Florida Purchasing Cost Estimate

Description

How to fill out Purchasing Cost Estimate?

Are you currently in a position where you require documents for either business or personal needs almost every day.

There are numerous legitimate document templates available online, but finding versions you can trust isn't simple.

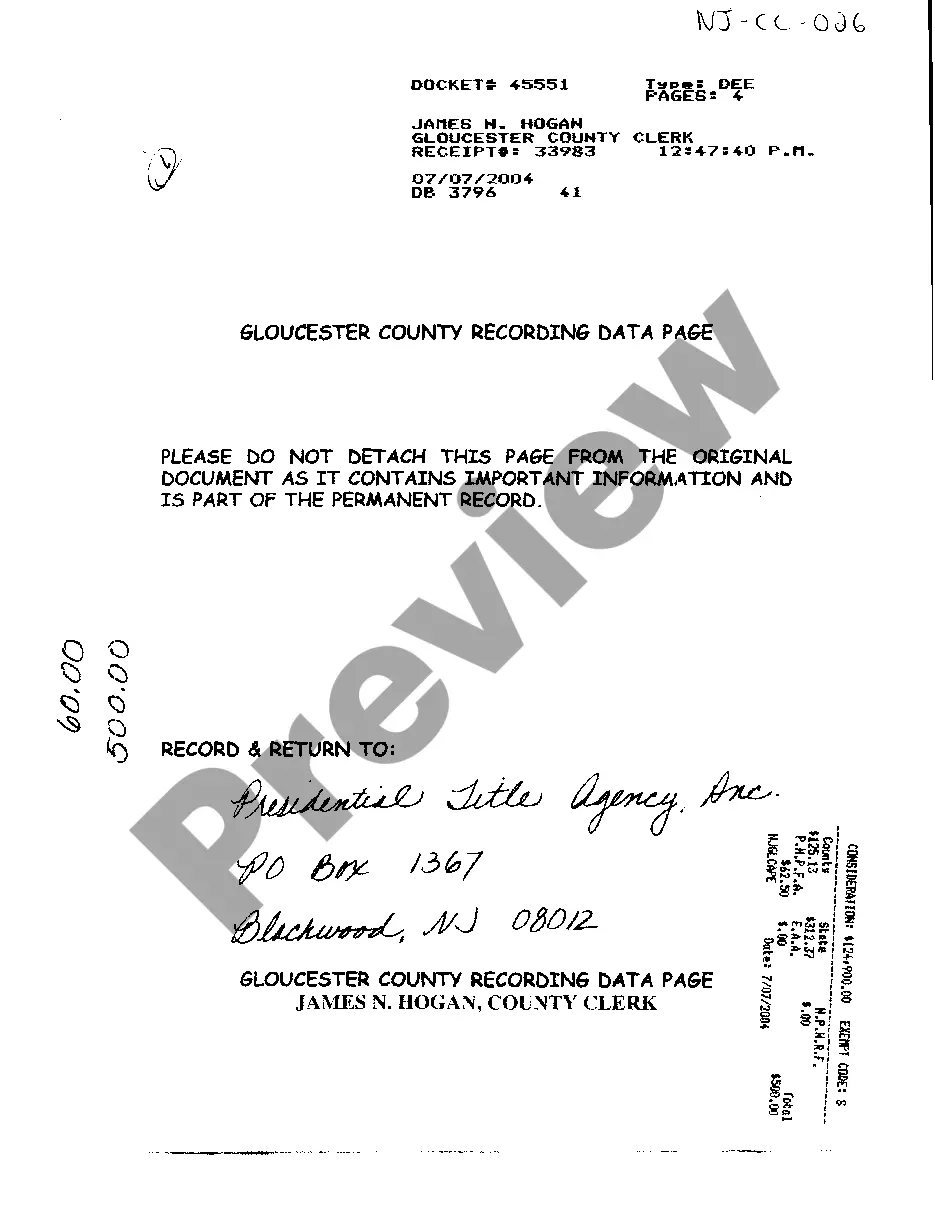

US Legal Forms offers a vast array of templates, including the Florida Purchasing Cost Estimate, designed to comply with federal and state regulations.

Once you find the correct form, click on Buy now.

Choose the pricing plan you need, fill in the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Florida Purchasing Cost Estimate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the right city/area.

- Use the Preview button to view the form.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find a form that suits your needs.

Form popularity

FAQ

For a 300k house in Florida, you can expect closing costs to fall between $6,000 and $15,000, based on the common range of 2% to 5%. This estimate includes a variety of fees that buyers should anticipate, such as lender fees and property taxes. Understanding your Florida Purchasing Cost Estimate empowers you to budget wisely and plan accordingly. Consider using US Legal Forms to access valuable information and tools related to closing costs.

Closing costs can increase or decrease depending on the home purchase price. In Florida, the average closing costs come to approximately 1.98% of the home purchase price. So, if you take out a mortgage worth $200,000 to purchase a home, you'll pay roughly $3,900 in closing costs.

Closing costs in Florida are, on average, $4,606 for a home priced at $255,006, according to a 2021 report by ClosingCorp, which provides research on the U.S. real estate industry. That price tag makes up 1.81 percent of the home's price tag.

Depending on the location, sellers can expect to pay anywhere between 5 to10 percent of the sale price of the home. In addition to the commission, a seller may have to pay: Mortgage payoff.

The average closing costs for a seller total roughly 8% to 10% of the sale price of the home, or about $19,000-$24,000, based on the median U.S. home value of $244,000 as of December 2019. Seller closing costs are made up of several expenses. Here's a quick breakdown of potential costs and fees: Agent commission.

Closing Costs for a Cash Buyer in Florida Typically, a closing fee on a cash deal for a home in Florida will run between $500-$900 depending on the title company.

Closing costs for buyers are typically between 2.5% and 3.5% of the price of the home, explains Robinson. In extreme cases such as with a very high HOA fee it could be 4%.

In Florida, the average closing costs come to approximately 1.98% of the home purchase price. So, if you take out a mortgage worth $200,000 to purchase a home, you'll pay roughly $3,900 in closing costs.

To calculate your closing costs, most lenders recommend estimating your closing fees to be between one percent and five percent of the home purchase price. If you're purchasing your house for $300,000, you can estimate your total closing costs to be between $3,000 and $15,000.

How Much Are Closing Costs in Florida?The seller will pay between 5% and 10% of the overall home's sale price, largely due to real estate commission which can be as high as 6%The buyer will pay between 2% and 4% of their total price for closing costs alone.