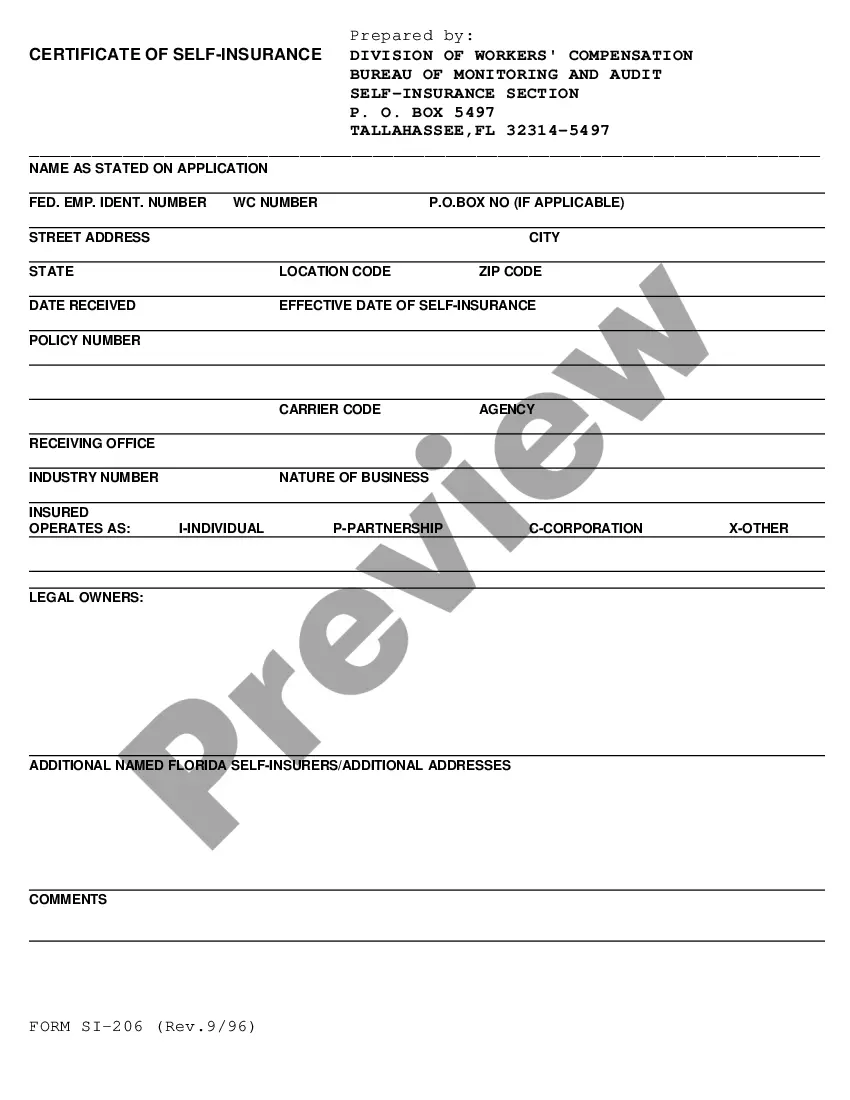

Florida Certification of Servicing for Self-Insurers

Description

How to fill out Florida Certification Of Servicing For Self-Insurers?

Obtain entry to one of the most comprehensive collections of legal documents.

US Legal Forms is a platform to locate any state-specific document in just a few clicks, including Florida Certification of Servicing for Self-Insurers samples.

There's no need to waste time searching for a court-admissible document. Our expert professionals guarantee you receive current examples at all times.

After you select a pricing option, create your account. Make the payment via credit card or PayPal. Save the document to your device by clicking the Download button. That's it! You simply need to complete the Florida Certification of Servicing for Self-Insurers form and check out. To ensure that everything is correct, consult your local legal advisor for assistance. Sign up and easily browse over 85,000 useful forms.

- To utilize the forms library, select a subscription and register an account.

- If you have already created one, simply Log In and then click Download.

- The Florida Certification of Servicing for Self-Insurers template will be quickly saved in the My documents tab (a section for all forms you retrieve from US Legal Forms).

- To establish a new account, follow the straightforward instructions listed below.

- If you're planning to use a state-specific template, ensure you indicate the correct state.

- If possible, review the description to understand all the intricacies of the document.

- Utilize the Preview feature if it is available to examine the document's details.

- If everything appears accurate, click Buy Now.

Form popularity

FAQ

To become a self-insured company in Florida, you first need to apply for the Florida Certification of Servicing for Self-Insurers. This process includes proving your financial capability to cover any liabilities that may arise. You should gather all necessary documentation and consider how you will manage risk effectively. Engaging with US Legal Forms can assist in navigating the complex requirements, ensuring your application is thorough and complete.

Becoming a self-insured trucking company involves understanding the requirements of the Florida Certification of Servicing for Self-Insurers. You must demonstrate financial stability and a viable plan for handling claims. Your company needs to maintain adequate reserves and show readiness to bear potential liabilities from accidents or damages. Using platforms like US Legal Forms can simplify the documentation and compliance processes, guiding you through necessary paperwork and regulations.

To qualify for the Florida Certification of Servicing for Self-Insurers, businesses typically need to have a minimum of 25 vehicles. This threshold ensures that the self-insured entity can manage the risks associated with operating a significant fleet. By being self-insured, you can save costs on premiums while maintaining coverage for liability and physical damage. It's crucial to review your specific needs and consider consulting a professional for tailored advice.

In Florida, self-insuring a vehicle is allowed if you have enough financial resources to cover potential damages and liabilities. However, most individuals opt for traditional auto insurance to meet state requirements. If you are considering self-insurance for your vehicle, it's wise to explore various coverage options and consult with insurance experts to ensure compliance and coverage.

Certification of self-insurance is a legal acknowledgment that a business can independently cover its workers' compensation claims without relying on traditional insurance. In Florida, businesses must acquire a Florida Certification of Servicing for Self-Insurers, which assesses their financial capability and readiness to handle potential claims. This certification provides reassurance to employers and employees alike.

In Florida, most employers are required to carry workers' compensation insurance if they have four or more employees. However, having a Florida Certification of Servicing for Self-Insurers allows businesses to fulfill this requirement through self-insurance, providing greater flexibility. Small businesses should assess their employee count to determine their obligations.

A major disadvantage of a self-insured program is the potential risk of unexpected claims. If your business underestimates the costs of injuries or claims, it could lead to financial strain. Therefore, it is essential to have a robust financial strategy and, ideally, obtain a Florida Certification of Servicing for Self-Insurers to manage risks effectively.

Yes, you can self-insure workers' compensation in Florida if you meet the state's requirements. Obtaining a Florida Certification of Servicing for Self-Insurers is crucial for this process, as it verifies your ability to cover potential claims. Many businesses choose this route to save on costs and simplify their insurance management.

Yes, Florida allows self-insurance for certain businesses that can meet the necessary requirements. To operate as a self-insured entity, you must obtain a Florida Certification of Servicing for Self-Insurers and prove your financial capability to handle claims. This option can benefit businesses looking for more control over their workers' compensation coverage.

In Florida, independent contractors generally do not require workers' compensation insurance unless they are working in certain high-risk industries. However, having a Florida Certification of Servicing for Self-Insurers can provide additional security in case of workplace injuries. Independent contractors should assess their risks and consider insurance options based on their specific situations.