Florida Use of Company Equipment

Description

How to fill out Use Of Company Equipment?

US Legal Forms - one of the largest repositories of legal documents in the USA - provides a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the most recent forms like the Florida Use of Company Equipment in no time.

If you already possess a membership, Log In and download Florida Use of Company Equipment from your US Legal Forms library. The Download button will be visible on each form you review.

Once you are satisfied with the form, affirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your details to create an account.

Complete the transaction. Use a Visa or Mastercard or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the downloaded Florida Use of Company Equipment.

Each template you save in your account has no expiration date and is permanently yours. Therefore, if you wish to download or print an extra copy, simply navigate to the My documents section and click on the form you need.

Access the Florida Use of Company Equipment with US Legal Forms, the most comprehensive collection of legal form templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Access all previously downloaded forms in the My documents tab of your account.

- If this is your first time using US Legal Forms, here are straightforward instructions to help you get started.

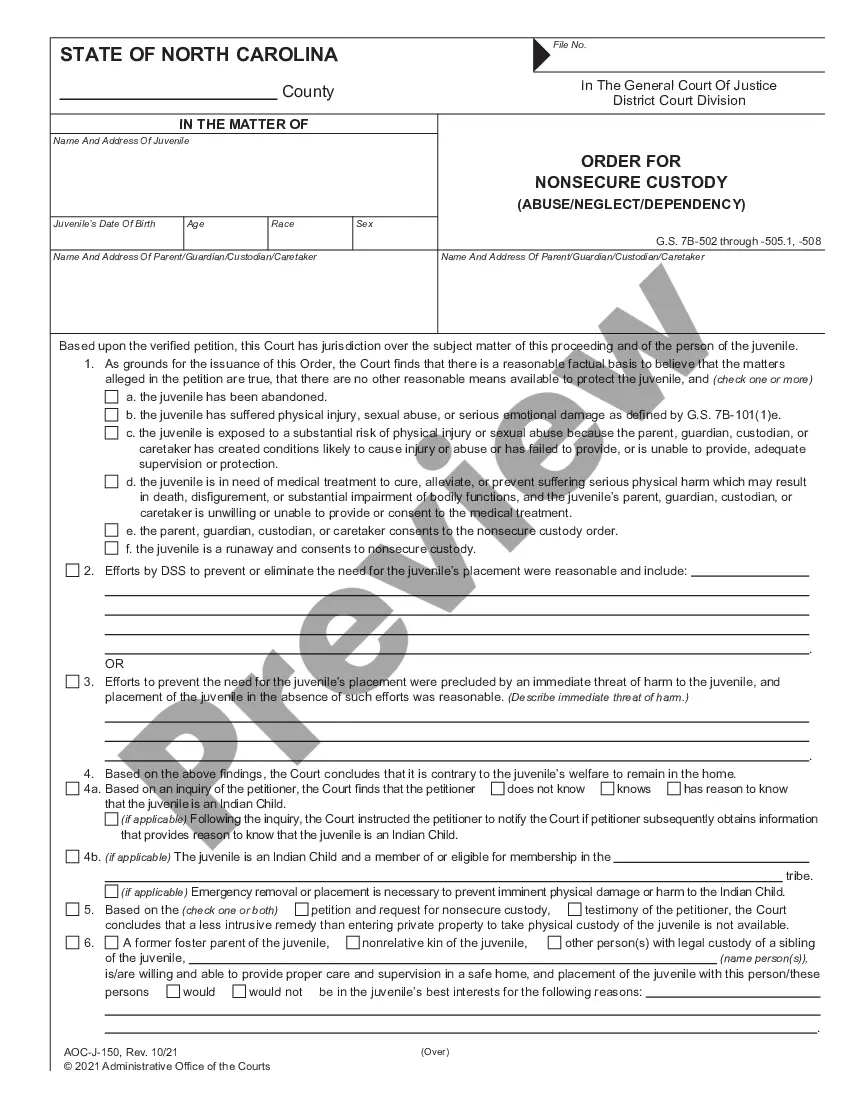

- Ensure you have selected the appropriate form for your locality/county.

