A security interest in an aircraft engine can be perfected only in the manner required by federal law. Federal law excludes by preemption the recording of title to or liens against aircraft, so that a transfer that is not recorded under the federal system is not effective. Security Interests in Engines less than 550 horsepower are not eligible for recording. A security interest in an aircraft is perfected by filing with the Aircraft Registration Branch of the Federal Aviation Administration.

Florida Security Agreement Granting Security Interest in Aircraft Engine

Description

How to fill out Security Agreement Granting Security Interest In Aircraft Engine?

Are you in a situation where you need documents for both corporate and personal activities almost daily.

There are numerous legal document templates available online, but locating ones you can trust is challenging.

US Legal Forms provides thousands of document templates, such as the Florida Security Agreement Granting Security Interest in Aircraft Engine, designed to comply with state and federal regulations.

Once you acquire the correct template, click on Buy now.

Select your desired payment plan, complete the necessary details to create your account, and finalize the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Florida Security Agreement Granting Security Interest in Aircraft Engine template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it corresponds to the correct area/state.

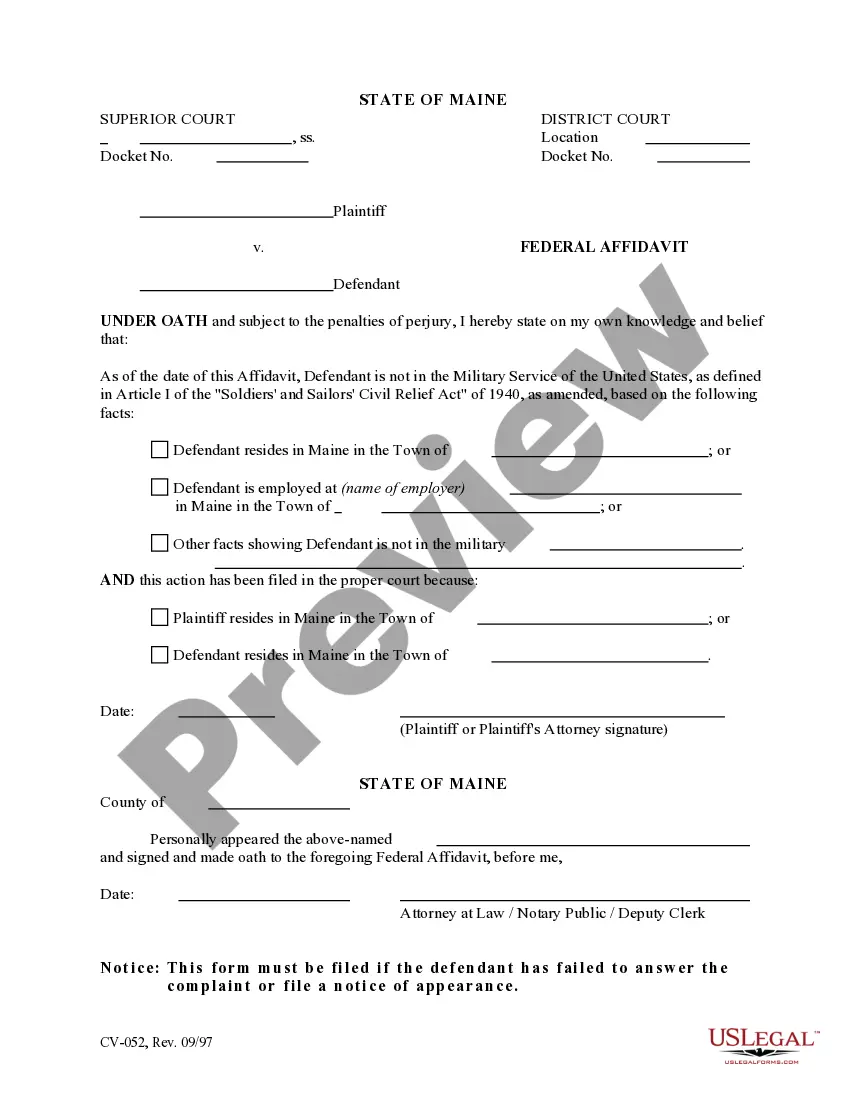

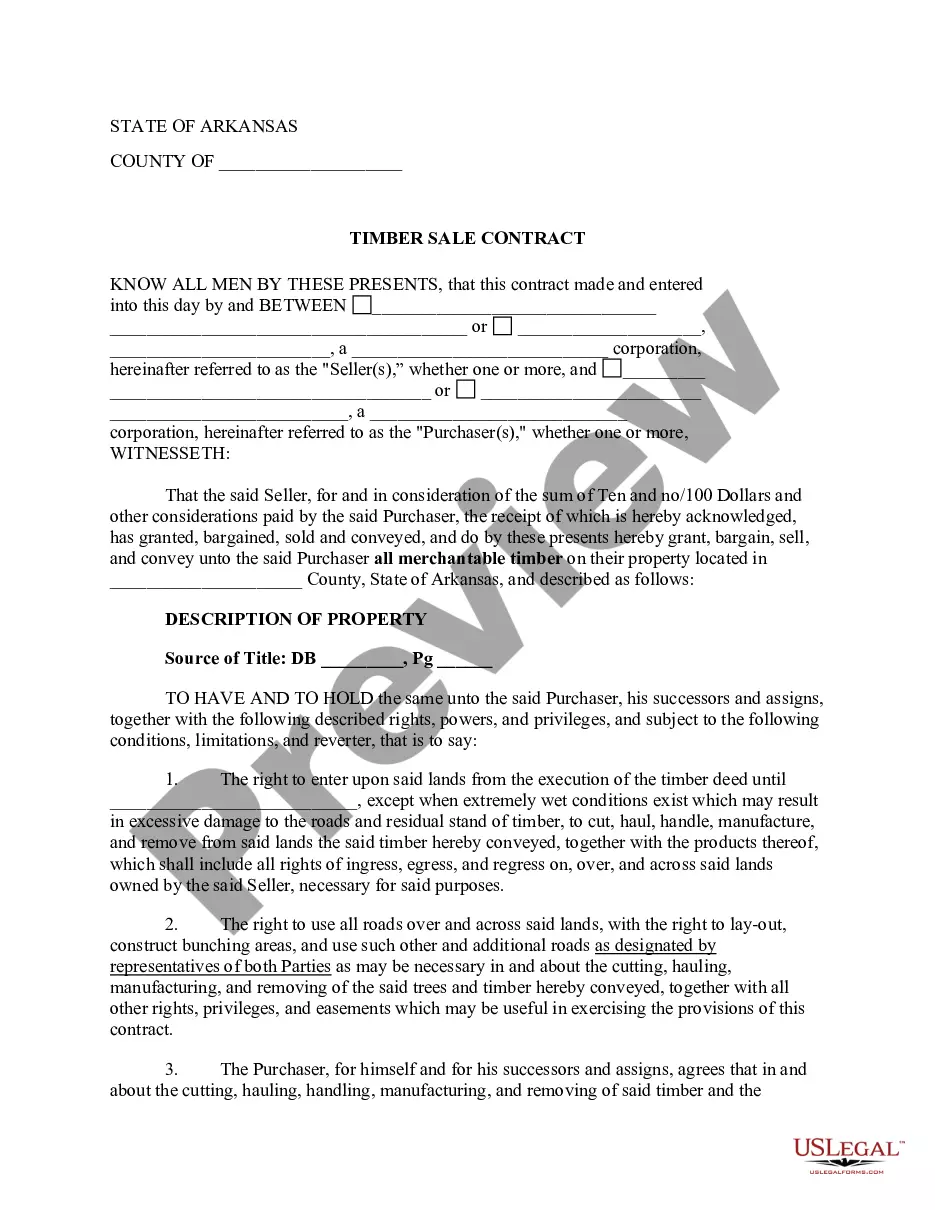

- Use the Preview button to examine the form.

- Check the description to confirm you have selected the right template.

- If the template is not what you are looking for, utilize the Search field to find the form that meets your requirements.

Form popularity

FAQ

To perfect a lien on an aircraft engine, you need to file a secured financing statement in accordance with Florida law. This process involves creating a Florida Security Agreement Granting Security Interest in Aircraft Engine, which outlines the rights of the secured party. It is crucial to ensure that your documentation is accurate and filed with the appropriate state authorities. By using a platform like US Legal Forms, you can easily access templates and guidance to help you navigate this process effectively.

Yes, the Uniform Commercial Code (UCC) does apply to aircraft, including engines and parts. UCC governs secured transactions, helping protect the interests of lenders and buyers alike. If you are involved with leasing or financing an aircraft, a Florida Security Agreement Granting Security Interest in Aircraft Engine is crucial to formalize your arrangements and ensure compliance.

To perfect a security interest in an aircraft, you must file a financing statement with the appropriate state authority or register the security interest with the FAA, depending on the context and usage. By doing this, you protect your rights against other creditors. With a Florida Security Agreement Granting Security Interest in Aircraft Engine, ensuring proper perfection can safeguard your investment effectively.

