Florida Business Trust

Description

How to fill out Business Trust?

You can dedicate numerous hours online trying to locate the valid document template that matches the state and federal criteria you require.

US Legal Forms offers thousands of valid forms that are vetted by professionals.

You can effortlessly download or print the Florida Business Trust from my service.

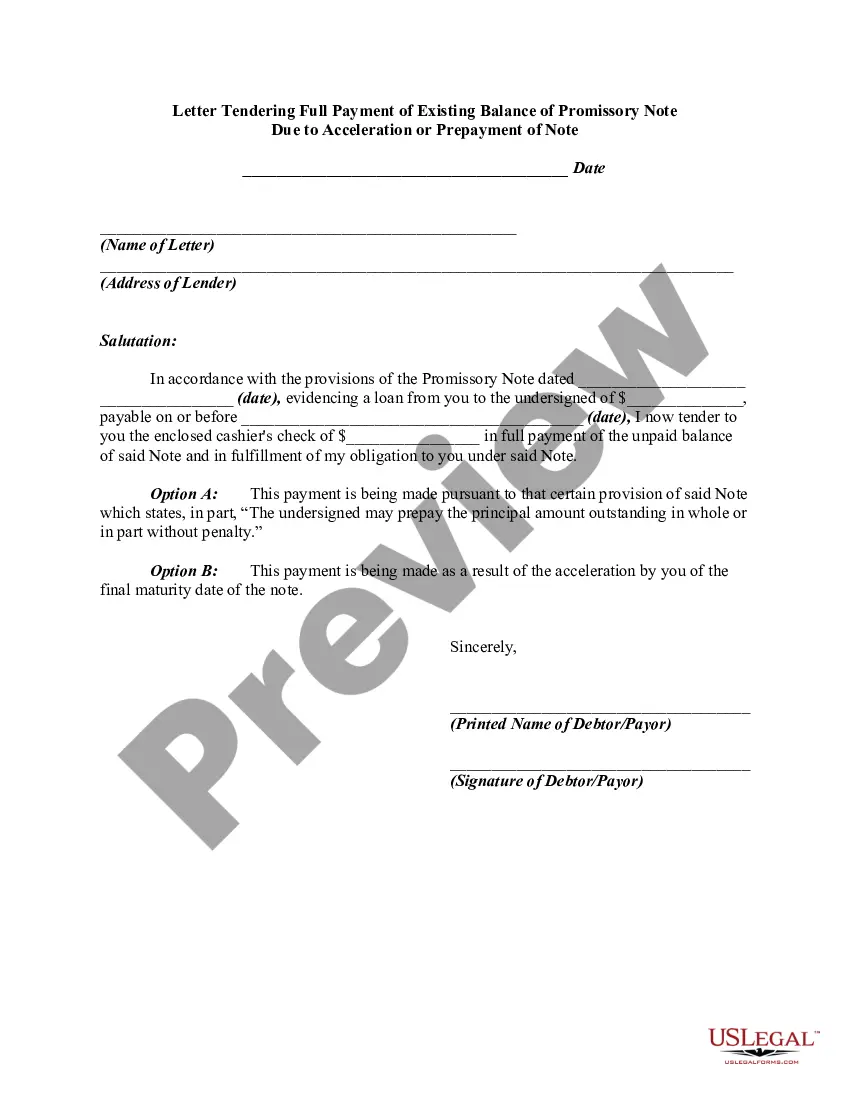

If available, use the Preview option to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Florida Business Trust.

- Every valid document template you obtain is yours to keep indefinitely.

- To retrieve another copy of a purchased form, go to the My documents section and click the corresponding option.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Check the form description to confirm you have chosen the proper type.

Form popularity

FAQ

Under the state's Chapter 609, business trusts are defined as unincorporated business organizations that are created by an investment of property, the said investment property to be managed and held by appointed trustees for the profit and benefit of the individuals who may become or are holders of the trust's

Advantages of a trust A trust provides asset protection and limits liability in relation to the business. Trusts separate the control of an asset from the owner of the asset and so may be useful for protecting the income or assets of a young person or a family unit. Trusts are very flexible for tax purposes.

Trust advantages and disadvantageslimited liability is possible if a corporate trustee is appointed.the structure provides more privacy than a company.there can be flexibility in distributions among beneficiaries.trust income is generally taxed as income of an individual.

How Does a Business Trust Work? A trust is an agreement that allows one party, known as a trustee, to hold, manage, and direct assets or property on behalf of another party, called the beneficiary. In a business trust, a trustee manages a business and conducts transactions for the benefit of its beneficiaries.

The major disadvantages that are associated with trusts are their perceived irrevocability, the loss of control over assets that are put into trust and their costs. In fact trusts can be made revocable, but this generally has negative consequences in respect of tax, estate duty, asset protection and stamp duty.

A business trust is a legal instrument that can be used to delegate the authority to manage a beneficiary stake in a certain business. It can also be used to run the business itself.

Register the business trust with the Florida Secretary of State; If the trust plans to offer ownership units, shares, or certificates, register it with the Office of Financial Regulation; Obtain an employer tax identification number from the IRS; and. Open a bank account for the business trust.

A living trust for a business relieves the burden of business debts on your family members. If your business is not in a trust, business assets may be used to satisfy personal debts, and that could cause the business to fold. The living trust also reduces the tax burden on your estate.