This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida Agreement to Renew Trust Agreement

Description

How to fill out Agreement To Renew Trust Agreement?

Are you in a situation where you require documents for both professional and personal purposes almost every business day.

There are numerous reliable document templates accessible online, yet finding ones you can trust is not simple.

US Legal Forms offers a vast array of form templates, such as the Florida Agreement to Renew Trust Agreement, which are designed to comply with state and federal regulations.

Once you find the right form, click Get now.

Select a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Florida Agreement to Renew Trust Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and make sure it is for the correct city/region.

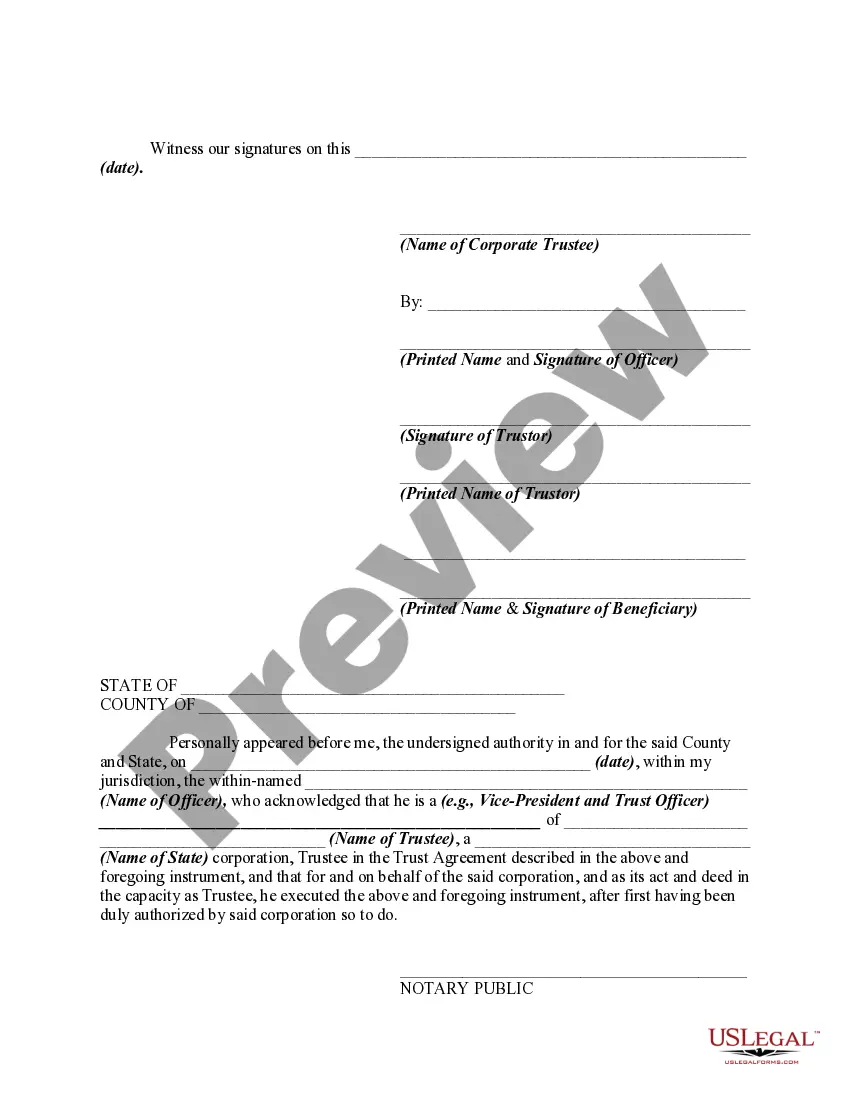

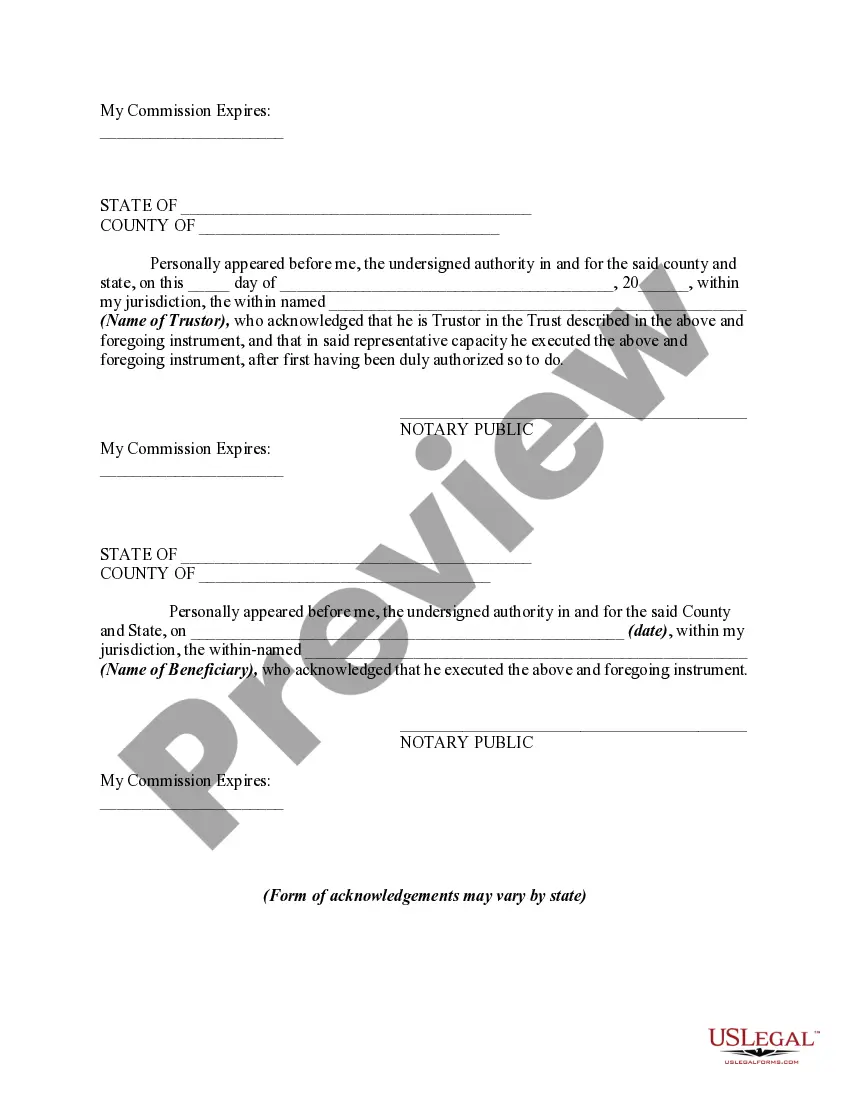

- Utilize the Review button to inspect the form.

- Check the description to ensure you have selected the proper form.

- If the form is not what you need, use the Research field to find the form that meets your requirements.

Form popularity

FAQ

In Florida, you do not need to file a trust return for living trusts unless the trust generates income. However, specific tax situations may require additional filing depending on the circumstances. By understanding the regulations surrounding your situation, you can better navigate compliance. If you need further clarification on your obligations, resources like USLegalForms can offer helpful insights on a Florida Agreement to Renew Trust Agreement.

Yes, you can amend your trust by yourself, provided you follow your state’s legal requirements. Drafting a clear amendment document is essential to ensure validity and effectiveness. While you can manage this independently, using a service like USLegalForms can streamline the process and help you avoid common pitfalls related to your Florida Agreement to Renew Trust Agreement.

You can make changes to a living trust by drafting an amendment. This amendment allows you to add new provisions or modify existing ones without creating a new document. It is important to follow the proper legal procedures to ensure your changes are valid. If you are unsure, consider consulting resources like USLegalForms for guided assistance on a Florida Agreement to Renew Trust Agreement.

In Florida, inherited property typically enjoys a temporary exemption from reassessment when passed through a trust. This means beneficiaries may retain the property's assessed value, preventing sudden tax increases. A well-drafted Florida Agreement to Renew Trust Agreement is vital in outlining clear beneficiary rights and preserving tax benefits for the heirs.

