Florida Complex Guaranty Agreement to Lender

Description

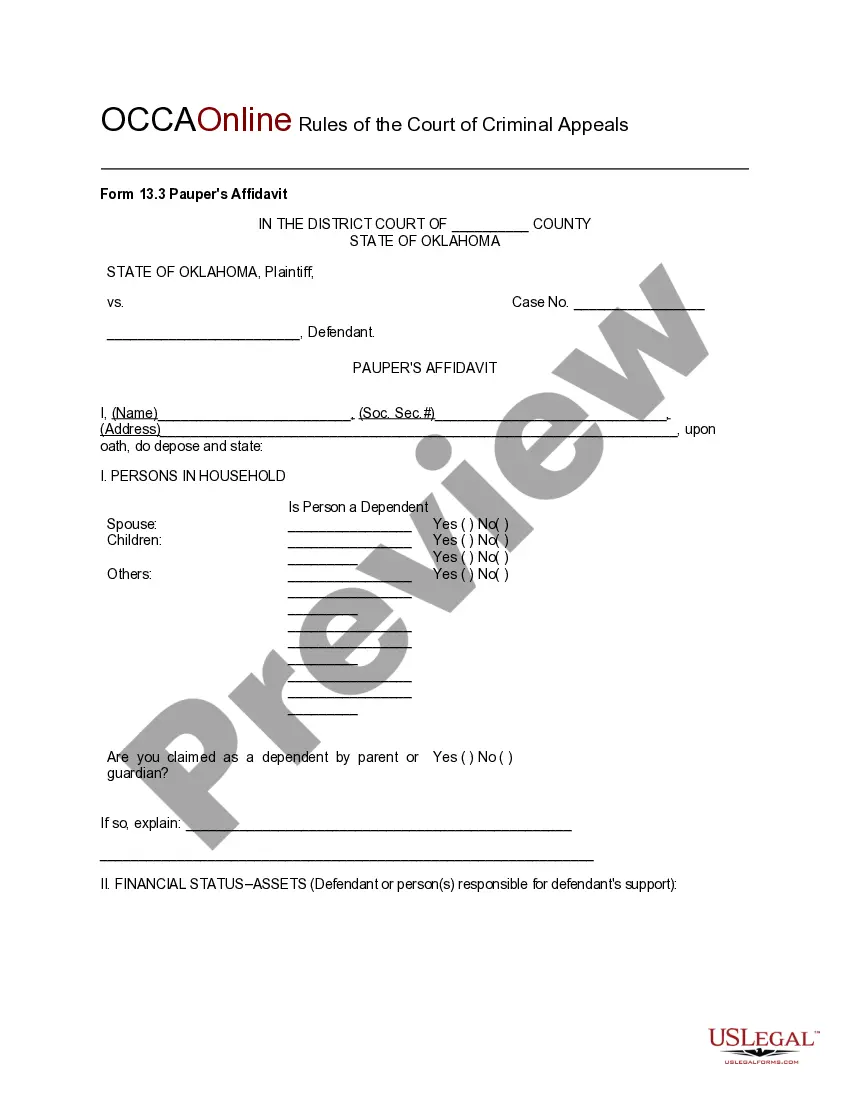

How to fill out Complex Guaranty Agreement To Lender?

Choosing the best authorized record web template can be quite a have a problem. Of course, there are a variety of layouts available on the net, but how do you obtain the authorized type you need? Utilize the US Legal Forms site. The assistance delivers a large number of layouts, like the Florida Complex Guaranty Agreement to Lender, that you can use for company and personal needs. Every one of the kinds are inspected by experts and meet state and federal demands.

If you are previously registered, log in in your bank account and click on the Obtain key to have the Florida Complex Guaranty Agreement to Lender. Make use of bank account to search through the authorized kinds you may have ordered earlier. Visit the My Forms tab of your bank account and have another copy of the record you need.

If you are a new consumer of US Legal Forms, allow me to share straightforward recommendations so that you can adhere to:

- First, make certain you have chosen the right type for your town/county. You may look through the form using the Preview key and browse the form information to guarantee it will be the right one for you.

- When the type does not meet your expectations, take advantage of the Seach discipline to find the appropriate type.

- When you are positive that the form would work, go through the Buy now key to have the type.

- Opt for the costs plan you would like and enter in the needed details. Create your bank account and pay money for an order using your PayPal bank account or bank card.

- Pick the submit file format and obtain the authorized record web template in your product.

- Full, modify and printing and sign the obtained Florida Complex Guaranty Agreement to Lender.

US Legal Forms may be the biggest catalogue of authorized kinds in which you can see various record layouts. Utilize the company to obtain skillfully-produced paperwork that adhere to condition demands.

Form popularity

FAQ

In order for a guaranty agreement to be enforceable, it has to be in writing, the writing has to be signed by the guarantor, and the writing has to contain each of the following essential elements: 1. the identity of the lender; 2. the identity of the primary obligor; 3.

Guarantor agrees to the provisions of this Guaranty, and hereby waives notice of (a) any loans or advances made by Lender to Borrower, (b) acceptance of this Guaranty, (c) any amendment or extension of the Note, the Loan Agreement or of any other Loan Documents, (d) the execution and delivery by Borrower and Lender of ...

The guarantee is normally in written and signed by the guarantor. But a guarantee can be enforceable even if it is not in writing; the guarantee could be implied from the conduct of the parties such as a partial payment after a promise relied upon by the creditor to provide credit to the debtor.

IN WRITING Oral guaranties are almost never enforceable in California though many creditors have attempted to enforce them claiming that they only extended credit predicated on various oral assurances from the owners of the debtor.

A guarantee does have to be in writing under section 4 of the Statute of Frauds 1677. However, a guarantee is often executed as an agreement by the guarantor and the beneficiary.

A guarantor contracts to pay if, by the use of due diligence, the debt cannot be paid by the principal debtor. The surety undertakes directly for the payment. The surety is responsible at once if the principal debtor defaults. In other words, a guaranty is an undertaking that the debtor shall pay.

The usual way that a guaranty is enforced is through a written demand (although this is not usually required in most forms) followed by the filing of a law suit. If the guarantor has pledged collateral to secure the guaranty obligation, foreclosure proceedings against that will often be commenced.

IN WRITING Oral guaranties are almost never enforceable in California though many creditors have attempted to enforce them claiming that they only extended credit predicated on various oral assurances from the owners of the debtor.