Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Fiduciary Deed for Use by Executors Trustees - This specific type of deed is used in the transfer of property on behalf of a decedent's estate. The document is executed by an estates executor or the trustee handling the estates assets under a trust. In the U.S., this legal document ensures that the property is transferred in accordance with the wishes of the deceased and under the law guiding trusts and estates.

Step-by-Step Guide

- Understanding the Responsibility: Identify the responsibilities as an executor or trustee, which involves managing and distributing the estate's assets legally and ethically.

- Obtaining the Fiduciary Deed: Consult with a legal expert to obtain the correct fiduciary deed forms that comply with state laws where the property is located.

- Completing the Deed: Fill out the deed accurately, ensuring all details like property description, beneficiary details, and terms of the trust or will are correct.

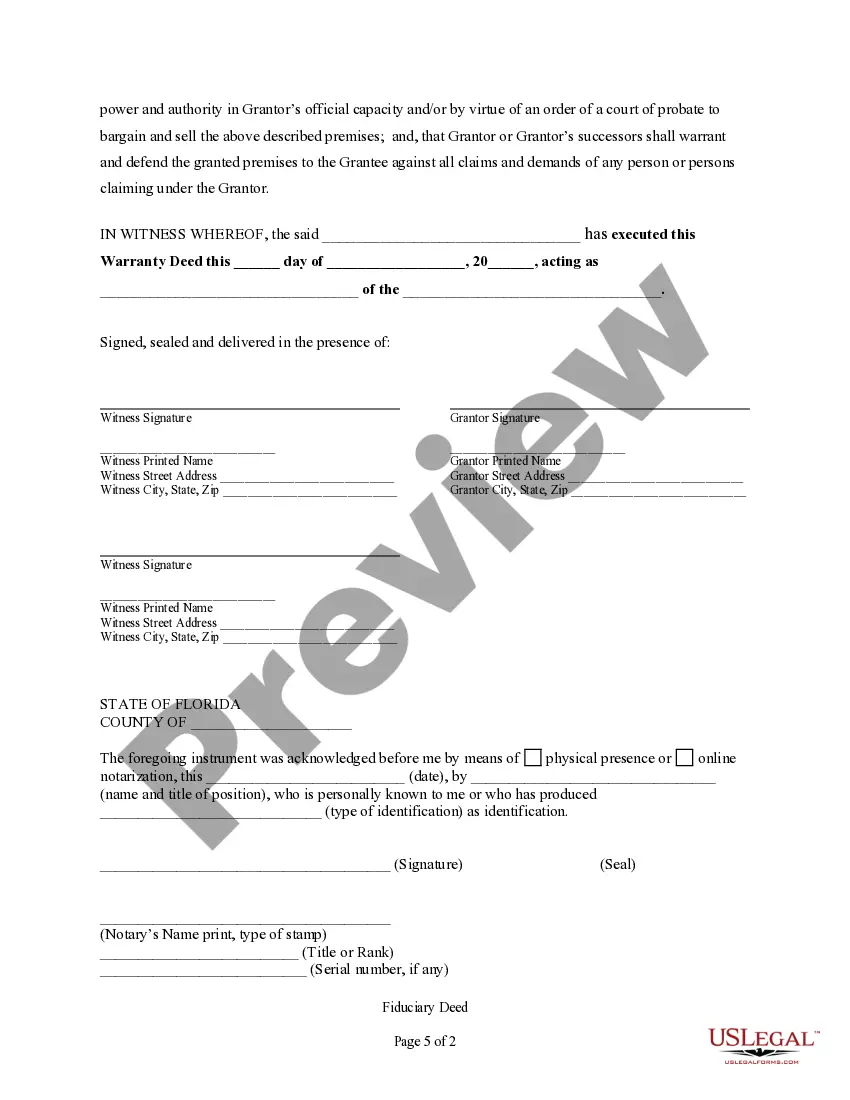

- Signing and Notarization: The deed must be signed in the presence of a notary to ensure its authenticity and validity.

- Recording the Deed: File the completed, signed, and notarized deed with the appropriate county recorder's office to make the transfer official.

Risk Analysis

The use of a fiduciary deed involves several risks such as incomplete transfer of title if not properly executed, potential conflicts among beneficiaries if terms are not clearly outlined or followed, and legal challenges that can arise from heirs or other interested parties. It's crucial for executors and trustees to handle the process with utmost precision and legal guidance.

Key Takeaways

- Fiduciary deeds are crucial for lawful property transfer from estates.

- Executors and trustees must handle fiduciary deeds with precision to avoid legal repercussions.

- Proper legal guidance and state law compliance are essential throughout the process of transferring property through a fiduciary deed.

Best Practices

- Always consult with legal professionals experienced in estate planning and property laws.

- Double-check all entries on the fiduciary deed form for accuracy and completeness.

- Maintain transparency with all beneficiaries regarding steps being taken during the property transfer process.

Common Mistakes & How to Avoid Them

- Incorrect Property Description: Always verify the legal description of the property with existing property records.

- Failure to Properly Notarize: Ensure the deed signing is witnessed by a certified notary public.

- Omitting Necessary Documentation: Confirm that all necessary supporting documents are attached before filing the deed.

How to fill out Florida Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among countless no-cost and paid samples that you can locate online, you cannot guarantee their precision.

For instance, who generated them or if they possess the necessary qualifications to manage what you require them for.

Always stay calm and make use of US Legal Forms!

Review the file by examining the description using the Preview feature.

- Obtain Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries templates crafted by experienced attorneys.

- Steer clear of the expensive and lengthy process of searching for a lawyer and subsequently paying them to draft a document for you that you can easily find on your own.

