Florida Request for Accounting of Disclosures of Protected Health Information

Description

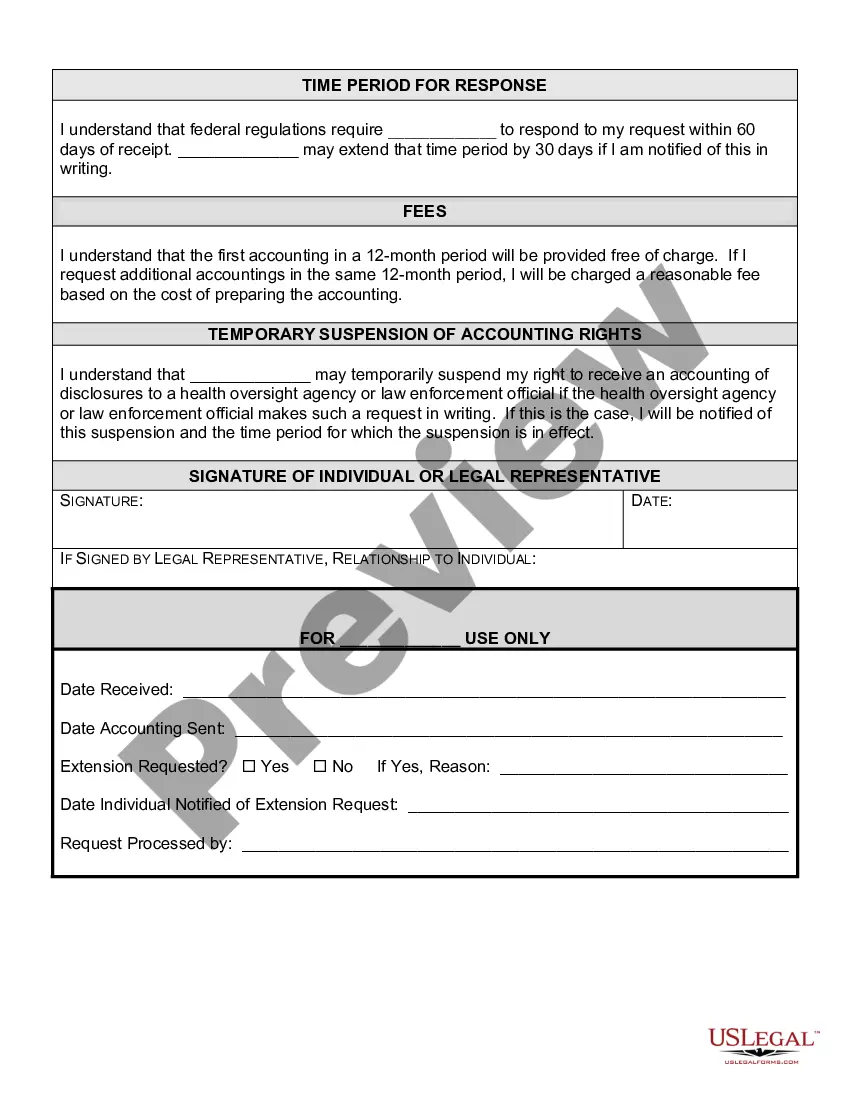

How to fill out Request For Accounting Of Disclosures Of Protected Health Information?

You might spend hours online attempting to locate the proper legal document format that meets both federal and state requirements.

US Legal Forms provides thousands of authentic forms that can be evaluated by professionals.

You can actually acquire or print the Florida Request for Accounting of Disclosures of Protected Health Information from our service.

If available, use the Preview button to examine the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Florida Request for Accounting of Disclosures of Protected Health Information.

- Every legal document format you purchase is yours to keep permanently.

- To get another copy of the downloaded form, navigate to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have chosen the correct document format for the state/area of your preference.

- Review the form summary to confirm you have selected the correct document.

Form popularity

FAQ

Under HIPAA, health care providers must provide accounting of disclosures to the data subject within 60 days of a request. This timeframe ensures quick access, promoting transparency and trust between patients and providers. A Florida Request for Accounting of Disclosures of Protected Health Information can streamline this process for patients seeking their data.

HIPAA enables patients to learn to whom the covered entity has disclosed their PHI. This is called an accounting of disclosures. The accounting will cover up to six years prior to the individual's request date and will include disclosures to or by business associates of the covered entity.

Other instances necessitating Accounting of Disclosures (AOD) include: Those Required by Law (Court Orders, subpoenas, state reporting, emergencies) Public Health Activities (Prevention of disease, public health investigations) Victims of abuse, neglect, or domestic violence.

Under the HIPAA Privacy Rule, a covered entity must act on an individual's request for access no later than 30 calendar days after receipt of the request.

The Privacy Rule at 45 CFR 164.528 requires covered entities to make available to an individual upon request an accounting of certain disclosures of the individual's protected health information made during the six years prior to the request.

The maximum disclosure accounting period is the six years immediately preceding the accounting request, except a covered entity is not obligated to account for any disclosure made before its Privacy Rule compliance date.

With limited exceptions, the HIPAA Privacy Rule (the Privacy Rule) provides individuals with a legal, enforceable right to see and receive copies upon request of the information in their medical and other health records maintained by their health care providers and health plans.

The Privacy Rule does not require accounting for disclosures: (a) for treatment, payment, or health care operations; (b) to the individual or the individual's personal representative; (c) for notification of or to persons involved in an individual's health care or payment for health care, for disaster relief, or for

Patients (or their Personal Representatives see Yale Policy 5038 - Personal Representatives) may request an accounting of disclosures by submitting a request in writing using the Request for Accounting of Disclosures of Protected Health Information form, or other sufficient written documentation requesting the

Under the HIPAA Privacy Rule, a covered entity must act on an individual's request for access no later than 30 calendar days after receipt of the request.