Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Engagement Letter Between Accounting Firm and Client For Tax Return Preparation

Description

How to fill out Engagement Letter Between Accounting Firm And Client For Tax Return Preparation?

If you need to obtain, acquire, or print official document templates, utilize US Legal Forms, the largest collection of legal paperwork available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard, or PayPal account to finalize the payment.

- Use US Legal Forms to obtain the Florida Engagement Letter Between Accounting Firm and Client for Tax Return Preparation with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to acquire the Florida Engagement Letter Between Accounting Firm and Client for Tax Return Preparation.

- You can also access documents you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

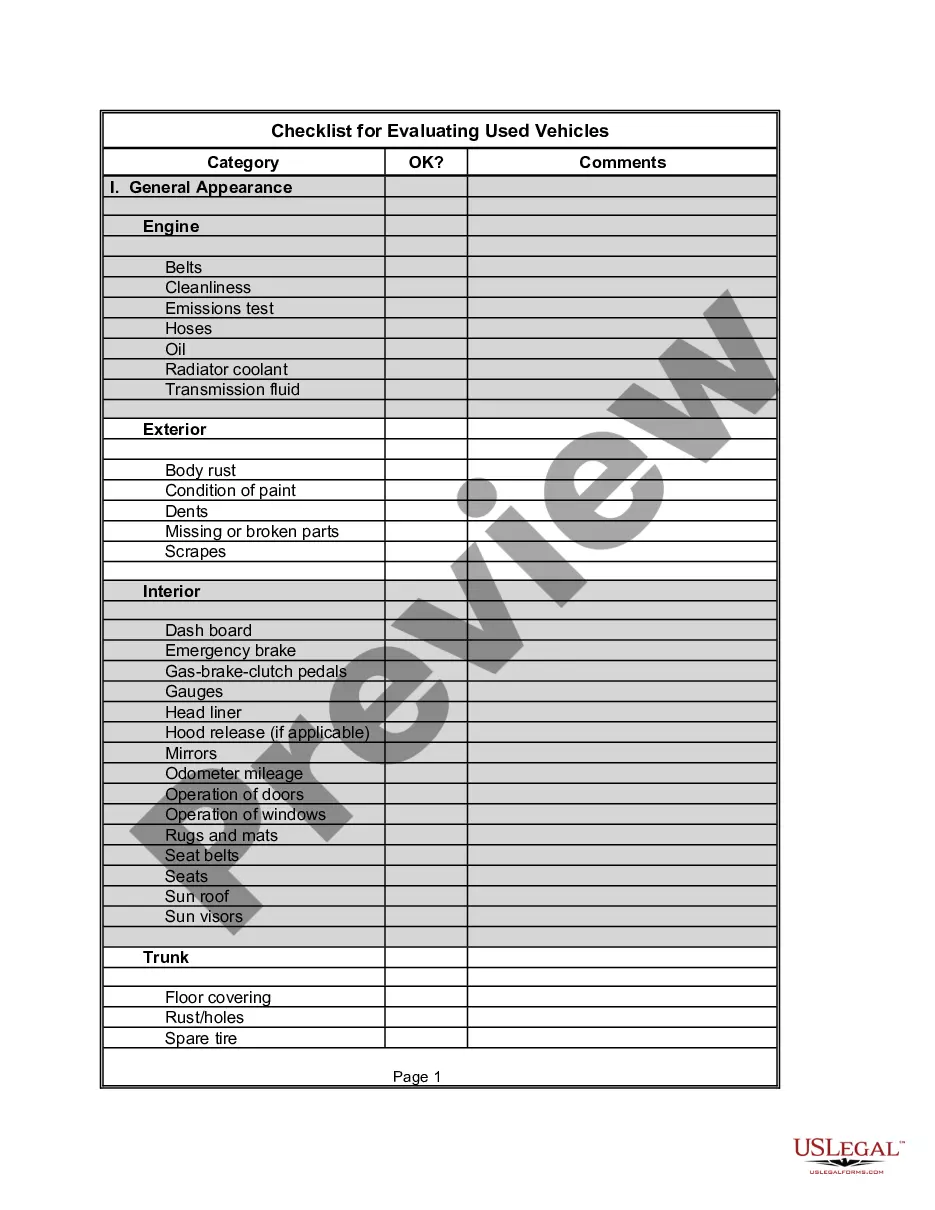

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form design.

Form popularity

FAQ

A CPA letter from a tax preparer is a formal communication that certifies specific information regarding a client's tax situation. This letter can serve various purposes, such as confirming the tax preparer's qualifications or the accuracy of prepared documents. Incorporating a Florida engagement letter between an accounting firm and client for tax return preparation alongside such letters strengthens the credibility and accountability of the tax preparation process.

Engagement letter software for accountants is a tool that helps automate the creation, management, and tracking of engagement letters. This software streamlines the process by providing templates and facilitating easy customization to meet specific client needs. For accountants preparing Florida engagement letters between the firm and clients for tax return preparation, such software enhances productivity and minimizes errors.

The purpose of the engagement letter is to define the relationship between the accountant and the client, ensuring both parties are on the same page regarding services and obligations. It acts as a protective measure for both sides, establishing trust and clarity. By using a Florida engagement letter between an accounting firm and client for tax return preparation, clients can feel more secure and informed about the process.

An engagement letter from an accountant is a critical document that outlines the agreement between the accountant and the client. This letter specifies the services to be rendered, fees, and the responsibilities of both parties. For effective tax return preparation, a Florida engagement letter between accounting firm and client can mitigate risks and clarify expectations, thus creating a smoother working relationship.

A tax audit engagement letter is a specific document that addresses the services provided by the accountant during a tax audit. This letter outlines the accountant's role, the client's obligations, and the extent of the accountant's work in preparing for or responding to an audit. Providing this document ensures both parties understand their responsibilities and maintains a level of professionalism, especially when dealing with sensitive tax matters.

The engagement letter for taxes is a formal agreement that specifies the scope of the accountant's services regarding tax preparation. It typically outlines the details of the tax services, the information required from the client, and the expectations for both parties. Utilizing a Florida engagement letter between an accounting firm and client for tax return preparation ensures transparency and sets clear guidelines for the entire process.

An engagement letter outlines the agreement between the accounting firm and the client specifically for tax return preparation. For instance, a Florida engagement letter between an accounting firm and client will detail the services offered, timelines, and fees. This document ensures both parties have a clear understanding of their responsibilities and helps prevent any misunderstandings during the tax preparation process.

When writing a tax engagement letter, begin by identifying the parties involved and the nature of the tax services to be provided. Detail the specific tasks, timelines for submission, and the responsibilities of both the client and the accounting firm. Utilizing a template for a Florida Engagement Letter Between Accounting Firm and Client For Tax Return Preparation from platforms like US Legal Forms can streamline this process, ensuring all necessary components are included.

To write a professional engagement letter, start by clearly stating the purpose of the letter, the services being offered, and the relevant terms and conditions. Be specific about timelines and fees, and ensure you use language that is easy to understand. For instance, when creating a Florida Engagement Letter Between Accounting Firm and Client For Tax Return Preparation, include all key details related to the tax services being rendered.

An accounting engagement letter is a document that defines the terms of the relationship between an accounting firm and its client. It describes the services that will be performed, the timeline for completion, and relevant financial details. A Florida Engagement Letter Between Accounting Firm and Client For Tax Return Preparation is a specific type that focuses on tax return preparation, making it essential for clarity on tax-related issues.