Florida Nonqualified Stock Option Agreement of Orion Network Systems, Inc.

Description

How to fill out Nonqualified Stock Option Agreement Of Orion Network Systems, Inc.?

Choosing the right lawful papers format might be a have difficulties. Obviously, there are tons of themes available on the net, but how will you find the lawful develop you need? Utilize the US Legal Forms website. The service delivers a huge number of themes, including the Florida Nonqualified Stock Option Agreement of Orion Network Systems, Inc., that can be used for organization and personal requirements. Every one of the kinds are inspected by professionals and meet up with state and federal requirements.

When you are already listed, log in in your bank account and click the Acquire button to get the Florida Nonqualified Stock Option Agreement of Orion Network Systems, Inc.. Make use of your bank account to search through the lawful kinds you possess purchased in the past. Proceed to the My Forms tab of your own bank account and acquire another version of the papers you need.

When you are a brand new customer of US Legal Forms, allow me to share easy recommendations for you to comply with:

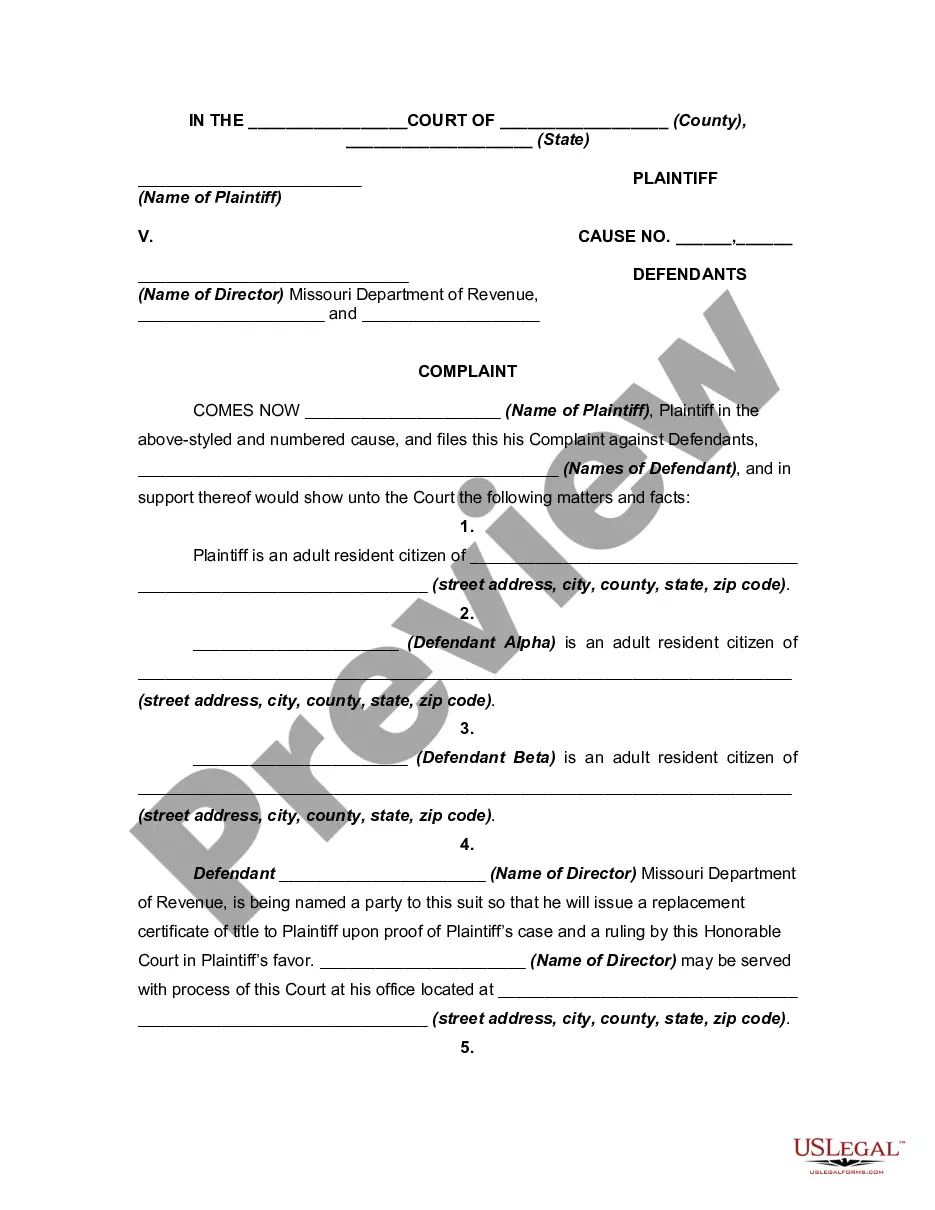

- Very first, make sure you have chosen the right develop for your personal town/state. You can look through the form making use of the Review button and study the form information to guarantee it is the best for you.

- In the event the develop will not meet up with your expectations, use the Seach industry to find the correct develop.

- Once you are certain that the form is acceptable, select the Buy now button to get the develop.

- Pick the rates strategy you would like and type in the required information and facts. Build your bank account and pay for your order using your PayPal bank account or charge card.

- Opt for the submit formatting and acquire the lawful papers format in your product.

- Full, change and produce and indication the acquired Florida Nonqualified Stock Option Agreement of Orion Network Systems, Inc..

US Legal Forms is definitely the largest local library of lawful kinds where you can discover numerous papers themes. Utilize the service to acquire expertly-created papers that comply with condition requirements.