Generally, placing property into a trust does not trigger a reassessment in Florida if the owner remains the same. However, it is essential to ensure that the Florida Agreement to Renew Trust Agreement is correctly executed, as this helps protect property tax benefits and maintain the property's value. Consulting with a legal expert can provide clarity tailored to your specific situation.

To update a living trust in Florida, you can create an amendment or restate the entire trust document. This process allows you to modify terms, add or remove beneficiaries, and update property information. Utilizing a Florida Agreement to Renew Trust Agreement simplifies this process, ensuring your intentions are clearly documented and legally recognized.

In Florida, a reassessment typically occurs when there is a change in ownership or a significant alteration to the property. This can be due to selling the property or making extensive renovations. An updated Florida Agreement to Renew Trust Agreement may help clarify ownership changes and ensure proper handling of reassessments, protecting both current and future beneficiaries.

The rule against perpetuities in Florida prevents trusts from lasting indefinitely without proper restrictions. Generally, trusts must terminate within a certain period, often measured by the lifetime of a specified individual plus twenty-one years. This rule aims to ensure that property does not remain in trust forever, allowing for timely distribution. A Florida Agreement to Renew Trust Agreement can clarify your trust’s duration and adherence to this important rule.

The statute governing trust accounting in Florida is detailed in the Florida Trust Code. It outlines the trustee's obligations to keep accurate records and provide periodic accountings to beneficiaries. This legislation aims to foster transparency and maintain trust among parties involved. Using a Florida Agreement to Renew Trust Agreement can assist in complying with these statutory requirements seamlessly.

In Florida, trust accountings are indeed required under specific circumstances. Trustees must regularly inform beneficiaries about the trust's financial activities and provide documentation upon request. This requirement protects beneficiaries' interests and prevents misuse of trust assets. Employing a Florida Agreement to Renew Trust Agreement can guide trustees through these requirements.