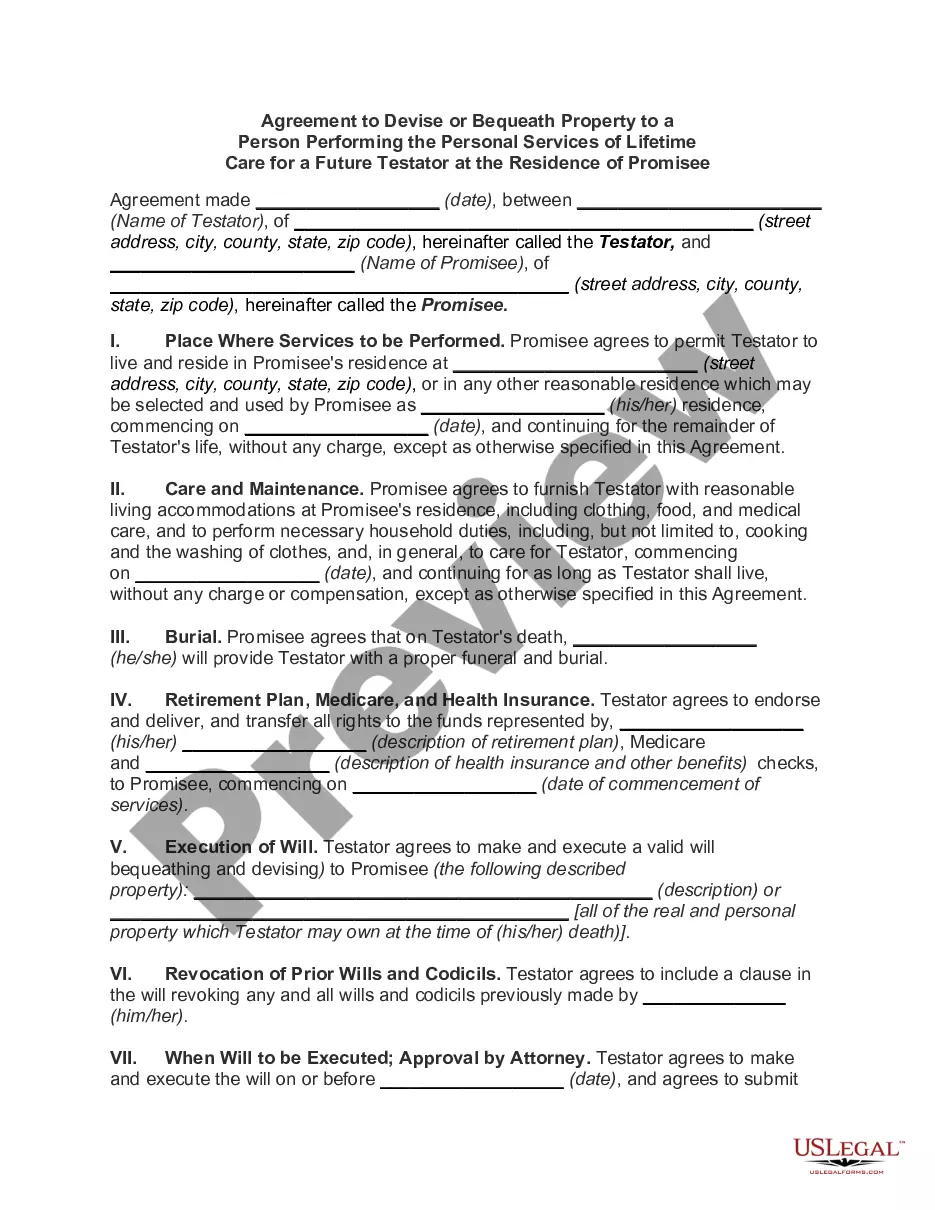

Florida Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services

Description

How to fill out Provision Of Agreement To Devise Or Bequeath Property To Person Performing Personal Services?

Locating the appropriate official document template can present a challenge.

Certainly, there are numerous templates available on the web, but how do you secure the official form you require.

Utilize the US Legal Forms website. The service provides an extensive collection of templates, such as the Florida Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services, which can serve both business and personal purposes.

You can examine the form using the Review button and view the form description to confirm it meets your needs.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Florida Provision of Agreement to Devise or Bequeath Property to Person Performing Personal Services.

- Use your account to browse through the official forms you may have previously ordered.

- Visit the My documents tab of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

Even with formal administration, most estates are resolved within 18 months. However, all claims against an estate must be filed within 2 years of the person's death.

Yes. A personal representative can also be a named beneficiary in the decedent's will. For example, in a family with four siblings, one of the siblings or even the spouse may act as a personal representative. There is no law against it as long as the individual is mentally and physically fit to perform the duties.

No, there is no deadline to open a probate in Florida, and we have handled estates 50 years after a person's death. If family members have paid the property taxes so that no tax deeds are granted, probate is often feasible for decades.

Let's break it down: State laws may vary slightly, but the typical scheme of most states, including Florida (§732.101 to A§732.111), is that intestate property passes in this order: spouse, descendants (children or grandchildren), parents, siblings (and children of deceased siblings).

Families typically have to wait six months or more to complete the probate legal process and receive their inheritance. Florida statutes protect attorneys' interest by establishing attorney fees based upon a percentage of probate estate value.

If you own the property alone under your individual name, then a will does dispose of the property at death. However, if you own the property as joint tenants with right of survivorship or as husband and wife, then the real property will pass outside of the will.

In Florida, if you are married when you die and have no will, your spouse will inherit everything, even if you have children together.

Florida law gives a surviving spouse rights in some, but not all, of a decedent's property. A surviving spouse will inherit by operation of law, automatically and immediately, any property titled jointly with rights of survivorship or as tenants by entireties. Jointly owned assets are not subject to probate.

The state of Florida does not allow automatic "transfer upon death" arrangements for deeds of real estate. If a Florida property owner passes away, the property must go through the probate court system for the county the decedent lived in.