Florida Assignment of Profits of Business

Description

How to fill out Assignment Of Profits Of Business?

Selecting the appropriate legal document format can be rather challenging.

It goes without saying that there are numerous templates accessible on the internet, but how will you find the valid form you require.

Make use of the US Legal Forms website.

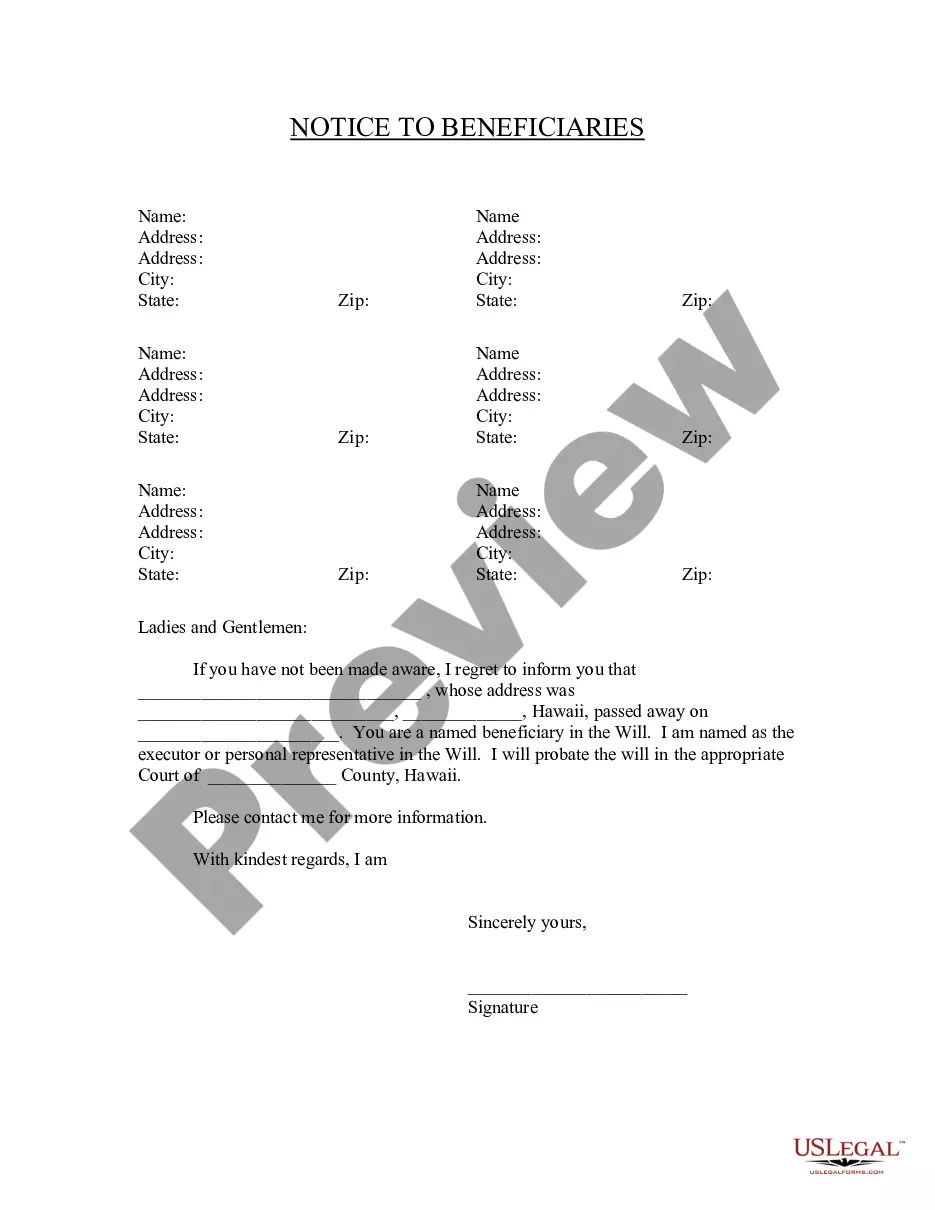

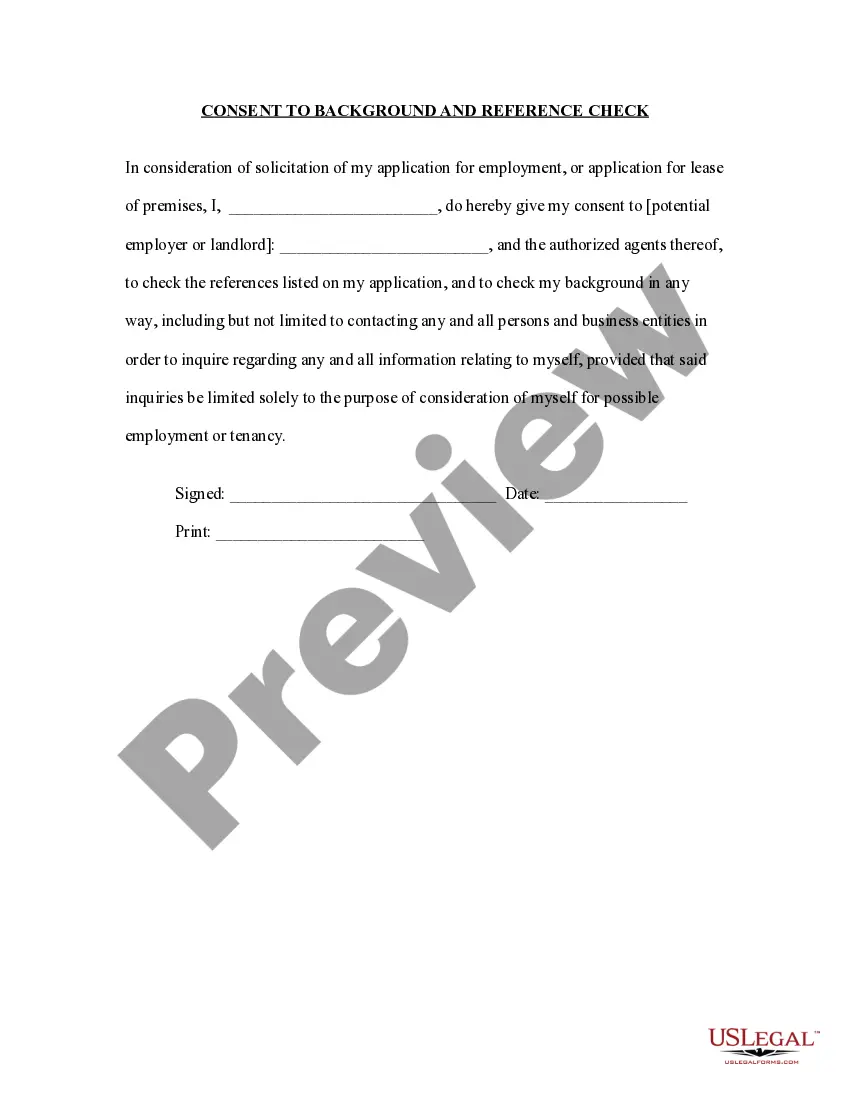

First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and read the form details to confirm this is the right one for you.

- The service offers a wide array of templates, such as the Florida Assignment of Profits of Business, suitable for both business and personal purposes.

- All of the documents are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to download the Florida Assignment of Profits of Business.

- Use your account to search through the legal documents you have purchased before.

- Go to the My documents section of your account and get another copy of the document you seek.

- If you are a new user of US Legal Forms, here are some basic instructions you should follow.

Form popularity

FAQ

Assignment of benefits is a legal contract between you and a third party, such as a roofer, contractor, or other vendors. The AOB allows you to transfer specific rights that your insurance policy grants you to a third party.

An assignment of benefits form (AOB) is a crucial document in the healthcare world. It is an agreement by which a patient transfers the rights or benefits under their insurance policy to a third-party in this case, the medical professional who provides services.

