Florida Joint Venture Agreement - Purchase and Operation of Apartment Building

Description

How to fill out Joint Venture Agreement - Purchase And Operation Of Apartment Building?

If you need to be thorough, acquire, or create valid document templates, utilize US Legal Forms, the largest repository of valid forms available online.

Take advantage of the site's straightforward navigation to find the documents you require.

Numerous templates for commercial and individual purposes are sorted by categories and states, or by keywords and phrases.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to look for other versions of the legal form template.

Step 4. After finding the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your information to create an account.

- Utilize US Legal Forms to access the Florida Joint Venture Agreement - Purchase and Operation of Apartment Building with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the Florida Joint Venture Agreement - Purchase and Operation of Apartment Building.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the correct city/state.

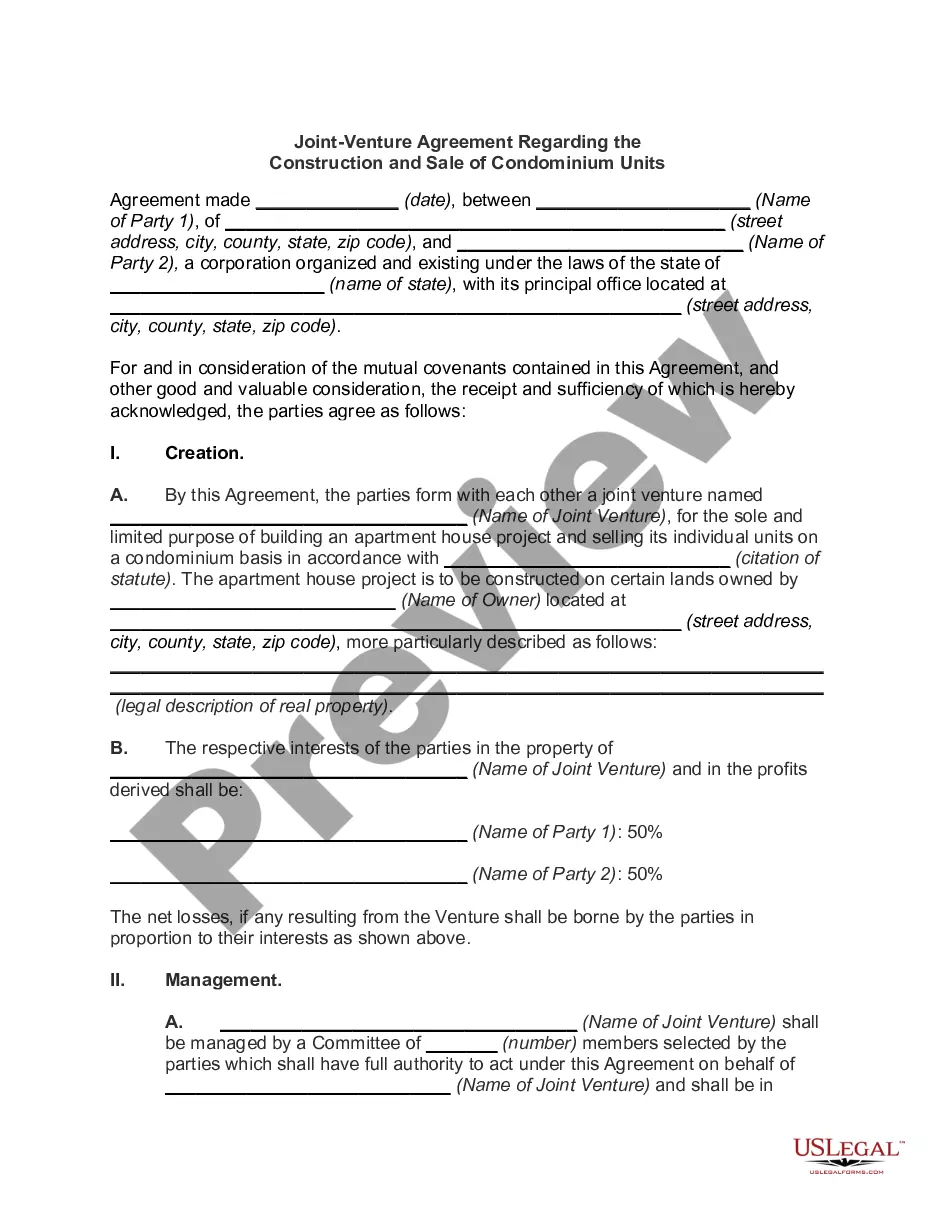

- Step 2. Use the Preview option to review the form’s content. Remember to check the summary.

Form popularity

FAQ

To form a joint venture in Florida, begin by identifying potential partners and discussing shared objectives. Next, draft a joint venture agreement that details contributions, roles, and profit distribution. Finally, ensure compliance with state regulations and legal requirements; utilizing a service like uslegalforms can help simplify the process of your Florida Joint Venture Agreement - Purchase and Operation of Apartment Building.

The requirements of a joint venture agreement include mutual consent from all parties, a clear outline of contributions, and defined profit-sharing arrangements. It should also specify operational guidelines and address how conflicts will be resolved. Understanding these requirements is vital when forming a Florida Joint Venture Agreement - Purchase and Operation of Apartment Building to ensure a successful partnership.

To write a joint venture agreement, start with an introduction outlining the parties involved and the purpose of the joint venture. Detail each party's contributions, responsibilities, and how profits will be divided. Conclude with clauses covering dispute resolution, duration, and termination of the agreement, all vital elements in a Florida Joint Venture Agreement - Purchase and Operation of Apartment Building.

Not necessarily; joint ventures can have any division of ownership, depending on the agreement between the parties. While a 50/50 split is common, partners can agree on other ratios based on their contributions and roles. This flexibility allows for tailored arrangements that meet the needs of all parties involved in a Florida Joint Venture Agreement - Purchase and Operation of Apartment Building.

