This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

If you aim to finalize, obtain, or generate sanctioned document templates, utilize US Legal Forms, the largest collection of sanctioned documents available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you need.

Various templates for commercial and personal use are organized by categories and claims, or keywords.

Step 4. After identifying the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to make the payment.

- Utilize US Legal Forms to acquire the Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust with just a few clicks.

- If you are presently a US Legal Forms user, Log In to your account and click on the Download button to locate the Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

- You can also access forms you have previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

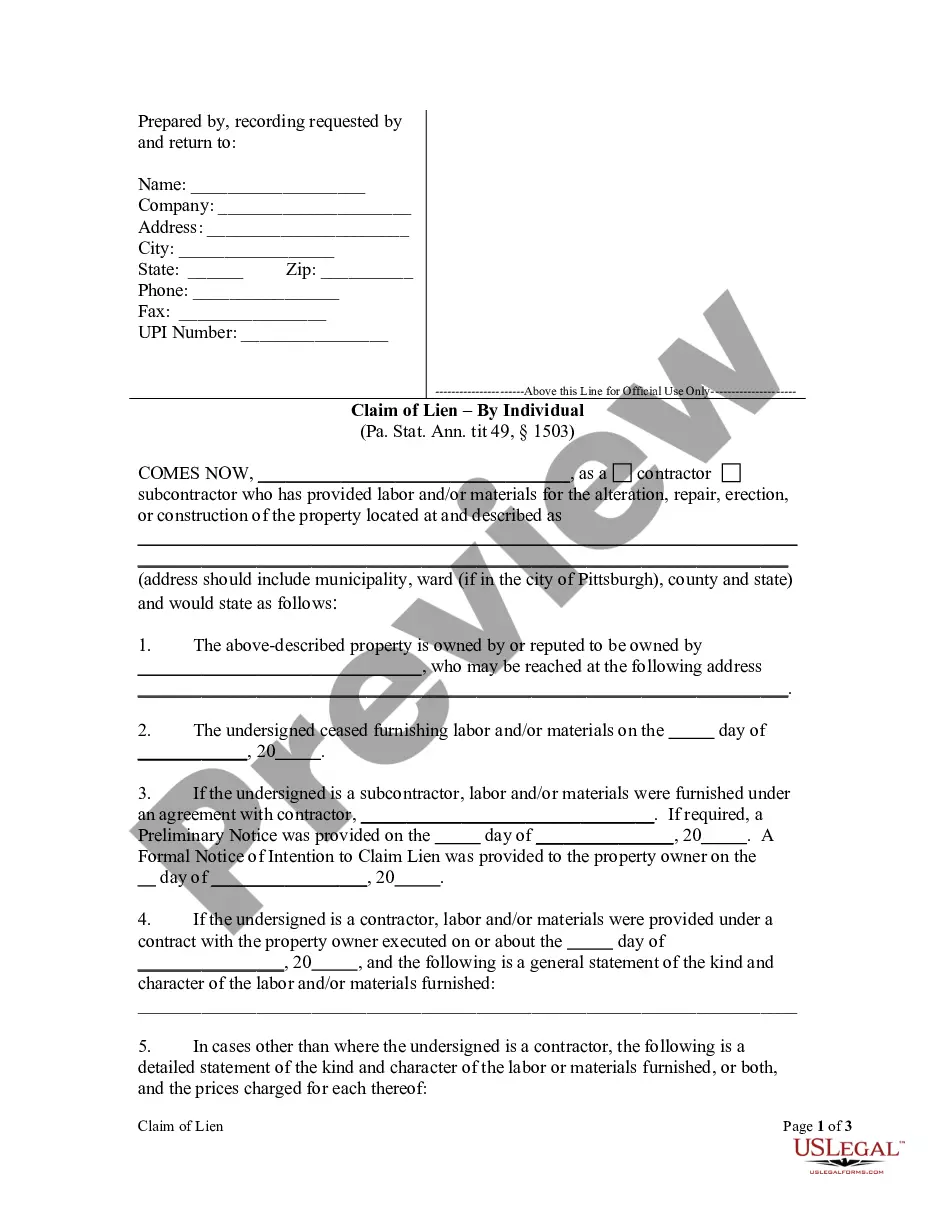

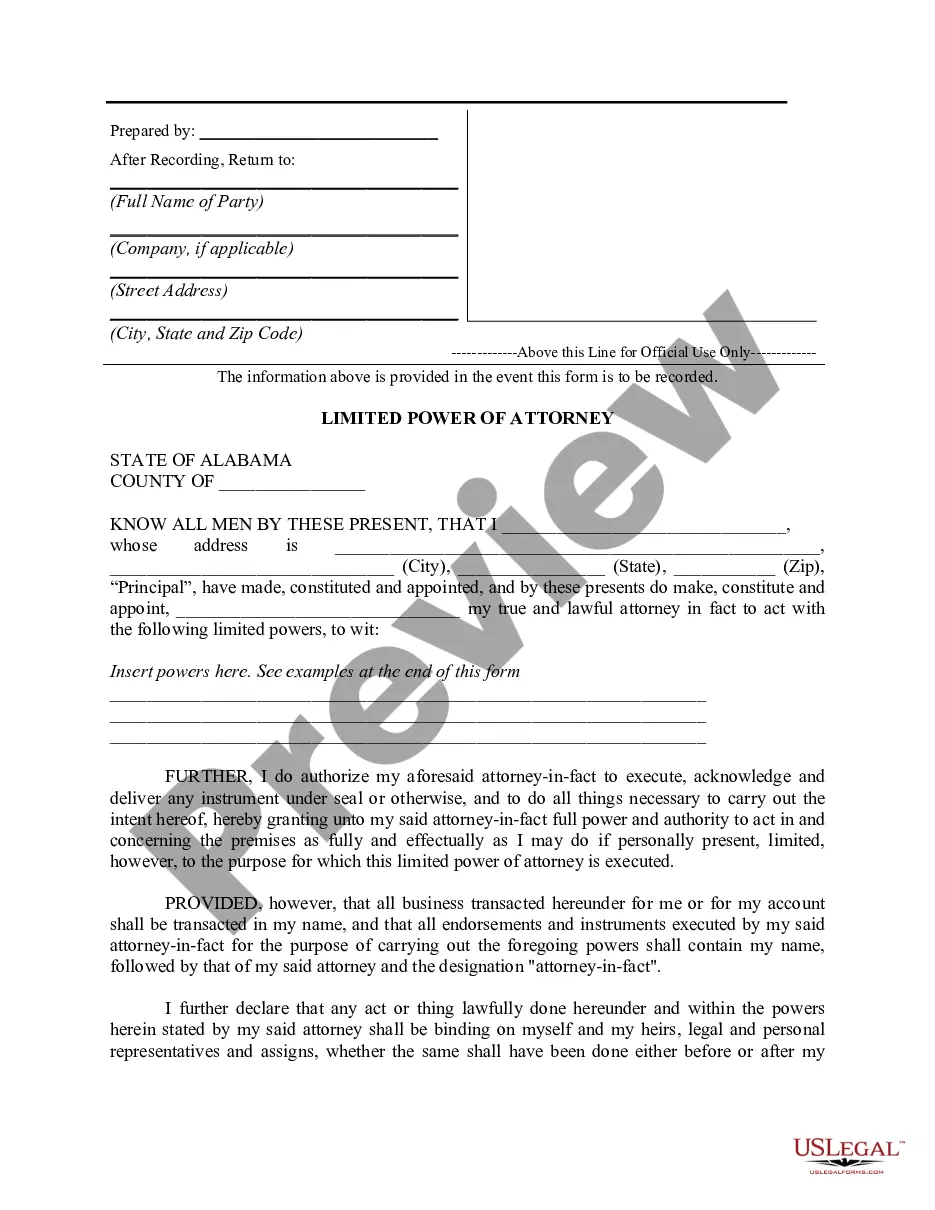

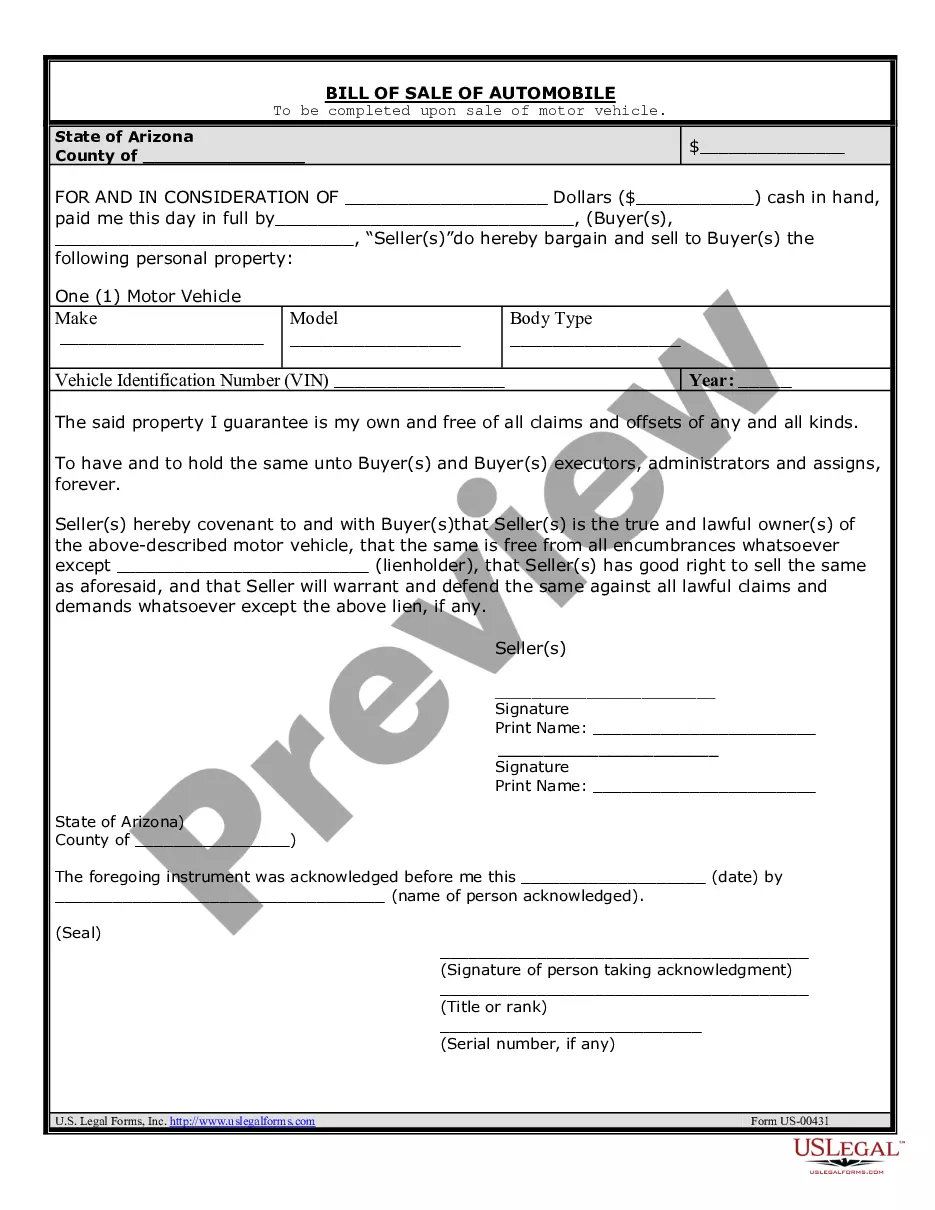

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don't forget to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Writing a letter to a trustee requires clarity and precision. Begin by addressing the trustee with their proper title, followed by a clear explanation of your intent. If you are notifying the trustee about an assignment, refer specifically to the Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust. Conclude with your contact information and ensure that your letter is both formal and respectful to facilitate effective communication.

In general, a trustee must notify all beneficiaries within 60 days after they accept the trust. This notification includes essential information about the trust's existence and its provisions. The Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust further clarifies the responsibilities of trustees in this context. For a thorough understanding and templates to assist in notifications, explore what US Legal Forms offers.

