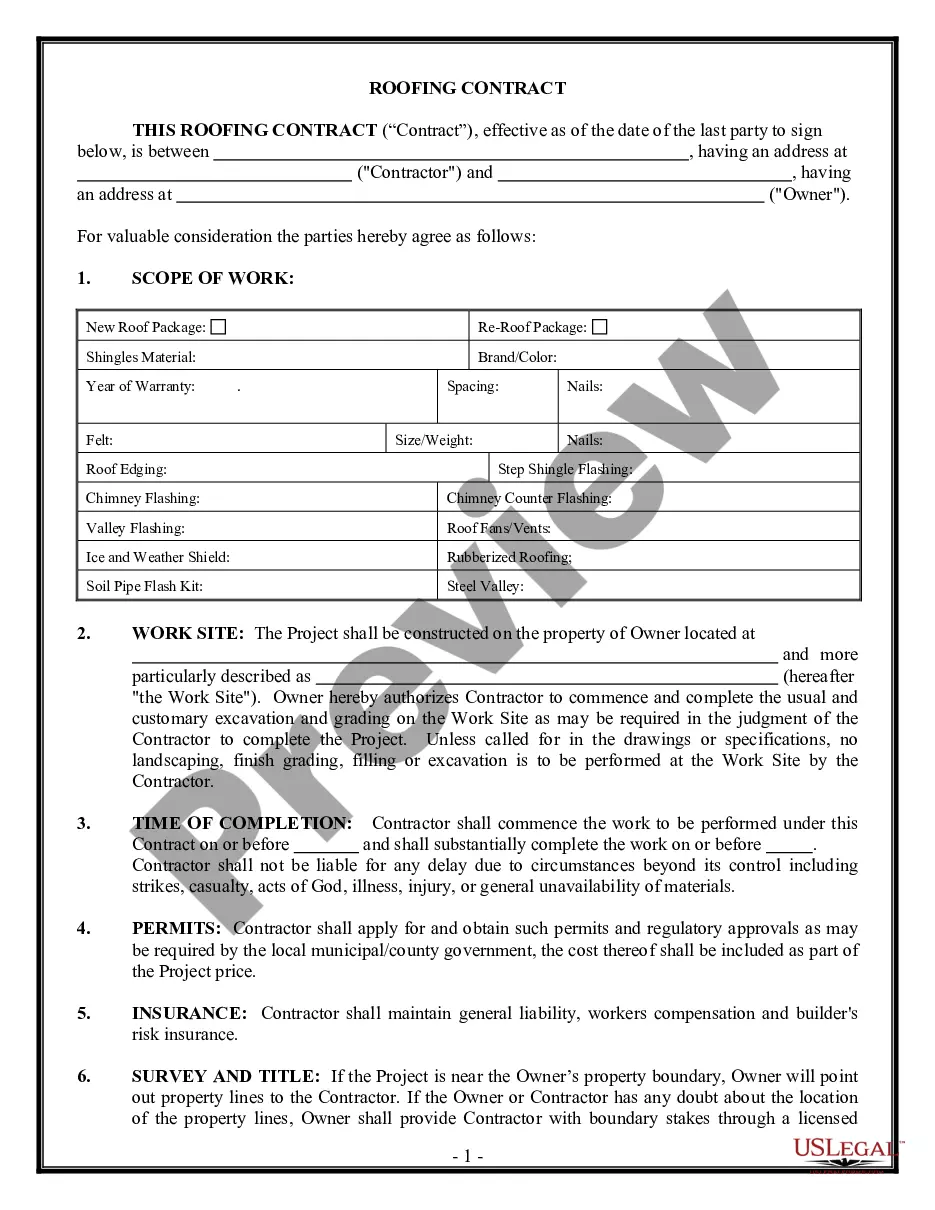

How to form a partnership: 10 steps to success Choose your partners. ... Determine your type of partnership. ... Come up with a name for your partnership. ... Register the partnership. ... Determine tax obligations. ... Apply for an EIN and tax ID numbers. ... Establish a partnership agreement. ... Obtain licenses and permits, if applicable.

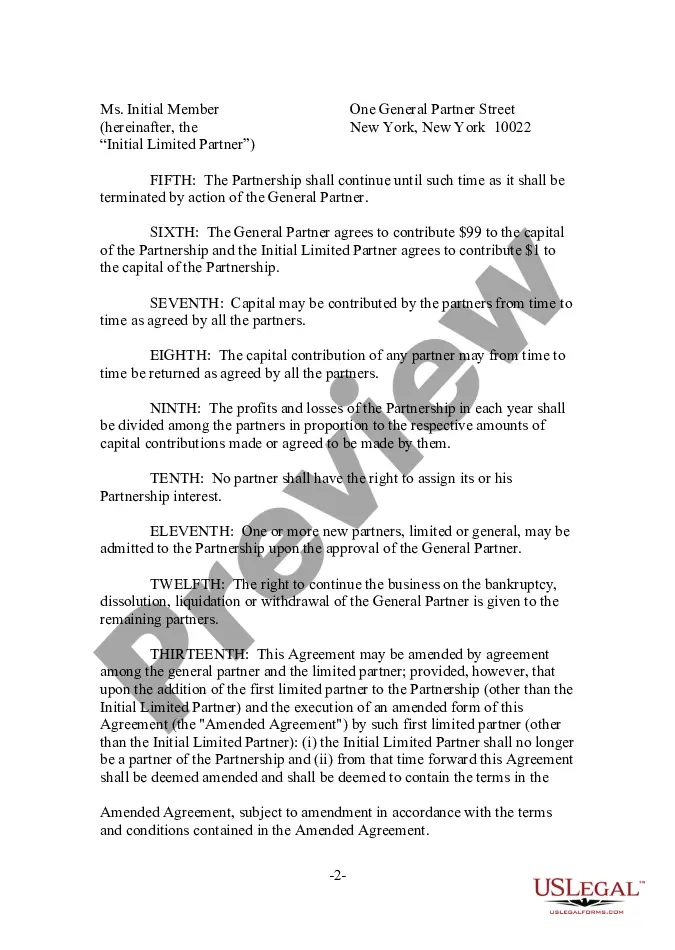

A typical partnership agreement will set out the agreed rules by which the partnership operates, and deals with matters including: Sharing of income and capital profits between the partners. Capital contributions required and made by the partners.

Form 1065, U.S. Return of Partnership Income, is a tax form used by partnerships to provide a statement of financial performance and position to the IRS each tax year. The form includes information related to a partnership's income and deductions, gains and losses, taxes and payments during the tax year.

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Steps to Create an Iowa General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Iowa state tax identification numbers.

Partnerships in Iowa are considered pass-through entities. This means the partnerships pay no business tax in Iowa, but the income from the partnership is passed on to the owners' personal income, where it is then taxed as income. Partnerships in Iowa may have to file annual reports with the state of Iowa.

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP).

What does Limited partnership agreement (LPA) mean? Written agreement between the general partner(s) and limited partners to a limited partnership setting out the rights and duties of the partners between themselves.