The joint venture format typically includes the parties involved, the purpose of the venture, contribution details, management structure, and profit-sharing methods. It should also outline procedures for decision-making and modifications to the agreement. When creating a Florida Joint Venture Agreement - Purchase and Operation of Apartment Building, having a well-organized format can streamline discussions and create a solid foundation for the partnership.

Writing a joint venture agreement involves outlining objectives, contributions, profit distribution, and management roles. Begin by defining the purpose of the joint venture, such as the purchase and operation of an apartment building in Florida. Ensure clarity in terms that outline each party’s responsibilities and obligations; this transparency reduces potential conflicts in the future.

A joint venture operating agreement is a legal document that outlines the management, operations, and profit-sharing structure of a joint venture. This agreement is crucial for ensuring all parties have aligned expectations and responsibilities while undertaking the purchase and operation of an apartment building. It provides a roadmap for decision-making and conflict resolution, which is essential in a Florida Joint Venture Agreement - Purchase and Operation of Apartment Building.

To form and operate a joint venture in Florida, you need a clear agreement outlining the roles, contributions, and responsibilities of each party involved. Additionally, you must comply with state laws and obtain the necessary permits if required for the operation of your apartment building. It's advisable to consult with legal professionals who specialize in Florida Joint Venture Agreement - Purchase and Operation of Apartment Building to navigate legal complexities.

Correct, a joint venture is not considered a distinct legal entity in Florida by default. Instead, it is a collaboration between parties who agree to work together on a common business project. However, creating a Florida Joint Venture Agreement - Purchase and Operation of Apartment Building can clarify the roles and liabilities of each participant, helping to solidify the structure and operation of the venture.

While a joint venture shares similarities with a partnership, it is not exactly the same. A joint venture in Florida is typically formed for a specific project or purpose, like purchasing and operating an apartment building, while partnerships often engage in broader, ongoing business activities. It’s crucial to have a robust Florida Joint Venture Agreement - Purchase and Operation of Apartment Building to distinguish the legal nature and obligations of the joint venture.