Florida Assignment of Security Agreement and Note with Recourse

Description

How to fill out Assignment Of Security Agreement And Note With Recourse?

If you need to finalize, obtain, or produce sanctioned document templates, utilize US Legal Forms, the largest compilation of legal forms, which is available online.

Employ the site’s straightforward and convenient search to locate the documents you need.

Various templates for commercial and personal purposes are categorized by groups and regions, or keywords. Use US Legal Forms to find the Florida Assignment of Security Agreement and Note with Recourse with just a few clicks.

Step 6. Select the format of the legal form and download it to your device.

Step 7. Complete, modify, and print or sign the Florida Assignment of Security Agreement and Note with Recourse. Each legal document template you purchase is yours forever. You can access any form you have downloaded in your account. Click on the My documents section and select a form to print or download again. Complete, obtain, and print the Florida Assignment of Security Agreement and Note with Recourse using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to get the Florida Assignment of Security Agreement and Note with Recourse.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

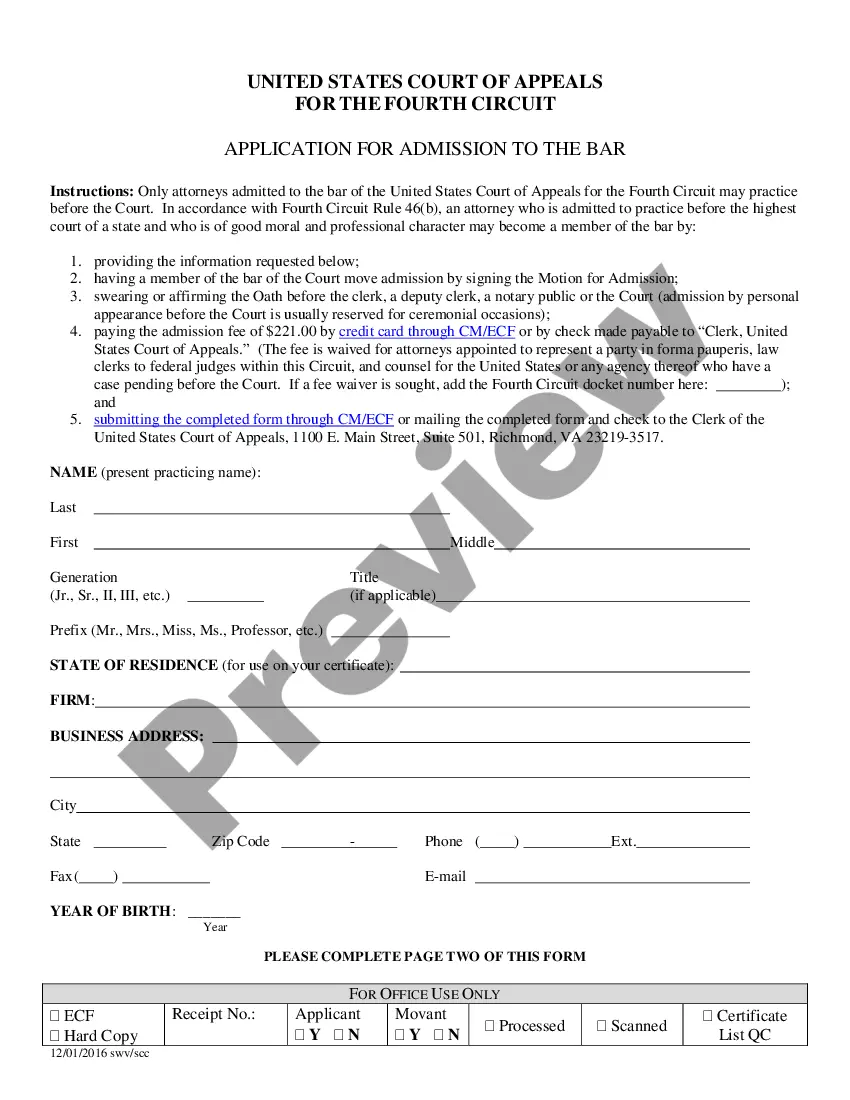

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s details. Do not forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your information to create your account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

In Florida, an assignment of mortgage: Transfers the assignor's rights under the mortgage to the assignee. Permits the assignee to pursue the same remedies, including foreclosure, as the original lender. Generally retains priority of the mortgage that is assigned for the benefit of the assignee.

Assignment by way of security is a concept that comes up on many construction projects; typically as a condition of providing finance a funder will require an assignment by way of security of key construction documents, including building contracts and appointments, with the intention that if the borrower defaults on

A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesn't.

The assignment agreement is often seen in real estate but can occur in other contexts as well. An assignment is just the contractual transfer of benefits that will accrue or have accrued. Obligations don't transfer with the benefits of an assignment. The assignor will always keep the obligations.

A loan agreement serves a similar purpose as a promissory note. Like a promissory note it is a contractual agreement between a lender who agrees to loan money to a borrower. However, a loan agreement is much more detailed than a promissory note. There are two types of loan agreements.

What Is a Secured Note? A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

Security agreements are generally used to supplement a secured promissory note. The note is the borrower's actual promise to repay the money it received. The enclosed security agreement assumes the existence of a secured promissory note, but that agreement is not included with this package.

To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It's common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Security Assignment Agreement means a Global Assignment Agreement on the Global Assignment of Accounts Receivable, substantially in the form of EXHIBIT Q, entered into by the Subsidiary Borrower and the Administrative Agent for the benefit of the Lenders.