Beneficiaries in Florida have numerous rights, including the right to request an accounting of the trust and to receive their designated distributions. They can also contest improper actions taken by the trustee. Understanding the Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust is crucial, as it outlines how beneficiaries can assert their rights. You can find valuable resources on platforms like US Legal Forms to assist in this area.

To file a notice of trust in Florida, you need to follow specific procedural steps. First, prepare the notice document that includes vital details about the trust. Next, file this notice with the appropriate court or county office. The Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust guides this process, ensuring you fulfill all requirements. Services like US Legal Forms can simplify this filing process for you.

In Florida, a beneficiary typically has a period of 90 days from receiving the notice regarding the trust to contest it. This timeframe allows beneficiaries to understand the terms and make informed decisions. When considering the Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust, it is essential to act swiftly to protect your interests. Utilizing resources such as US Legal Forms can help you navigate these processes effectively.

To file a notice of trust in Florida, you typically need to prepare a Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust. This document should outline the key details of the trust and any assignments made. Once completed, the notice must be presented to the appropriate court or recorded in the county where the trust is administered. For assistance with forms and filing, consider U.S. Legal Forms, where you can find appropriate templates tailored to your needs.

Yes, a beneficiary can serve as a trustee in Florida. This dual role is common in many trusts, provided the trust document permits it. It's important to consider the implications of this dual responsibility, as a Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust can clarify roles and assignments. If you’re setting up a trust, U.S. Legal Forms can help ensure compliance with state laws.

In Florida, a trust does not need to be filed with the state to be valid. However, certain documents may need to be recorded, like a Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust. This notice helps inform relevant parties about the trust's assignment details. If you have questions regarding filings, U.S. Legal Forms provides the necessary resources to guide you through the process.

Statute 739.204 deals with the powers of a trustee in managing trust property, explicitly detailing the specific actions a trustee may take. This statute enhances a trustee's ability to effectively manage trust assets while keeping beneficiaries’ interests at heart. Knowing this statute is particularly useful when navigating the complexities associated with the Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

Statute 739.402 pertains to the authority of a trustee concerning trust distributions in Florida. It outlines the standard by which a trustee must operate in regards to managing and distributing trust property. Understanding the implications of this statute is vital for beneficiaries dealing with situations like the Florida Notice to Trustee of Assignment by Beneficiary of Interest in Trust.