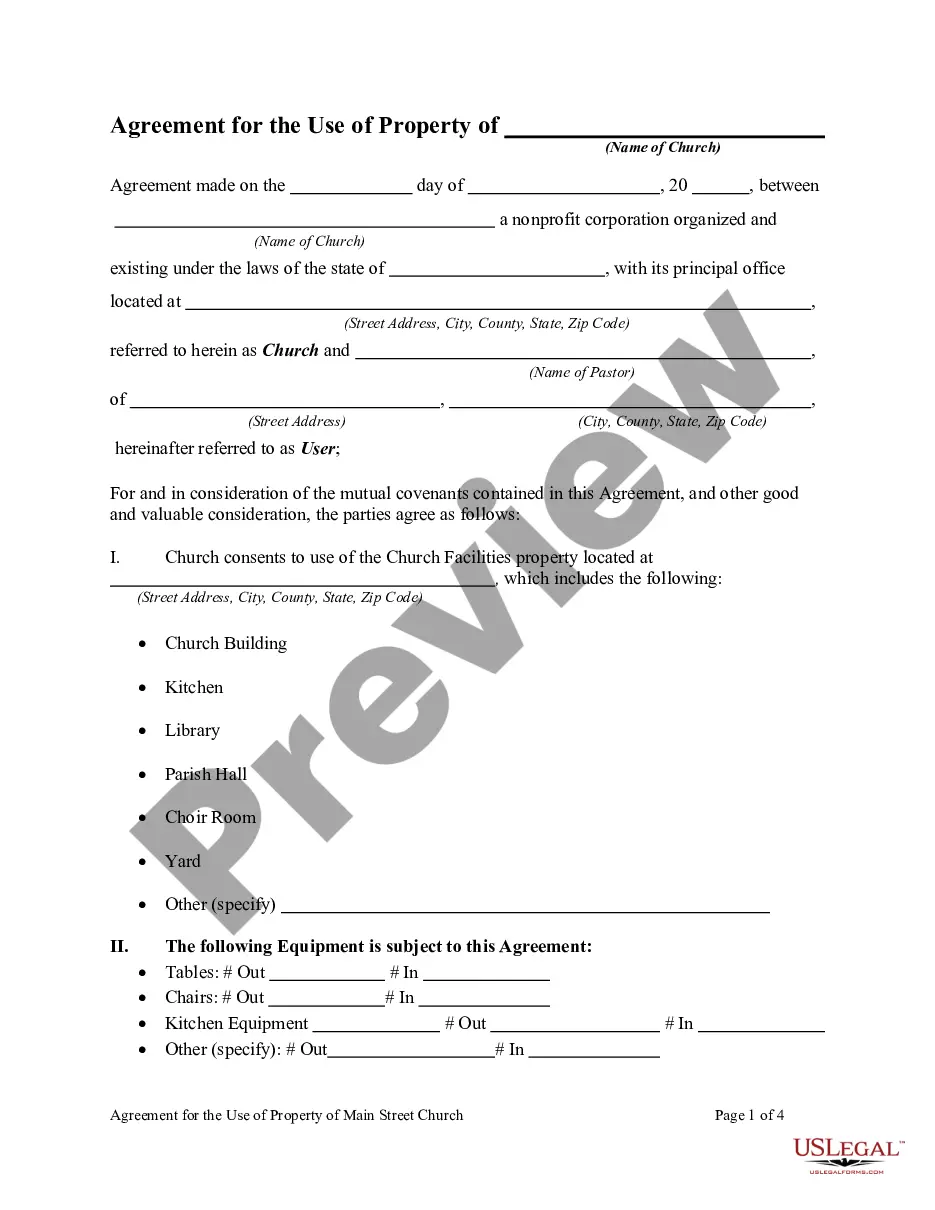

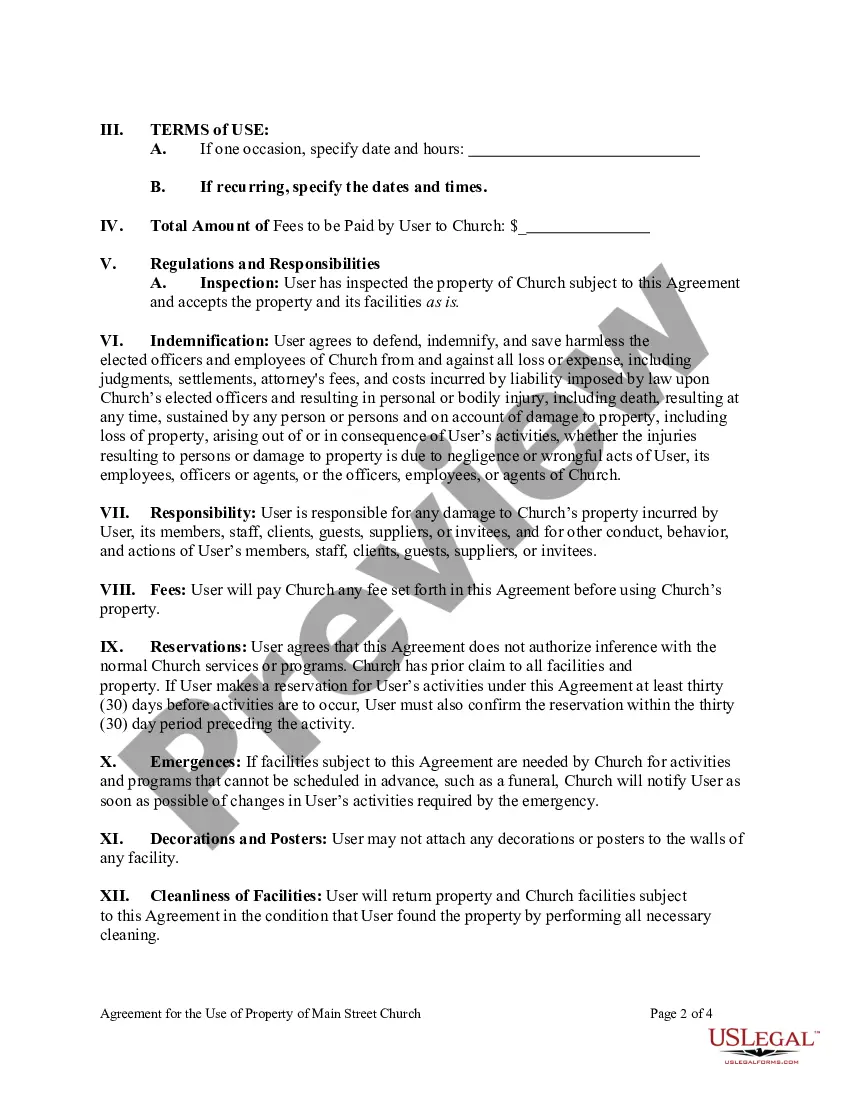

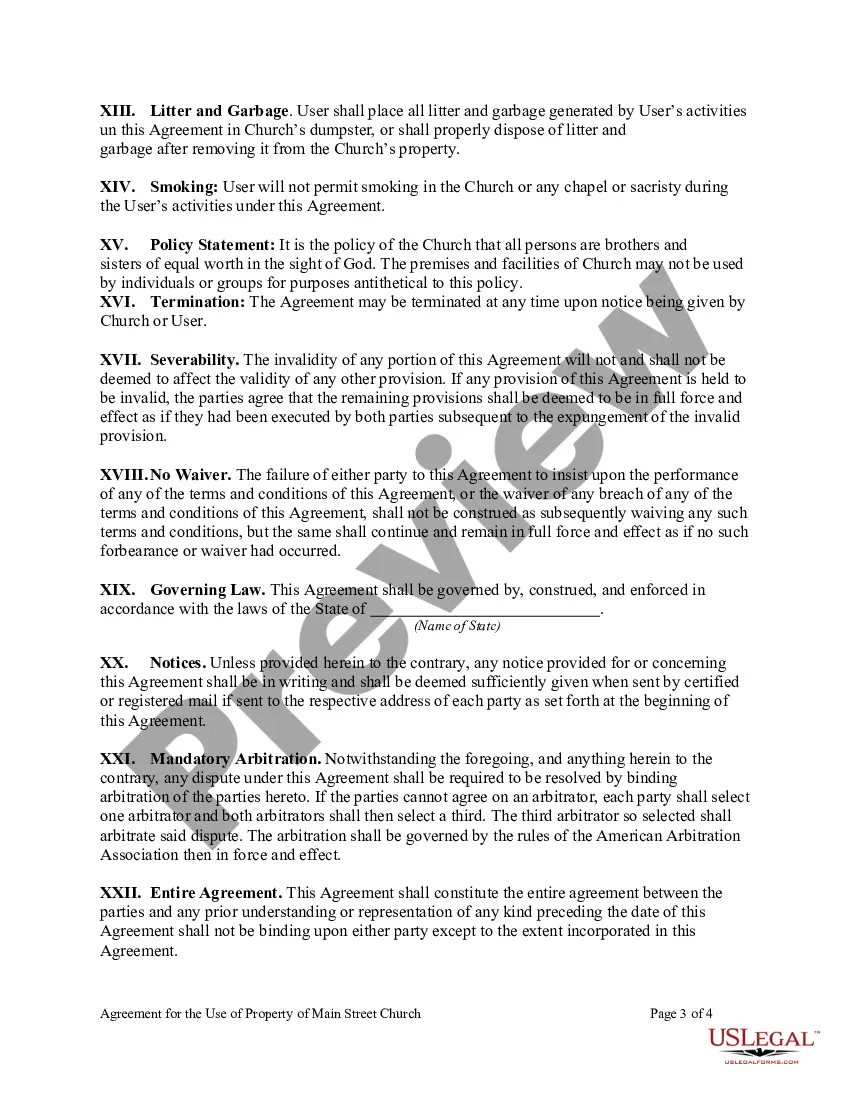

Florida Agreement for the Use of Property of a Named Church

Description

How to fill out Agreement For The Use Of Property Of A Named Church?

If you require thorough, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal documents, which can be accessed online.

Make use of the site’s straightforward and convenient search to find the files you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to locate the Florida Agreement for the Use of Property of a Named Church in just a few clicks.

Every legal document format you receive is yours permanently. You have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the Florida Agreement for the Use of Property of a Named Church with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download option to find the Florida Agreement for the Use of Property of a Named Church.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to locate other types in the legal form format.

- Step 4. Once you’ve found the form you need, click the Purchase now option. Choose the pricing plan you prefer and enter your details to sign up for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Florida Agreement for the Use of Property of a Named Church.

Form popularity

FAQ

The assets of a church are typically owned by the church organization itself, managed by its leaders or board. This ownership structure is fundamental for governance and operation. When drafting a Florida Agreement for the Use of Property of a Named Church, it's crucial to define asset ownership to prevent conflicts. Clear ownership rights support transparency and uphold trust among congregation members.

