Florida Employee Notice to Correct IRCA Compliance

Description

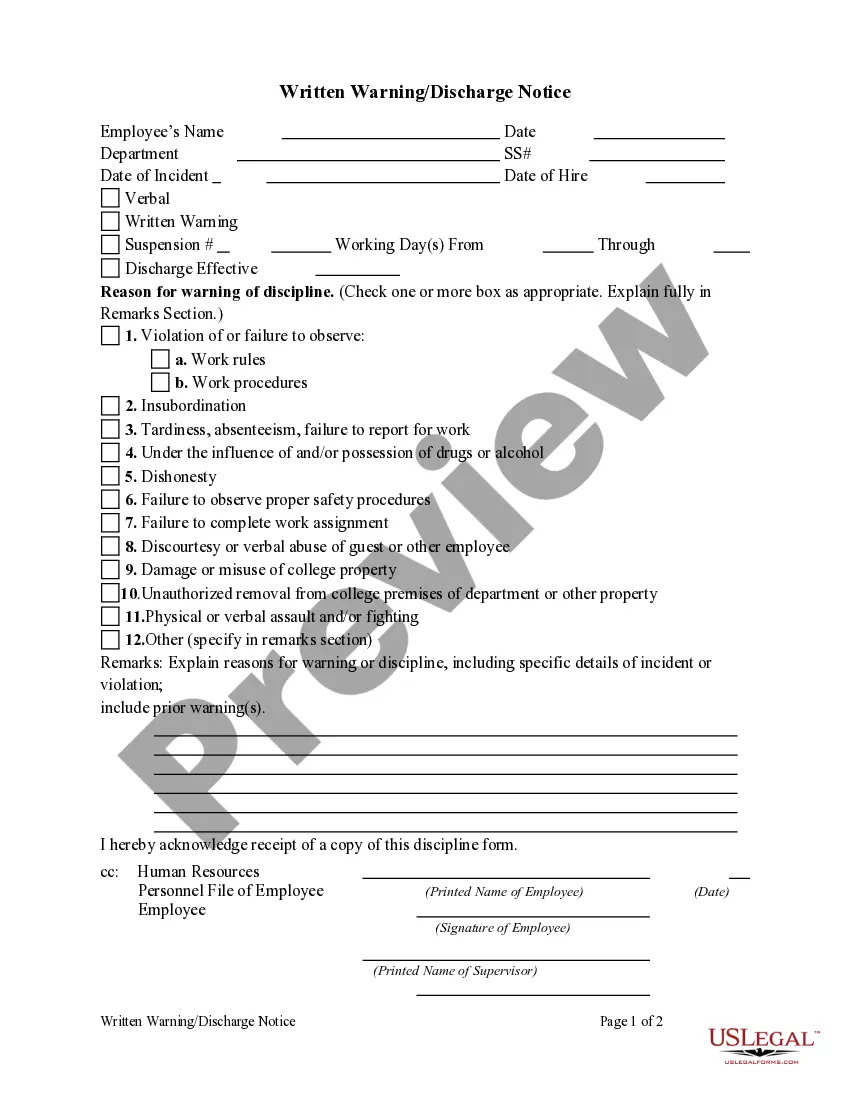

How to fill out Employee Notice To Correct IRCA Compliance?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse assortment of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Florida Employee Notice to Correct IRCA Compliance in mere seconds.

If you possess a subscription, Log In and download the Florida Employee Notice to Correct IRCA Compliance from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms within the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make changes. Complete, edit, print, and sign the downloaded Florida Employee Notice to Correct IRCA Compliance. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire. Gain access to the Florida Employee Notice to Correct IRCA Compliance with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

- Click on the Review button to examine the content of the form.

- Check the form details to confirm that you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

An I-9 audit can be triggered for a number of reasons, including random samples and reporting by disgruntled employees (or ex-employees). Certain business sectors, for example food production, are especially susceptible to I-9 audits, and "silent raids" by ICE.

