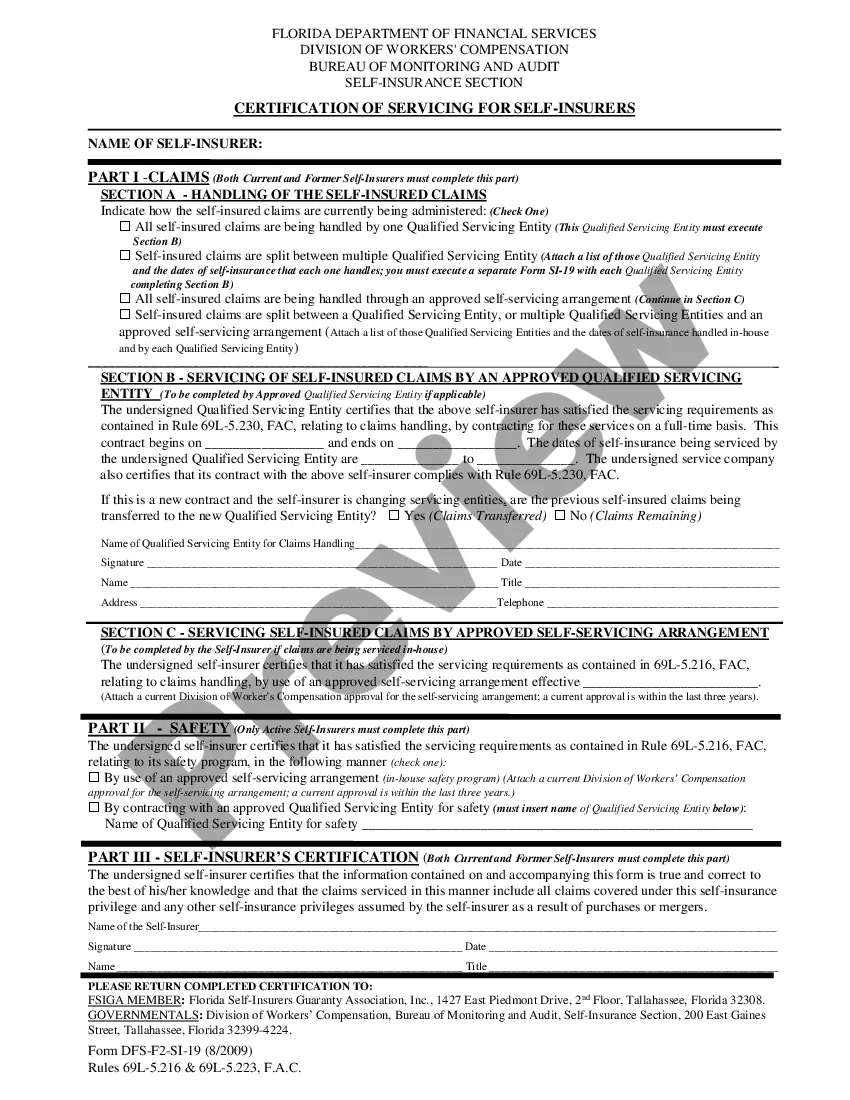

Florida Certificate of Self-Insurance

Description

How to fill out Florida Certificate Of Self-Insurance?

Gain access to one of the most comprehensive collections of approved forms.

US Legal Forms is a platform where you can discover any state-specific document within a few clicks, including examples of the Florida Certificate of Self-Insurance.

No need to waste hours of your time searching for a court-acceptable template.

After selecting a pricing plan, create an account. Pay using a card or PayPal. Download the template to your device by clicking Download. That's it! You should complete the Florida Certificate of Self-Insurance form and verify it. To ensure everything is correct, consult your local legal advisor for assistance. Register and easily browse over 85,000 valuable forms.

- To utilize the documents library, select a subscription and establish your account.

- Once created, simply Log In and click on the Download button.

- The Florida Certificate of Self-Insurance template will promptly be saved in the My documents section (a section for every document you store on US Legal Forms).

- To create a new account, adhere to the simple steps outlined below.

- When using a state-specific document, make sure to specify the correct state.

- If feasible, read the description to grasp all details of the form.

- Use the Preview option if available to examine the document's content.

- If all is accurate, click the Buy Now button.

Form popularity

FAQ

Proof of self-insurance is a document that verifies your financial ability to cover losses without traditional insurance. This can be provided through a Florida Certificate of Self-Insurance. This certificate serves as evidence to state authorities and others that you are financially dependable.

Yes, Florida does allow self-insurance, especially for vehicles and properties. By obtaining a Florida Certificate of Self-Insurance, you can legally prove your ability to cover potential damages. It's crucial to comply with state regulations to ensure that you remain protected.

Yes, you can insure a home you built yourself, provided it meets local building codes. Alternatively, with a Florida Certificate of Self-Insurance, you can manage the risks independently. Just ensure that your home complies with all legal requirements to protect your investment.

You are self-insured if you do not rely on an insurance policy to cover losses and instead utilize your own funds. Assess your savings and financial situation to determine if you have sufficient resources to handle potential damages. You may also want to maintain a detailed budget for transparency.

Self-insuring your home can be a wise choice if you are financially prepared for unexpected events. It allows for greater control over your finances, but it also carries risks. You should carefully evaluate your assets and your ability to absorb potential losses.

Yes, you can self-insure your house in Florida. This option allows you to manage your financial risks independently. However, you must ensure you have adequate funds to cover any potential damages or losses.

Yes, Florida allows digital proof of insurance. You can present electronic documents as evidence of your coverage. However, it is essential that these documents meet certain criteria, including being clearly visible and accessible.

To become self-insured in Florida, you must demonstrate financial stability and the ability to cover future claims. Generally, this involves maintaining significant reserves or liquid assets to cover potential liabilities. Additionally, you must apply and obtain a Florida Certificate of Self-Insurance from the state, ensuring you meet all regulatory requirements. Resources like USLegalForms can help streamline this process, guiding you through the necessary steps.

A major disadvantage of a self-insured program is the potential for overwhelming costs in the event of large claims. Unlike conventional insurance, where a provider absorbs these costs, self-insurance places the financial burden directly on you. Therefore, not sufficiently preparing for unexpected liabilities can have negative financial repercussions. It’s essential to weigh these risks carefully when seeking a Florida Certificate of Self-Insurance.

One disadvantage of self-insured plans includes the unpredictability of financial exposure, as claims can vary widely in costs. Additionally, managing your claims can become time-consuming and complex, requiring expertise to navigate effectively. Finally, without a safety net like traditional insurance, you may risk facing significant losses in adverse situations.