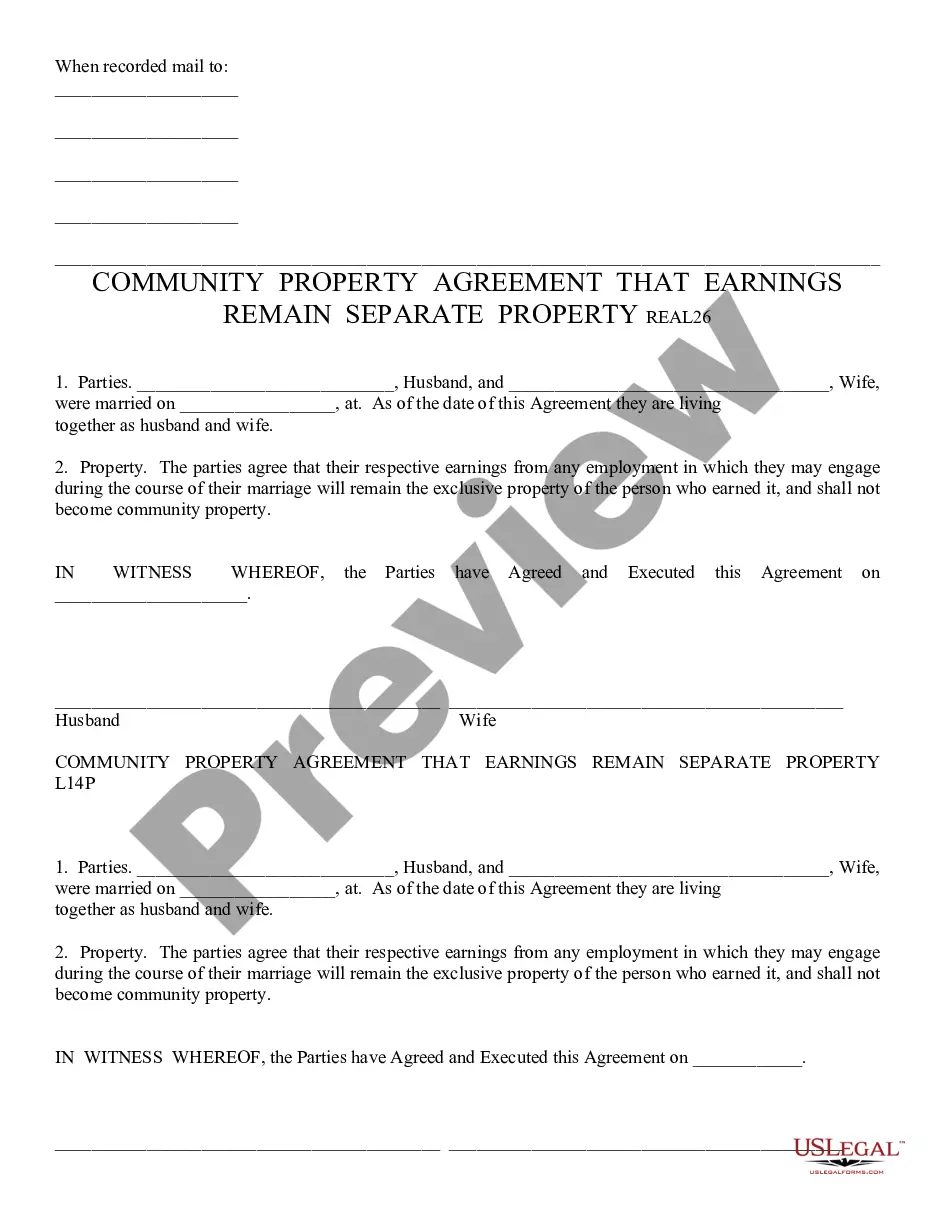

- Use the Review button to examine the form's content.

- Read the form description to confirm you have selected the correct document.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

Form popularity

FAQ

In Florida, the purchase of machinery and equipment is usually subject to sales or use tax. However, there may be exceptions (called exemptions) that allow a purchaser not to pay sales or use tax on the acquisition of machinery and equipment.

To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer's Certificate of Exemption, Form DR-14) from the Florida Department of Revenue.

Effective July 1, 2015, the sale, rental, lease, use, consumption, repair, and storage for use in Florida of power farm equipment or irrigation equipment, including replacement parts and accessories for power farm equipment or irrigation equipment are exempt from sales tax.

Effective April 30, 2014, an exemption from sales and use tax is available for purchases of industrial machinery and equipment used at a fixed location in Florida by an eligible manufacturing business that will manufacture, process, compound, or produce for sale items of tangible personal property.

Florida Sales Tax Exemptions:Prescriptions drugs.Groceries (unprepared food)Common household remedies.Long term residential real property leases.Seeds and fertilizers.

Effective April 30, 2014, an exemption from sales and use tax is available for purchases of industrial machinery and equipment used at a fixed location in Florida by an eligible manufacturing business that will manufacture, process, compound, or produce for sale items of tangible personal property.

If a purchaser uses the machinery, equipment, parts, accessories, or materials for any nonexempt purpose, the purchaser is required to pay tax on the purchase price directly to the Florida Department of Revenue.