In Florida, churches often qualify for property tax exemptions, which can significantly reduce financial burdens. However, these exemptions depend on specific criteria, such as how the property is used. The Florida Agreement for the Use of Property of a Named Church can help you ensure compliance with state regulations and maintain exemption status. It's advisable to review the legal requirements to maximize benefits.

Typically, the deed to the church is held by the church organization or the governing body of the church. This can include a board of trustees or a similar leadership group. The Florida Agreement for the Use of Property of a Named Church will outline the responsibilities and ownership of the church property. Ensuring clarity in documentation can prevent future disputes about property rights.

When a church closes, its assets are often distributed according to the church’s bylaws or state laws. Typically, any remaining assets may be transferred to other nonprofit organizations or charitable entities. The Florida Agreement for the Use of Property of a Named Church can provide guidance on the process to ensure assets are handled legally and ethically.

The 80% rule for churches generally refers to the concept that if a property is used for exempt purposes 80% of the time, it may qualify for property tax exemptions. This means that the church must demonstrate that the property serves its religious mission adequately. Understanding the Florida Agreement for the Use of Property of a Named Church can offer further insights into adhering to this rule.

Yes, many churches in Florida are exempt from property taxes under certain conditions. This exemption applies if the property is used primarily for worship and religious activities. The Florida Agreement for the Use of Property of a Named Church can help clarify eligibility and compliance for tax exemptions in your local jurisdiction.

The deed to a church is typically owned by the church organization as a legal entity, which may be a nonprofit corporation or another structure. The church’s governing body holds the title, and they have the authority to make decisions regarding the property. The Florida Agreement for the Use of Property of a Named Church should specify details about property ownership and management responsibilities.

The proceeds from the sale of a church property usually go back to the church's financial resources. These proceeds are often designated for revitalization projects, charitable outreach, or savings for future growth. The Florida Agreement for the Use of Property of a Named Church can help clarify how sale proceeds should be allocated and used by the church.

When a church decides to sell property, it must follow state laws and its internal governance structure. Typically, the church board or governing body must approve the sale, ensuring it aligns with the best interests of the congregation. The Florida Agreement for the Use of Property of a Named Church often outlines conditions related to property sales to ensure proper handling of assets.

Running a business through a church may be feasible if it aligns with the church's mission and complies with legal restrictions. Many churches provide space for small businesses, fostering community engagement. Utilizing a comprehensive guideline like the Florida Agreement for the Use of Property of a Named Church is essential to set clear expectations and protect both the church and the business involved.