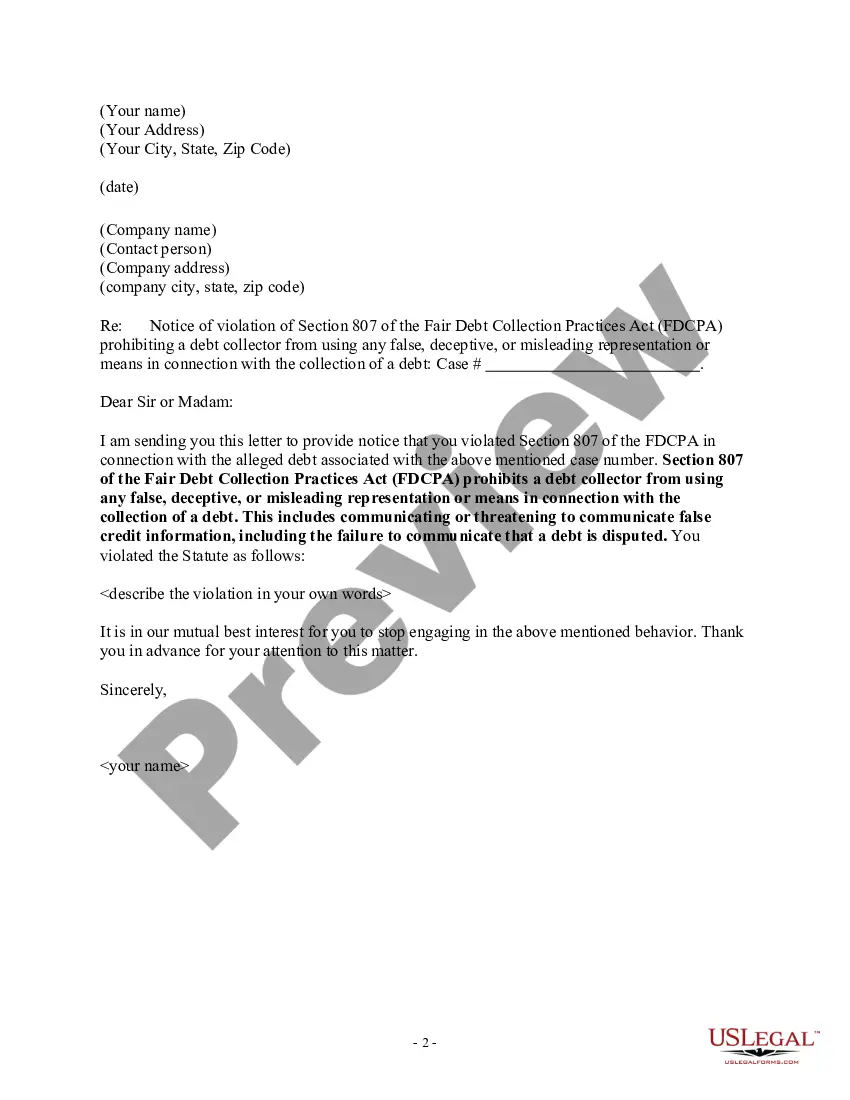

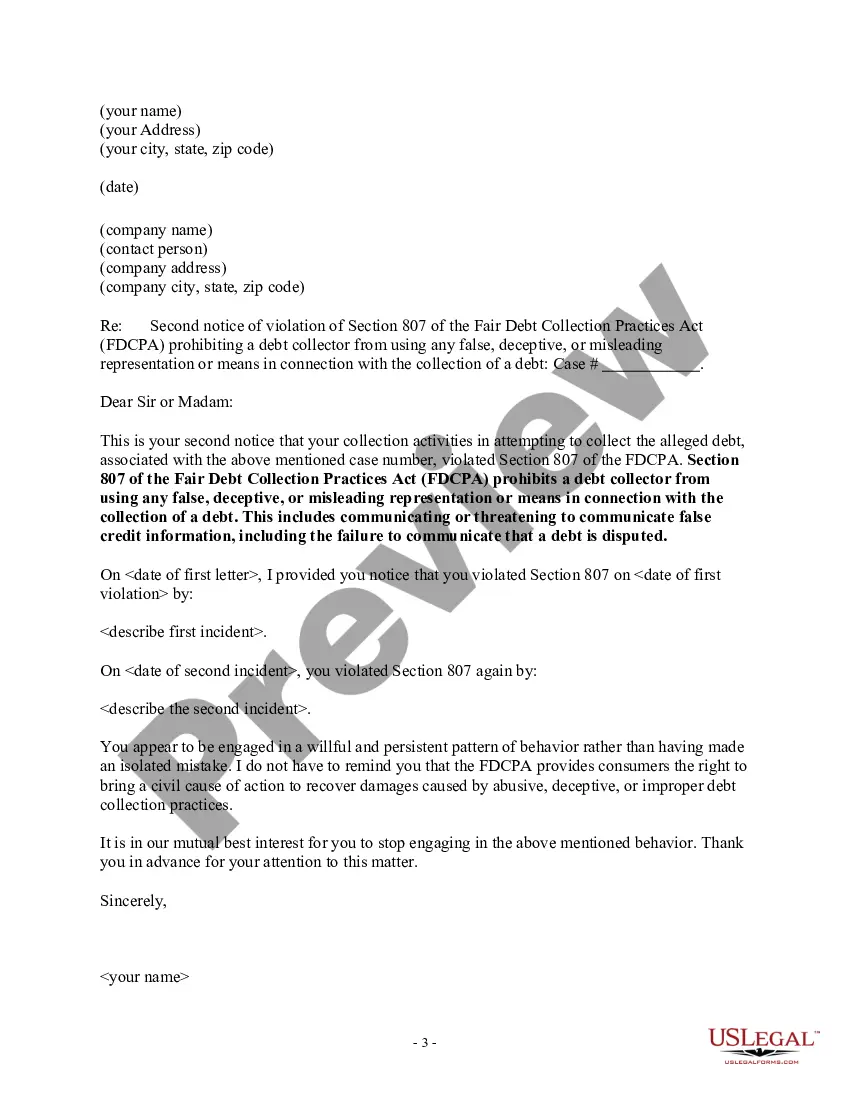

Florida Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

It is feasible to spend time online searching for the legal document template that fulfills the federal and state requirements that you need.

US Legal Forms provides a vast array of legal forms that have been reviewed by experts.

You can easily acquire or print the Florida Notice of Violation of Fair Debt Act - False Information Disclosed from my services.

If available, use the Preview option to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Acquire option.

- Afterward, you can complete, amend, print, or sign the Florida Notice of Violation of Fair Debt Act - False Information Disclosed.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms site for the first time, adhere to the straightforward instructions provided below.

- First, ensure that you have selected the correct document template for the region/city you want.

- Review the form details to confirm that you have chosen the correct one.

Form popularity

FAQ

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.