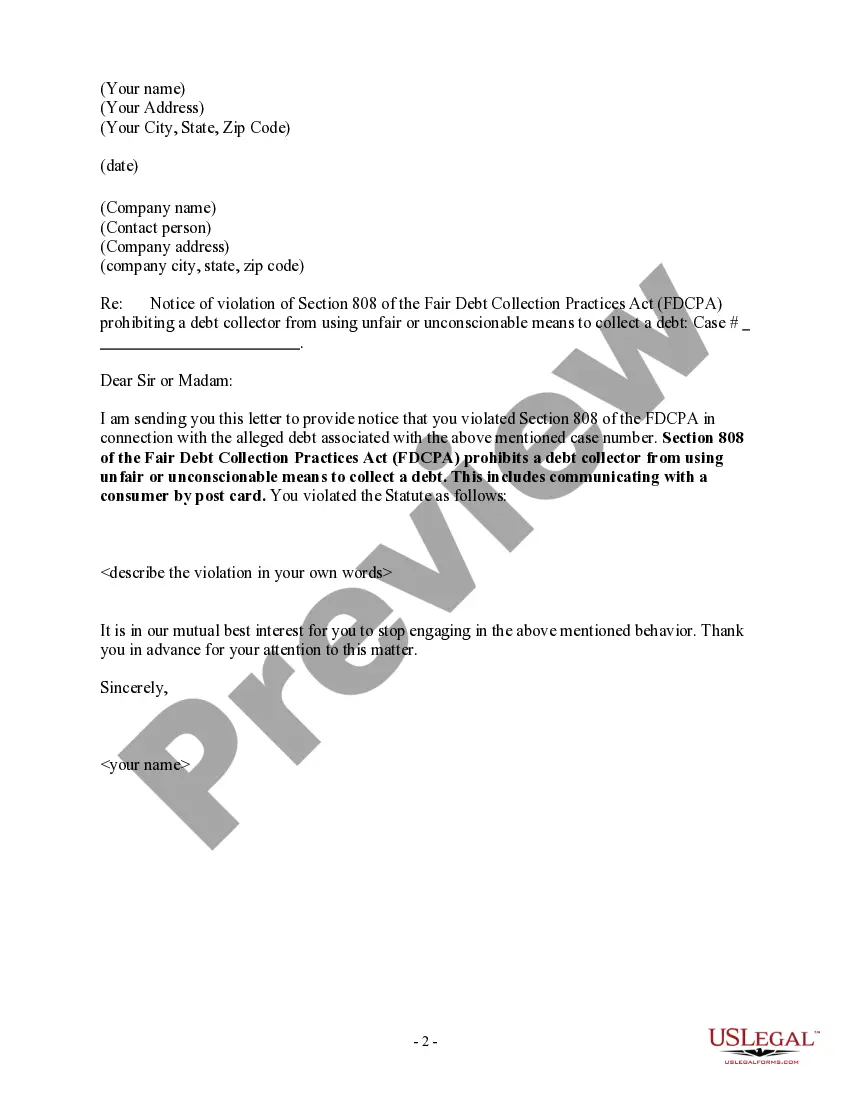

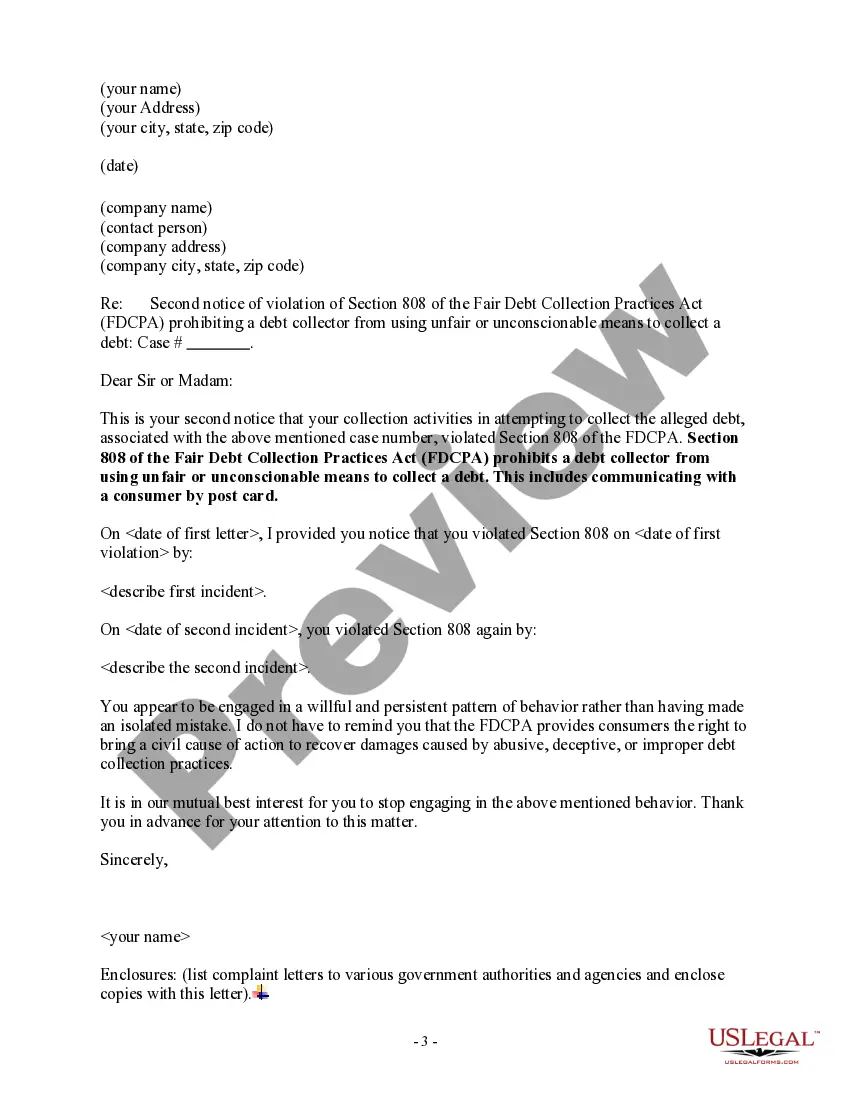

Florida Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

If you wish to acquire, obtain, or print legal document formats, utilize US Legal Forms, the largest selection of legal templates available online.

Make use of the site's straightforward and convenient search to find the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your details to sign up for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Florida Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and press the Download button to receive the Florida Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms of the legal template.

Form popularity

FAQ

Debt collection agencies are not bailiffs; They have no extra-legal authority. Debt collectors are either acting on behalf of your creditor or working for a company that has taken on the debt. They don't have any special legal powers and can't do anything different than the original creditor.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

Top 7 Debt Collector Scare TacticsExcessive Amount of Calls.Threatening Wage Garnishment.Stating You Have a Deadline.Collecting Old Debts.Pushing You to Pay Your Debt to Improve Your Credit ScoreStating They Do Not Need to Prove Your Debt ExistsSharing Your Debt With Family and Friends.07-May-2021

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

Debt collectors are not permitted to try to publicly shame you into paying money that you may or may not owe. In fact, they're not even allowed to contact you by postcard. They cannot publish the names of people who owe money. They can't even discuss the matter with anyone other than you, your spouse, or your attorney.

Can You Sue a Company for Sending You to Collections? Yes, the FDCPA allows for legal action against certain collectors that don't comply with the rules in the law. If you're sent to collections for a debt you don't owe or a collector otherwise ignores the FDCPA, you might be able to sue that collector.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.