Florida Payroll Deduction Authorization Form

Description

How to fill out Payroll Deduction Authorization Form?

If you intend to obtain, access, or print sanctioned document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you need.

A variety of templates for commercial and personal purposes are categorized by groups and states, or keywords.

Every legal document template you purchase is yours permanently. You will have access to every form you downloaded in your account.

Act competently and download, and print the Florida Payroll Deduction Authorization Form with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to quickly find the Florida Payroll Deduction Authorization Form.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Florida Payroll Deduction Authorization Form.

- You can also access forms you have previously downloaded from the My documents tab within your account.

- If you are using US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you have selected the form for your specific region/state.

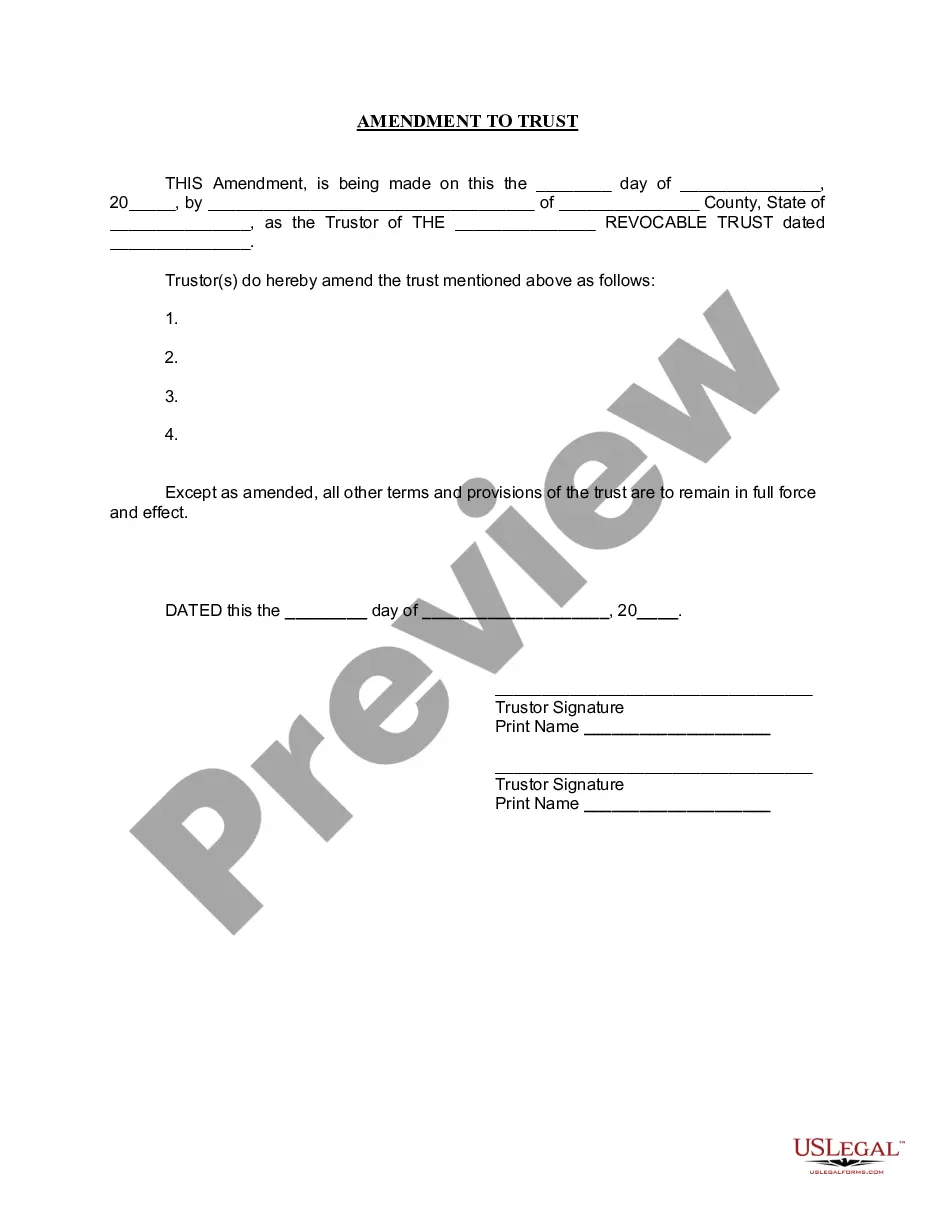

- Step 2. Use the Review option to analyze the form's content. Remember to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Florida Payroll Deduction Authorization Form.

Form popularity

FAQ

The form for payroll deduction acknowledgment serves as a written record that confirms an employee's understanding and approval of the payroll deductions processed from their wages. This acknowledgment helps protect both the employer and employee by establishing clear consent for the deductions taken. When you complete the Florida Payroll Deduction Authorization Form, you take an important step in making sure your deductions are accurate and correctly managed.

Payroll authorization refers to the approval process that allows employers to withhold specific amounts from an employee's paycheck for various reasons, such as tax obligations or benefits. This process is essential for maintaining accurate financial records and ensuring compliance with employment agreements. The Florida Payroll Deduction Authorization Form provides a clear framework for employees to specify their preferences and authorize deductions.

Employees wishing to cancel their deductions should contact their agency payroll office and request the allotment be cancelled.

Authorized Deduction means those items set forth in each Application, or other authorization, that a Settlement Products Client authorizes the Originator, or a servicer on behalf of the Originator, to deduct from its Deposit Account.

Employees wishing to cancel their deductions should contact their agency payroll office and request the allotment be cancelled.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

Mandatory Payroll Tax DeductionsFederal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding. Local tax withholdings such as city or county taxes, state disability or unemployment insurance.

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax.

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.