A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that someone is an attorney or that any communication is from an attorney.

Florida Notice to Debt Collector - Misrepresenting Someone as an Attorney

Description

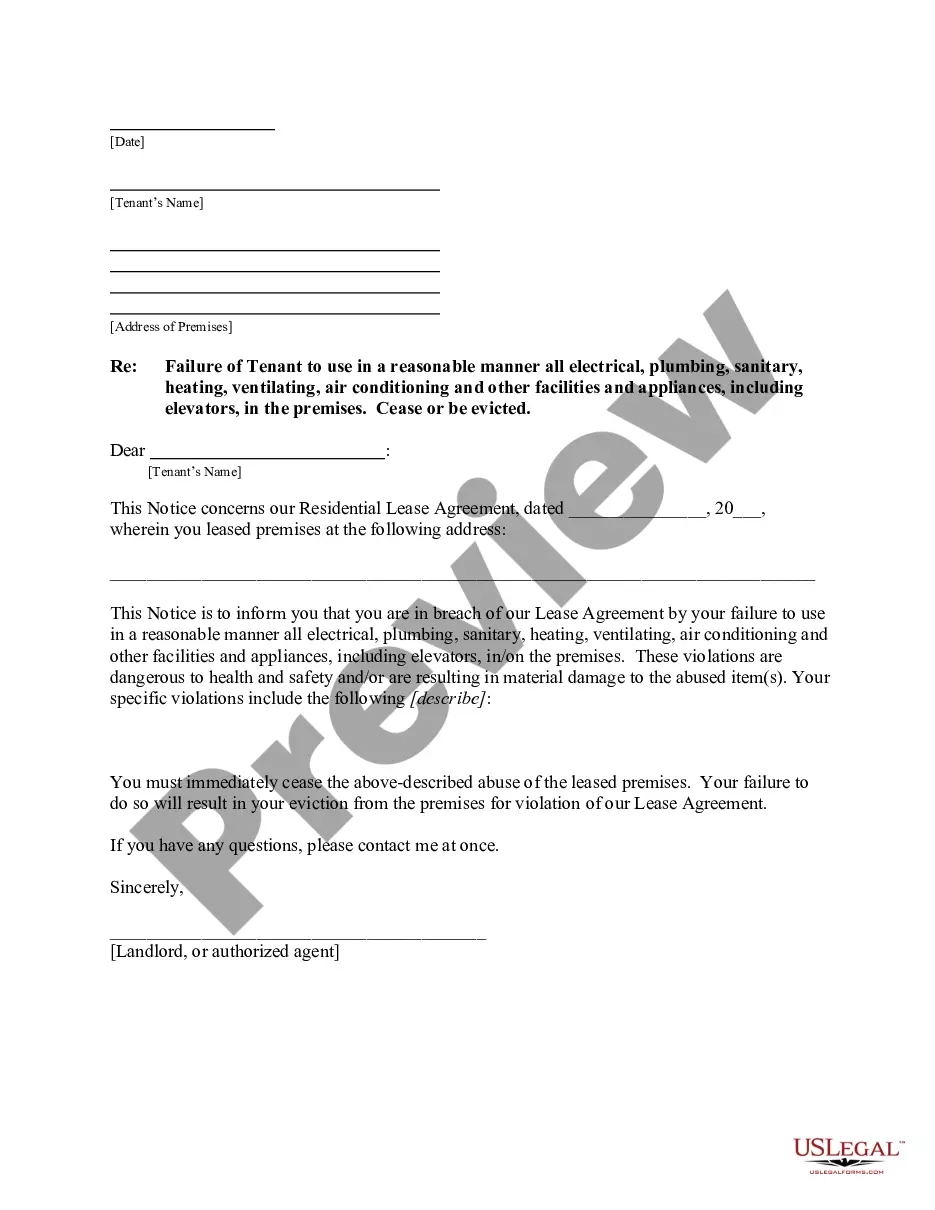

How to fill out Notice To Debt Collector - Misrepresenting Someone As An Attorney?

Discovering the right legitimate papers web template might be a have difficulties. Needless to say, there are tons of layouts available on the Internet, but how will you discover the legitimate kind you need? Make use of the US Legal Forms web site. The services gives a large number of layouts, like the Florida Notice to Debt Collector - Misrepresenting Someone as an Attorney, which you can use for enterprise and personal requires. Each of the types are checked out by experts and satisfy state and federal needs.

Should you be currently authorized, log in to your bank account and click on the Download key to find the Florida Notice to Debt Collector - Misrepresenting Someone as an Attorney. Make use of bank account to look through the legitimate types you may have purchased formerly. Go to the My Forms tab of the bank account and acquire yet another version of your papers you need.

Should you be a new customer of US Legal Forms, listed below are easy instructions so that you can adhere to:

- Initial, make certain you have chosen the proper kind for your area/region. You are able to look through the shape while using Preview key and read the shape explanation to ensure it will be the right one for you.

- When the kind does not satisfy your expectations, utilize the Seach area to get the correct kind.

- When you are sure that the shape is acceptable, go through the Get now key to find the kind.

- Opt for the costs prepare you would like and enter the needed info. Build your bank account and purchase the transaction with your PayPal bank account or Visa or Mastercard.

- Opt for the submit formatting and obtain the legitimate papers web template to your gadget.

- Comprehensive, edit and print out and indication the obtained Florida Notice to Debt Collector - Misrepresenting Someone as an Attorney.

US Legal Forms will be the largest local library of legitimate types that you can find numerous papers layouts. Make use of the company to obtain skillfully-created papers that adhere to express needs.

Form popularity

FAQ

6 Ways to Deal With Debt Collectors Check Your Credit Report. ... Make Sure the Debt Is Valid. ... Know the Statute of Limitations. ... Consider Negotiating. ... Try to Make the Payments You Owe. ... Send a Cease and Desist Letter.

Debt Collectors Cannot Threaten or Harass You They are not allowed to threaten to call or harass your employer or your family members, misrepresent the amount you owe, use obscene or profane language, or call repeatedly to annoy you. If debt collectors engage in these practices, their actions might be illegal.

Example ? Hi [Customer Name], this is [Your Name] from [Your Company]. I'm calling about your overdue invoice [invoice number] for [amount due] which was due on [due date]. I wanted to check in with you to see if there was a reason the payment has been delayed and if there's any way we can assist.

Under federal law, a debt collector must go through your attorney if they know that you have one, so it's a good idea ? if you get legal representation ? to tell the collector the name of the attorney who is representing you and how to contact them.

To block a recent caller on an Android: Open your phone app. Tap more, then go to your call history. Select the unwanted caller. Select block/report spam. Make sure the block/report spam button is checked. Click the block button.

Are debt collectors persistently trying to get you to pay what you owe them? Use this 11-word phrase to stop debt collectors: ?Please cease and desist all calls and contact with me immediately.? You can use this phrase over the phone, in an email or letter, or both.

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.

Communicating with debt collectors In addition to using the validation information to follow up with the debt collector, you can use these sample letters to communicate with them: I do not owe this debt . I need more information about this debt . I want the debt collector to stop contacting me .