9 Central U.S. Department of Labor.

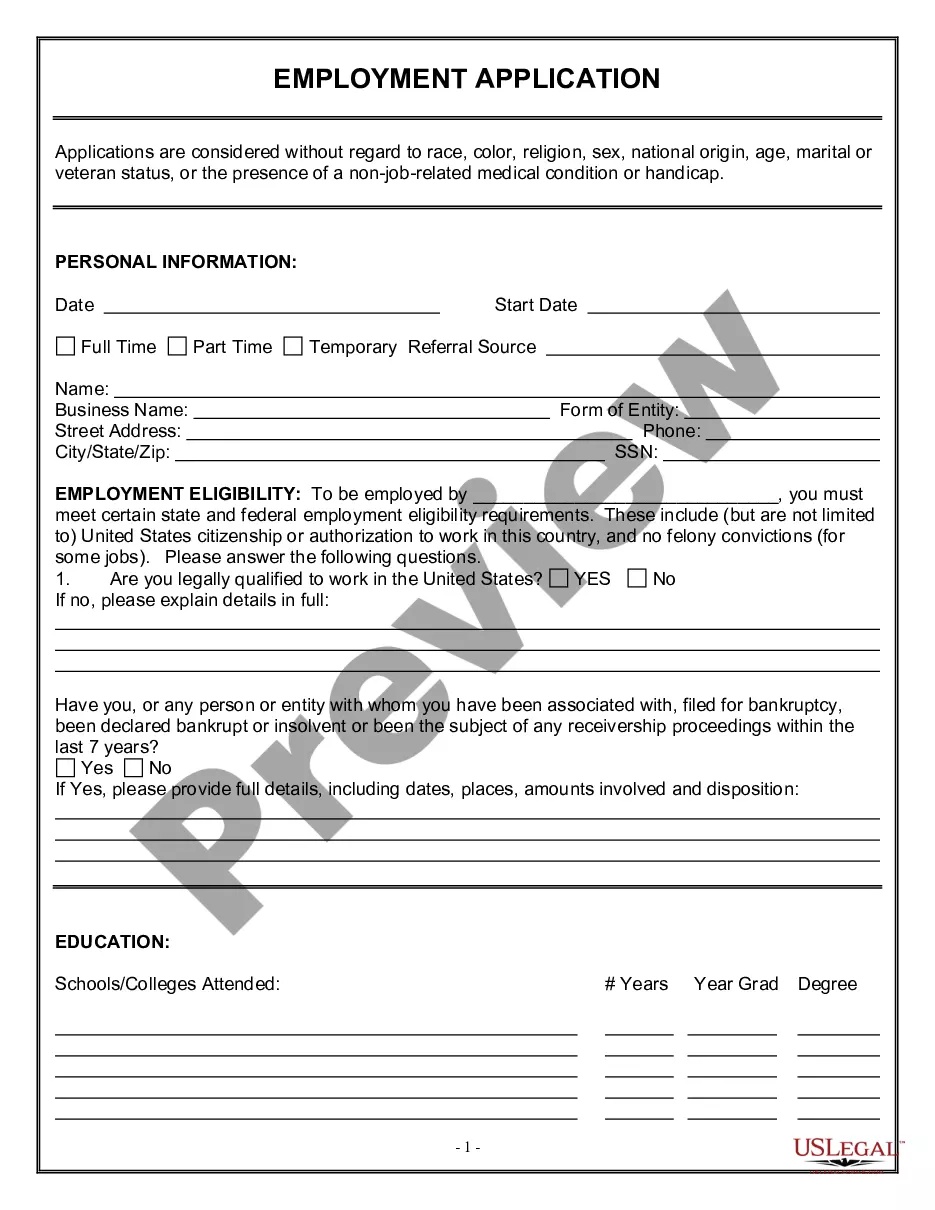

The Immigration Reform and Compliance Act of 1986 (IRCA) prohibits the employment of unauthorized aliens and requires all employers to: (1) not knowingly hire or continue to employ any person not authorized to work in the United States, (2) verify the employment eligibility of every new employee (whether the employee

The employee is required to complete Section 1 of the form; however, the employer is ultimately liable for proper completion of Form I20119 and must ensure that Section 1 of the form is properly completed by the employee.

U.S. Department of Labor, Wage and Hour Division (DOL/WHD) Toll-free phone number: 1-866-487-9243 (TDD for deaf and hard of hearing: 1-877-889-5627) Assistance is available in many languages via live interpreters.

The Immigration Reform and Control Act (IRCA) of 1986 requires all U.S. employers, regardless of size, to complete a Form I-9 upon hiring a new employee to work in the United States.

IRCA requires all employers to have all employees hired after 1986 complete I-9 verification paperwork. Workers who are not hired do not need to complete I-9 Forms and employers who selectively choose who will and will not complete I-9s could face penalties under anti-discrimination rules.

Do we have to pay an employee who terminated employment before completing Form I-9? Yes. An incomplete I-9 form does not affect an employer's ability or obligation to pay an employee. The I-9 form is used to verify eligibility to work in the U.S. and does not affect payroll.

Immigration and Customs Enforcement (ICE) is one of the main agencies that enforces this federal law, often by conducting I-9 audits, and with increasing regularity through work site raids (even during the COVID-19 pandemic).

The IRCA requires employers to certify (using the I-9 form) within three days of employment the identity and eligibility to work of all employees hired. I-9 forms must be retained for three years following employment or 1 year following termination whichever is later.