This form is used when Assignor grants, assigns, and conveys to Assignee a percentage of the net profit interest in the Working Interest. The Net Profits Interest is the stated percentage interest in the share of monies payable for gross production attributable to the Working Interest less the costs and expenses attributable to the Working Interest.

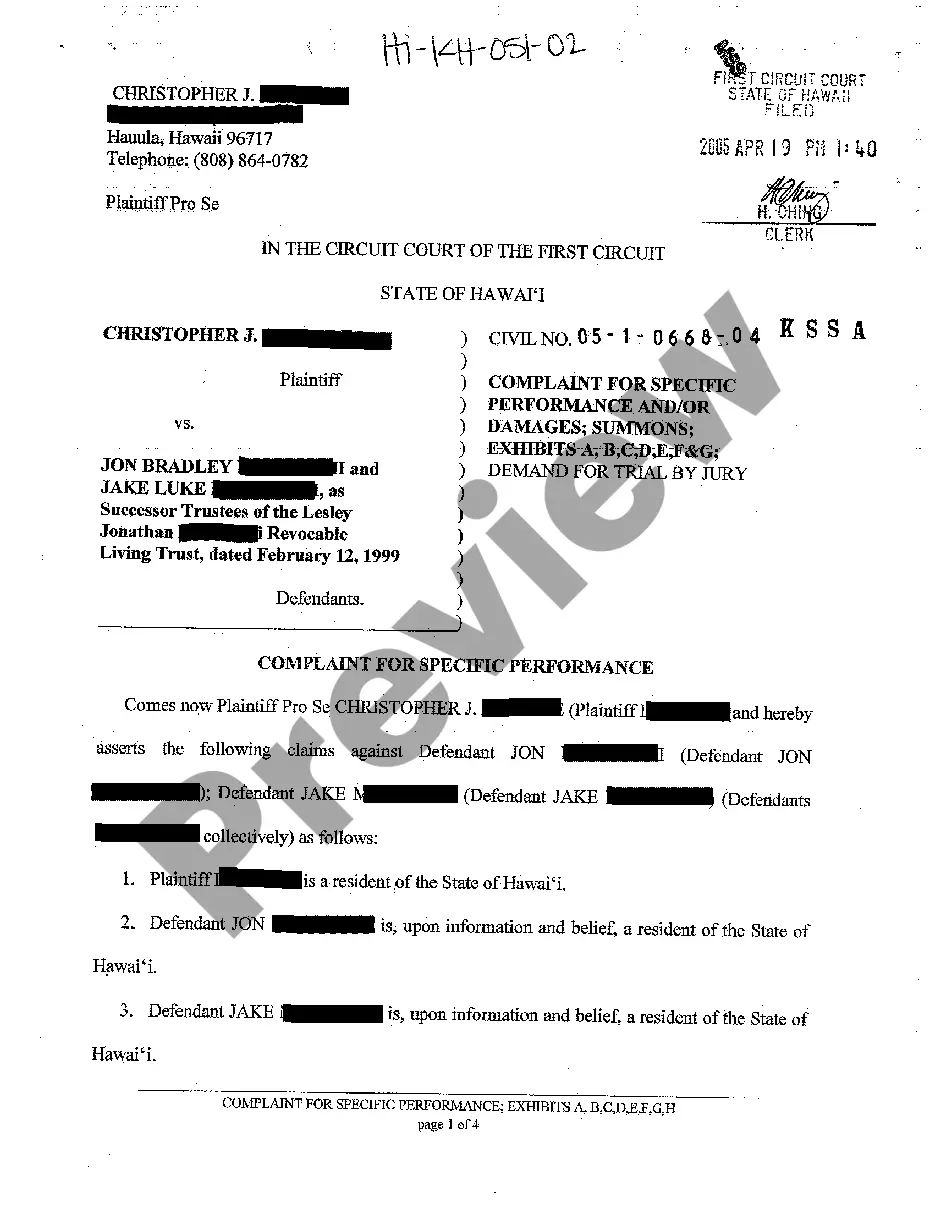

Florida Assignment of Net Profits Interest

Description

How to fill out Assignment Of Net Profits Interest?

