A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. This form is a sample of a trustor amending a trust agreement. It is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Florida General Form of Amendment of Trust Agreement

Description

How to fill out General Form Of Amendment Of Trust Agreement?

Are you presently in a situation where you need documents for potential business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable types isn’t easy.

US Legal Forms offers thousands of form templates, such as the Florida General Form of Amendment of Trust Agreement, designed to meet state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Florida General Form of Amendment of Trust Agreement template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for your specific city/region.

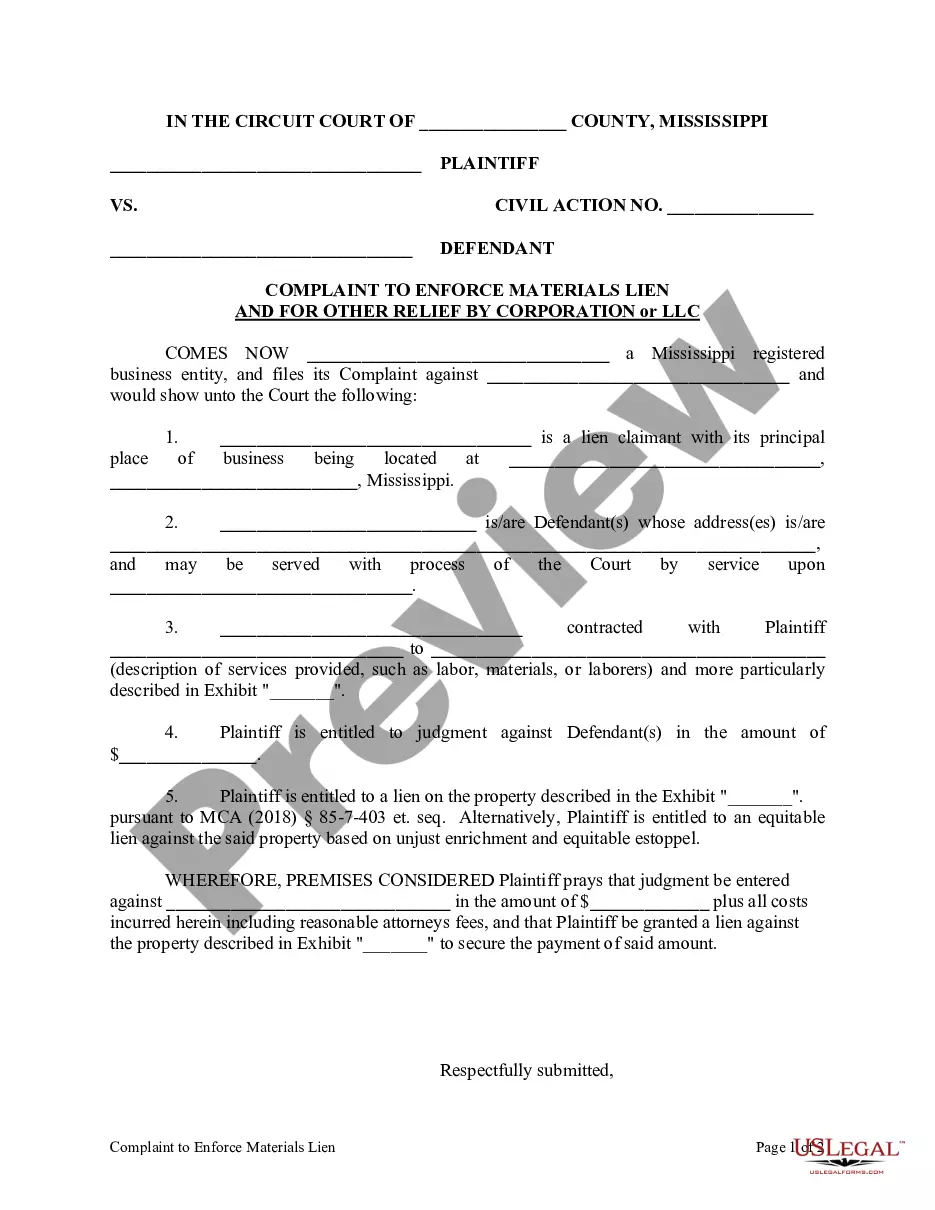

- Use the Review button to examine the form.

- Check the description to confirm that you have chosen the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

- Access all the document templates you’ve purchased in the My documents section.

- You can retrieve another copy of Florida General Form of Amendment of Trust Agreement at any time, if needed. Just click on the necessary form to download or print the document format.

Form popularity

FAQ

An amendment to the agreement refers to a formal change or addition made to an existing contract. This process updates the original terms while maintaining the core agreement's integrity. With the Florida General Form of Amendment of Trust Agreement, you can easily draft modifications that meet all legal requirements and reflect current intentions.

Modifying an irrevocable trust in Florida is challenging, but not impossible under certain conditions. Specific provisions allow for adjustments, provided they adhere to state regulations. Utilizing the Florida General Form of Amendment of Trust Agreement can help clarify your options and facilitate the modification process.

An amendment to contract terms is a formal modification to an existing agreement between parties. This process involves specifying which terms are altered and how they are updated. Using the Florida General Form of Amendment of Trust Agreement can streamline this procedure, especially when dealing with trust-related contracts.

The deed of amendment of a trust is a formal document that alters the provisions within an existing trust. This document typically highlights the changes intended by the trust creator, ensuring clarity and legal integrity. For efficiency, accessing the Florida General Form of Amendment of Trust Agreement can guide you through the necessary steps to make amendments legally.

A deed of amendment to a trust deed serves as a legal document that modifies the original trust agreement. This deed outlines the specific changes made to the trust, ensuring all parties are aware of the new terms. By using a Florida General Form of Amendment of Trust Agreement, you can simplify this process and ensure compliance with local laws.

You can obtain a trust amendment form from several online platforms, including uslegalforms. This platform provides access to the Florida General Form of Amendment of Trust Agreement, ensuring that you have a reliable and legally compliant document. Additionally, professional legal assistance may be beneficial in customizing the form to suit your specific needs.

In Florida, an amendment to a trust does not necessarily require notarization to be valid; however, it is often recommended. Notarizing the amendment adds an extra layer of authenticity, making it more challenging to challenge the document's validity. To ensure compliance, consider choosing the Florida General Form of Amendment of Trust Agreement and consulting with a legal professional.

An amendment to the trust agreement serves as a document that alters specific terms within the original trust. It allows the trustor to make changes without rewriting the entire agreement. These changes might involve updating beneficiaries, altering asset distributions, or addressing new circumstances. Utilizing the Florida General Form of Amendment of Trust Agreement simplifies this process.

One significant mistake parents make when creating a trust fund is failing to communicate their intentions. Clear communication about the purpose of the trust can prevent confusion among beneficiaries. Additionally, not regularly reviewing or amending the trust can lead to unintended consequences. Consider using the Florida General Form of Amendment of Trust Agreement to keep your trust aligned with your goals.

To amend a trust, you generally need to draft a Florida General Form of Amendment of Trust Agreement. This form clearly outlines the changes you wish to make. Once completed, it's vital to ensure that it complies with Florida law. After drafting, you can sign the amendment in front of witnesses to validate it.