Insurance company does not have right to make the payment directly to provider, if AOB is not signed by the patient.

An Assignment of Benefits (AOB) is an agreement that effectively allows a third party to deal directly with your insurance carrier on your behalf. This means they can file insurance claims, make repair decisions, and even collect money without you having to lift a finger.

Generally, donative assignments are revocable. An assignor can revoke an assignment by notifying the assignee of the revocation, by accepting the obligor's performance, or by subsequently assigning the same right to another party. Also, the death or bankruptcy of the assignor will automatically revoke the assignment.

Yes. An AOB is a legal contract and it must contain three specific cancellation provisions. The AOB must provide you with an option to rescind the AOB contract within 14 days following its execution by submitting written notice to the third-party.

Assignment of benefits is a legal contract between you and a third party, such as a roofer, contractor, or other vendors. The AOB allows you to transfer specific rights that your insurance policy grants you to a third party.

Assignment of Benefits is a legally binding agreement between you and your Insurance Company, asking them to send your reimbursement checks directly to your doctor. When our office accepts an assignment of benefits, this means that we have to wait for up to one month for your insurance reimbursement to arrive.

Assignment of benefits, widely referred to as AOB, is a contractual agreement signed by a policyholder, which enables a third party to file an insurance claim, make repair decisions, and directly bill an insurer on the policyholder's behalf.