US Legal Forms - one of many largest libraries of authorized kinds in the USA - delivers a wide array of authorized papers web templates you can down load or print out. While using web site, you can get a large number of kinds for enterprise and individual purposes, categorized by classes, claims, or search phrases.You can get the most up-to-date types of kinds just like the Florida Assignment of Net Profits Interest within minutes.

If you already have a monthly subscription, log in and down load Florida Assignment of Net Profits Interest from the US Legal Forms catalogue. The Acquire switch can look on each and every type you see. You gain access to all previously saved kinds inside the My Forms tab of your accounts.

If you want to use US Legal Forms initially, listed here are easy recommendations to help you get started:

- Be sure you have selected the right type for your personal area/area. Click the Preview switch to examine the form`s information. Look at the type information to ensure that you have chosen the correct type.

- In the event the type doesn`t fit your demands, make use of the Look for field towards the top of the display to find the one who does.

- Should you be satisfied with the shape, verify your option by clicking on the Purchase now switch. Then, pick the rates strategy you favor and offer your credentials to sign up on an accounts.

- Process the transaction. Utilize your credit card or PayPal accounts to accomplish the transaction.

- Choose the format and down load the shape in your gadget.

- Make adjustments. Complete, modify and print out and signal the saved Florida Assignment of Net Profits Interest.

Every design you added to your money does not have an expiration time which is yours permanently. So, if you want to down load or print out yet another duplicate, just check out the My Forms area and click in the type you will need.

Obtain access to the Florida Assignment of Net Profits Interest with US Legal Forms, by far the most considerable catalogue of authorized papers web templates. Use a large number of specialist and status-particular web templates that meet your business or individual requirements and demands.

Form popularity

FAQ

Hear this out loud PauseA net profits interest is an agreement that provides a payout of an operation's net profits to the parties of the agreement. It is a non-operating interest that may be created when the owner of a property, typically an oil and gas property, leases it out to another party for development and production.

?Catch-Up? Capabilities A catch-up provision typically provides that the holder of a profits interest is allocated the first dollars of income, after income allocations equal to the distribution threshold, until the holder has received allocations so that he or she is ?caught-up? on his or her proportionate interest. Modern Trends in Private Company Executive Compensation?Use of ... americanbar.org ? january_february_2016 americanbar.org ? january_february_2016

Like an option at the ?extremes,? meaning having either very low equity values (deep out-of-the-money) or very high equity values (deep-in-the-money), a profits interest will track closely either to a zero value or a fully diluted unit adjusted for the capital units' contributed capital. ?Key Points in Valuing Profits Interests | Valuation Research valuationresearch.com ? pure-perspectives valuationresearch.com ? pure-perspectives

Revenue Procedure 93-27 provides, subject to certain exceptions, a ?safe harbor? indicating that the receipt of a ?profits interest? in exchange for the provision of services to or for the benefit of a partnership in a partner capacity (or in anticipation of being a partner), is not a taxable event. Tax Court Confirms that Profits Interest Safe Harbor Should Apply ... - Mintz mintz.com ? insights-center ? viewpoints ? 2... mintz.com ? insights-center ? viewpoints ? 2...

Hear this out loud PauseA profits interest is an equity-like form of compensation that limited liability companies (LLCs) can offer to employees and other service providers. The value of a profits interest is based on the growing value of the LLC, which allows employees (or ?partners?) to benefit from the LLC's appreciation in value.

Hear this out loud PauseFrom an accounting perspective, profits interest is generally accounted for under Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 718 Stock Compensation or FASB ASC 710 Compensation.

Profits interests can be granted immediately or vested over time, based on personal performance and/or corporate success. In addition, the garnishing value components of the profits interest, like the share of annual profit allocation, and liquidation value, can be customized. The Complete Guide to Profits Interest - insightsoftware insightsoftware ? blog ? the-complete-guid... insightsoftware ? blog ? the-complete-guid...

Hear this out loud PauseProfits Interest Unit Examples Example 1: Profits interest ? Let's say that the company is worth $1,000,000 and has $50,000 in annual profits. A worker with a 10% interest grant doesn't have any interest in the company's current market value, but they do have a 10% interest in annual profits, which equates to $5,000.