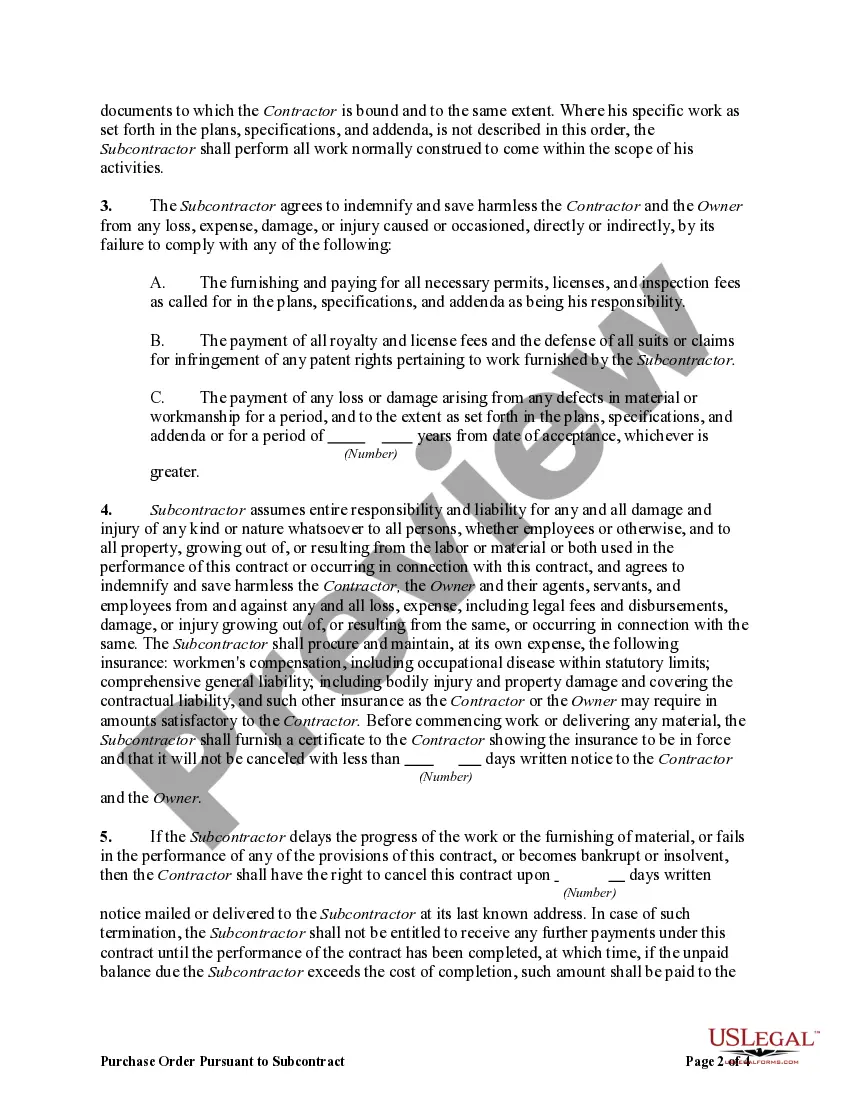

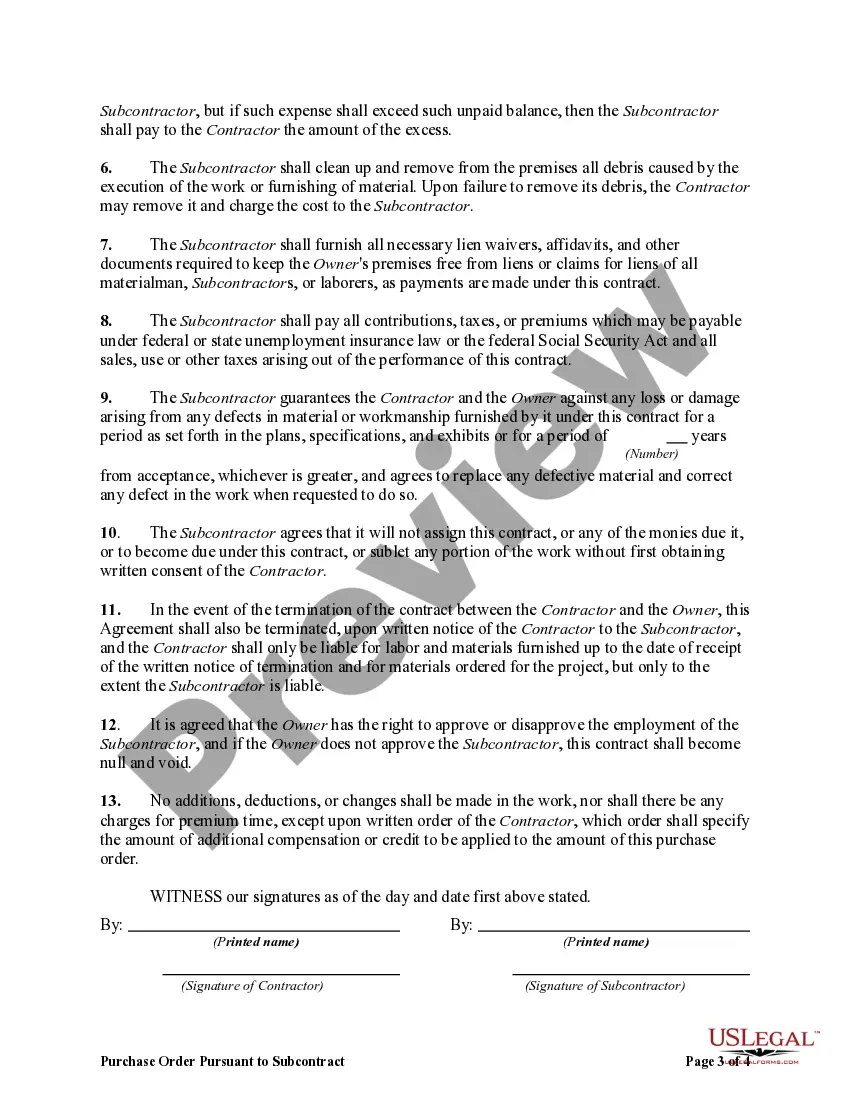

Florida Purchase Order Pursuant to Subcontract for Labor and Materials

Description

How to fill out Purchase Order Pursuant To Subcontract For Labor And Materials?

Are you in a location where you require documents for occasional business or specific tasks almost every day.

There is a multitude of legal document templates accessible online, but finding reliable ones isn't straightforward.

US Legal Forms offers an extensive collection of form templates, including the Florida Purchase Order Pursuant to Subcontract for Labor and Materials, crafted to fulfill federal and state requirements.

Once you find the appropriate form, click Acquire now.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Florida Purchase Order Pursuant to Subcontract for Labor and Materials template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

- Use the Review button to evaluate the form.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search area to find a form that meets your needs and requirements.

Form popularity

FAQ

Although work order and purchase order sound similar, they have very different functions in a business setting. It appear when particular tasks must be completed. A purchase order, on the other hand, occurs when a company is buying materials or services from an outside vendor.

The main difference between the two documents is the duration. Purchase orders represent single business transactions. Contracts are used for long term arrangements between the buyer and seller. Contracts may also allow for renewal options.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.

Charges for repairs of tangible personal property needing only labor or service are not taxable. The repair person must keep documentation to prove no tangible personal property was joined with or attached to the repaired item. Sales tax applies even if the parts are provided at no charge.

The purchase of materials and supplies to improve, alter, or repair land, buildings, homes, or other real property is subject to sales tax and applicable discretionary sales surtax.

Florida Statutes 713.01(28) defines a subcontractor as a person who is not a materialman or laborer and who enters into an agreement with a contractor to perform contractual obligations.

The primary difference between purchases and subcontracts is that purchases do not contain jobsite labor, whereas subcontracts always contain jobsite labor.

The truth is labor can be and often is taxable in Florida. The services this labor provides may be taxed specifically, or the labor may become taxable based on its association with the sale of tangible personal property.

The truth is labor can be and often is taxable in Florida. The services this labor provides may be taxed specifically, or the labor may become taxable based on its association with the sale of tangible personal property.