Florida Charity Subscription Agreement

Description

How to fill out Charity Subscription Agreement?

Choosing the right lawful papers template can be a battle. Obviously, there are plenty of layouts accessible on the Internet, but how would you find the lawful develop you require? Utilize the US Legal Forms web site. The service provides a large number of layouts, like the Florida Charity Subscription Agreement, which can be used for business and personal requirements. Each of the kinds are examined by specialists and meet up with federal and state needs.

When you are previously authorized, log in for your profile and click on the Acquire key to get the Florida Charity Subscription Agreement. Make use of your profile to search throughout the lawful kinds you might have acquired previously. Visit the My Forms tab of your profile and acquire an additional copy of the papers you require.

When you are a whole new consumer of US Legal Forms, allow me to share straightforward directions that you can adhere to:

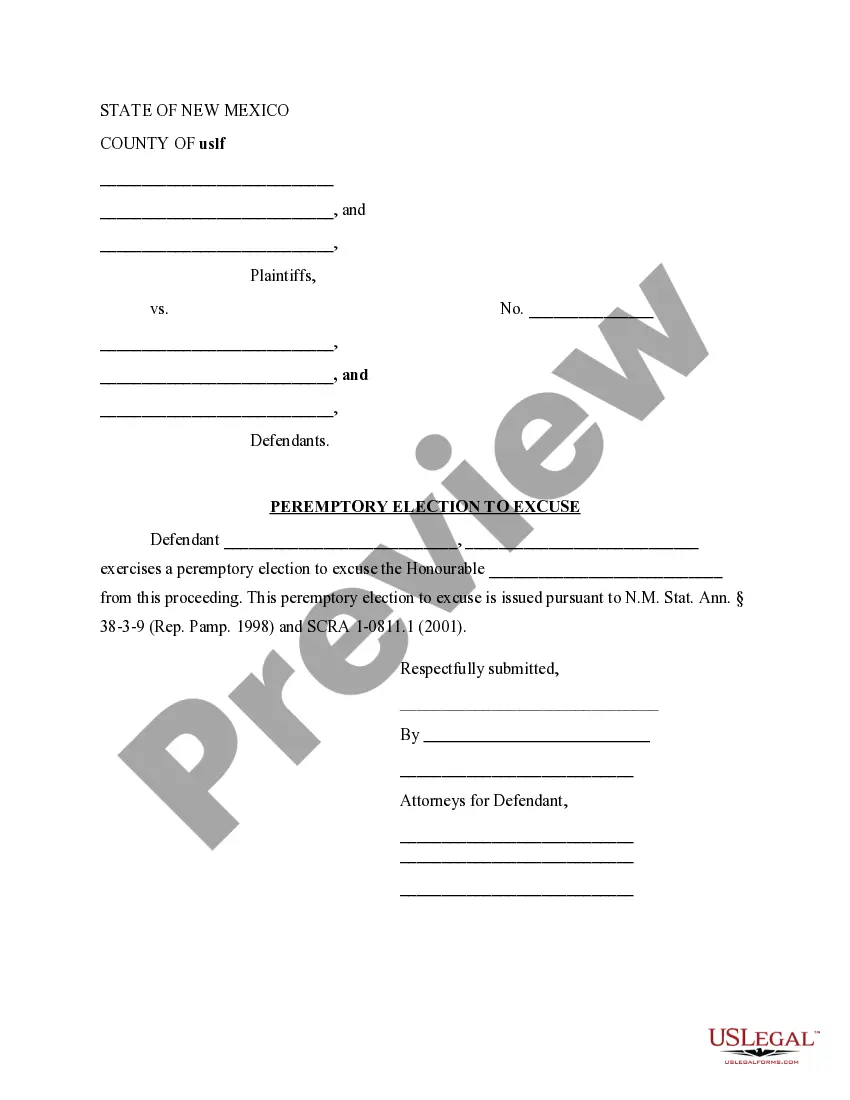

- Initial, make certain you have selected the right develop to your area/area. You are able to check out the shape using the Preview key and look at the shape description to guarantee it will be the best for you.

- In the event the develop is not going to meet up with your expectations, use the Seach field to get the right develop.

- Once you are certain the shape is acceptable, go through the Purchase now key to get the develop.

- Select the rates prepare you want and enter in the essential information. Build your profile and pay for an order using your PayPal profile or charge card.

- Opt for the submit file format and acquire the lawful papers template for your gadget.

- Complete, revise and print and signal the acquired Florida Charity Subscription Agreement.

US Legal Forms may be the largest collection of lawful kinds where you will find numerous papers layouts. Utilize the service to acquire professionally-made documents that adhere to state needs.

Form popularity

FAQ

The IRS requires all U.S. tax-exempt nonprofits to make public their three most recent Form 990 or 990-PF annual returns (commonly called "990s") and all related supporting documents.

In Florida, a pledge is enforceable only if there is evidence of contractual consideration or promissory estoppel. Consideration is the bargained for mutual exchange of binding legal detriment and benefit, where each of the parties extending something of value. Consideration is needed for most contracts to be binding.

How to Apply: Domestic Applicants: File formation documents to form an entity with the Florida Department of State. Submit a completed Charitable Organizations / Sponsors Registration Application and all required attachments to the Florida Department of Agriculture and Consumer Services - Division of Consumer Services.

The IRS maintains an ?Exempt Organizations Select Check Tool? (available at ), which enables a user to search for organizations to determine their eligibility to receive tax-deductible charitable contributions.

The Solicitation of Contributions Act requires anyone who solicits donations in or from Florida to register with the Florida Department of Agriculture and Consumer Services (FDACS) and to renew annually.

Prospective donors should contact the FDACS toll-free hotline at 1-800-HELP-FLA (435-7352) or use our online Check-A-Charity tool to verify registration and financial information. You can also visit Give.org, the website of the BBB Wise Giving Alliance, where you can access reports on nationally soliciting charities.

Charitable organizations or sponsors intending to solicit contributions from the public in Florida must annually register with the Division of Consumer Services. Access the required forms on the DACS website. See Chapter 496, F.S.

Check a database You can also research a legitimate nonprofit through various databases. You can check the IRS website, the BBB Wise Giving Alliance, or any other reputable website to ensure that your charity of choice is indeed real.