A security interest is the legal right that a lender has in the collateral until the debt is repaid, while a security agreement is the contract that outlines its terms. They work together effectively, with the agreement providing the framework for the lender's interest. Specifically, a Florida Security Agreement Granting Security Interest in Aircraft Engine documents the lender's rights to the engine as collateral.

While a security agreement creates a security interest in collateral, a lien is a legal right or interest that a lender has in the collateral, typically until the debt obligation is satisfied. A Florida Security Agreement Granting Security Interest in Aircraft Engine may create a lien on the engine, ensuring the lender has rights to claim it in case of default.

A mortgage is typically used for real property, while a security agreement applies to personal property, including aircraft engines. Both establish a security interest, but a security agreement tends to offer more flexibility regarding various types of collateral. Therefore, a Florida Security Agreement Granting Security Interest in Aircraft Engine focuses specifically on the engine itself.

A security agreement serves to define the relationship between the debtor and the secured party. It outlines the terms under which the secured party holds an interest in the collateral. In the case of a Florida Security Agreement Granting Security Interest in Aircraft Engine, it specifies the aircraft engine as collateral, providing assurance to the lender in case of default.

To establish an enforceable security interest, there are three key requirements you must meet: The security agreement must be in place, the debtor must have rights to the collateral, and the secured party must perfect their interest in the collateral. When it comes to a Florida Security Agreement Granting Security Interest in Aircraft Engine, you ensure the agreement reflects the specifics of the engine and its ownership.

Yes, you can file a security agreement to perfect your security interest in the aircraft engine. Filing the agreement creates a public record, which is essential for establishing your rights over the collateral. It's advisable to structure the Florida Security Agreement Granting Security Interest in Aircraft Engine carefully to ensure compliance with all applicable laws.

To perfect a security interest in Florida, you generally need to file a Uniform Commercial Code (UCC) financing statement with the Florida Secretary of State. This filing makes your interest legal and informs other parties about your claim. Utilizing a Florida Security Agreement Granting Security Interest in Aircraft Engine can aid in this procedure, ensuring you meet all necessary legal standards.