Florida Memo on Company Relocation including Relocation Pay for Employees

Description

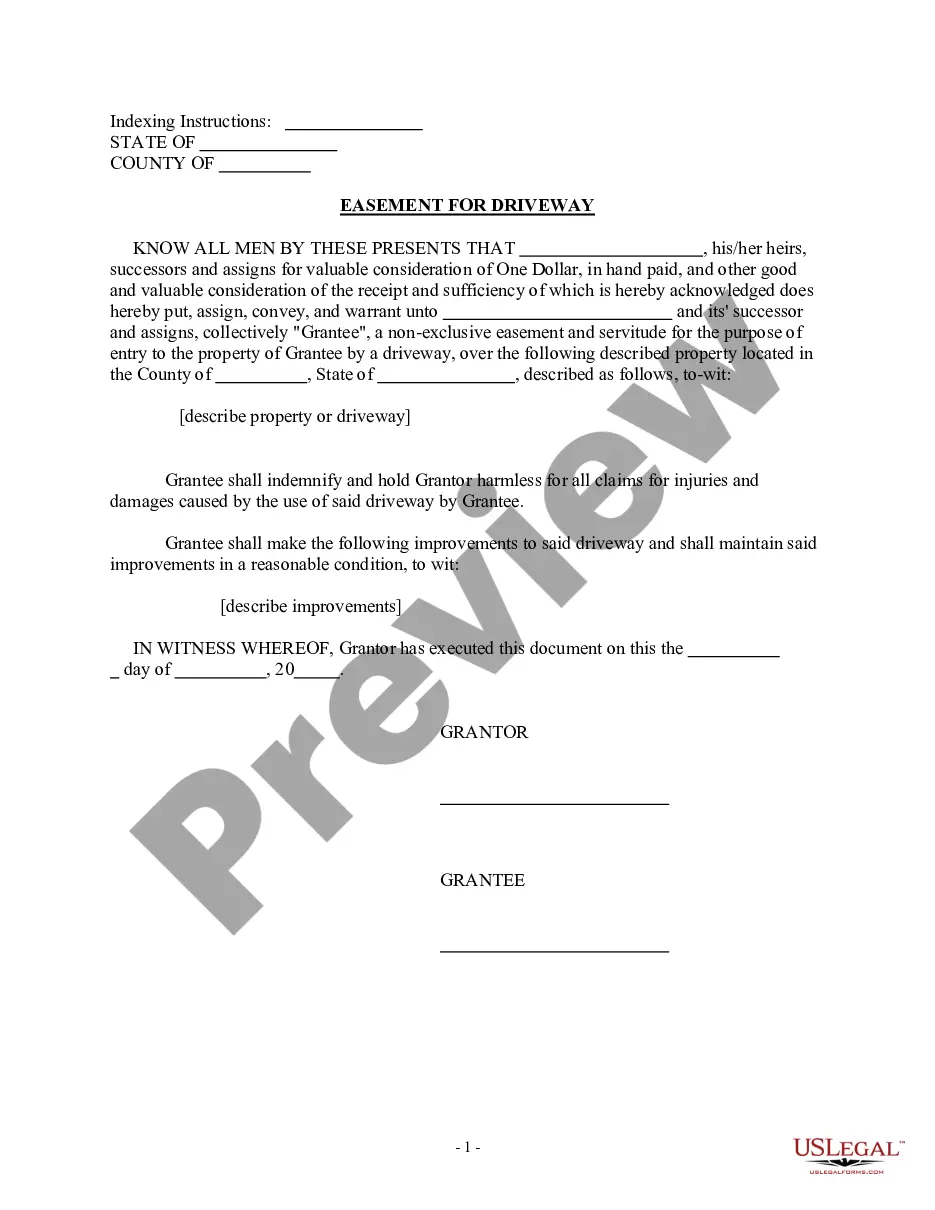

How to fill out Memo On Company Relocation Including Relocation Pay For Employees?

Locating the appropriate sanctioned document template can be quite a challenge.

Of course, there exists a multitude of templates accessible online, but how can you find the legal form you need.

Utilize the US Legal Forms platform. The service offers thousands of templates, such as the Florida Memo on Company Relocation, which includes Relocation Compensation for Employees, suitable for both business and personal purposes.

First, confirm that you have chosen the right form for your location. You can preview the form using the Preview option and read the form description to ensure it is suitable for you.

- All forms are reviewed by professionals and meet state and federal guidelines.

- If you are already a member, Log In to your account and click on the Download button to access the Florida Memo on Company Relocation including Relocation Pay for Employees.

- Use your account to examine the legal forms you may have previously acquired.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new subscriber of US Legal Forms, here are simple instructions you can follow.

Form popularity

FAQ

Yes, Florida does offer relocation assistance through various programs and employer initiatives. Companies may provide relocation packages that include financial support tailored to employee needs. By referring to the Florida Memo on Company Relocation including Relocation Pay for Employees, individuals can learn more about available programs and ensure they receive the assistance they deserve.

Relocation support refers to various forms of assistance provided by employers to help employees move. This may include financial aid, logistics planning, and resources to facilitate a smooth transition. The Florida Memo on Company Relocation including Relocation Pay for Employees outlines the benefits of such support in effectively managing a move.

Relocation reimbursement is a payment made by an employer to cover costs incurred by an employee during their move. This reimbursement can include expenses such as transportation, housing, and other relocation-related costs, as specified in the Florida Memo on Company Relocation including Relocation Pay for Employees. Employees should take advantage of this opportunity to ease their financial burden during the transition.

When a company pays for your relocation, this is often termed 'relocation assistance' or 'relocation benefits.' This support may cover various costs such as moving services, travel expenses, and more, as highlighted in the Florida Memo on Company Relocation including Relocation Pay for Employees. Utilizing such benefits ensures a more manageable transition to a new work location.

To obtain relocation reimbursement, keep records of all related expenses to present to your employer. Submit a formal reimbursement request along with your receipts according to your company’s policy. Consulting the Florida Memo on Company Relocation including Relocation Pay for Employees can guide you on the reimbursement process and the necessary documentation.

To request a relocation package, start by discussing your move with your employer or HR department. Explain your situation and express the need for a relocation package that aligns with the Florida Memo on Company Relocation including Relocation Pay for Employees. Clear communication about your requirements can facilitate a positive response from your employer.

When a company pays for relocation, it is typically referred to as a relocation package. This package often includes various types of financial support for moving expenses and may cover packing, transportation, and temporary housing. In the context of the Florida Memo on Company Relocation including Relocation Pay for Employees, these packages can significantly help employees transition smoothly to new locations.

To claim a relocation allowance, you typically need to submit a detailed record of your moving expenses and the reimbursement request to your employer. Some companies provide specific forms for this process. Relying on the Florida Memo on Company Relocation including Relocation Pay for Employees can streamline your claim process and ensure you meet all necessary requirements.

In general, relocation expenses can be taxable in the US, depending on the nature of the reimbursement and the employee’s circumstances. For many employees, qualified moving expenses may be deductible while some reimbursements may lead to taxable income. Knowing the ins and outs of the Florida Memo on Company Relocation including Relocation Pay for Employees can clarify this aspect.

You should report relocation expenses by documenting the costs and including them with your tax records. For businesses, tracking these costs in your accounting software is essential. The Florida Memo on Company Relocation including Relocation Pay for Employees provides valuable guidelines for proper reporting.