- If you have a membership, Log In to your account and locate the Download button next to the file you are seeking.

- You will also have access to your previously downloaded templates in the My documents section.

- If this is your first time using our platform, follow the steps outlined below to quickly obtain your Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

- Verify that the document you find is applicable in your locality.

Form popularity

FAQ

While there are benefits to placing your house in a trust, there are also disadvantages to consider. This may include costs related to setting up and maintaining the trust, which can be higher than simply retaining ownership. Additionally, some assets may lose certain protections or benefits when placed in a trust. Evaluating your situation carefully can help you determine if a Florida Fiduciary Deed is the right choice for you.

To transfer a deed to a trust in Florida, you will need to execute a Florida Fiduciary Deed that identifies the trust as the new owner. Begin by gathering information about your property and drafting the deed, which must detail the trust and comply with Florida laws. You will also need to sign the deed in front of a notary and file it with the local property records office. This process effectively shifts ownership to the trust.

Transferring property into a trust in Florida involves executing a Florida Fiduciary Deed that names the trust as the grantee. First, you must draft the trust document, specifying the terms of the trust and the property involved. Once you complete the deed, sign it in front of a notary public and record it with the county clerk. This process secures your property within the trust structure.

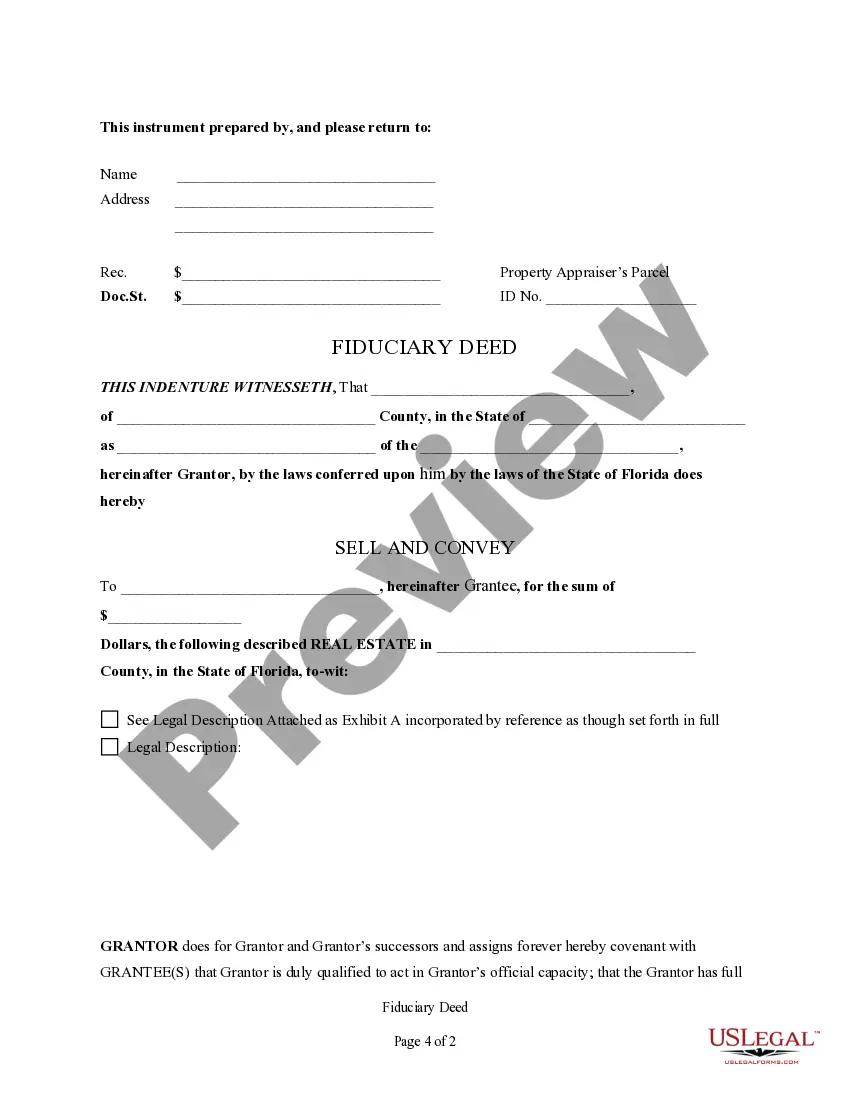

To create a valid Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, specific requirements must be met. The deed needs to be in writing, signed by the grantor, and properly witnessed. It should also include a legal description of the property and be notarized. Following these steps ensures that your deed is valid and enforceable.

A fiduciary deed is a specific legal document used by Executors, Trustees, Trustors, Administrators, and other Fiduciaries to transfer property on behalf of an estate or trust. This type of deed confirms the authority of the fiduciary to act in the best interest of the beneficiaries. When properly executed, a Florida Fiduciary Deed provides a transparent and legally binding way to handle property transfers. Utilizing our platform, you can easily create your fiduciary deed and ensure all details are correctly addressed.

In Massachusetts, there are several types of deeds to consider, including warranty deeds, quitclaim deeds, and fiduciary deeds. Each deed serves a different purpose, but a vital type for Executors, Trustees, Trustors, Administrators, and other Fiduciaries is the Florida Fiduciary Deed. This type of deed allows fiduciaries to manage and transfer property rights in a clear, legal manner. Understanding these options can help you navigate the complexities of property transfer effectively.

A fiduciary deed is used primarily to transfer property when the person managing the assets, such as an Executor or Trustee, is acting on behalf of another individual or estate. It plays a crucial role in the administration of estates, helping to ensure assets are distributed as intended. Utilizing a Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries ensures clear legal authority and fosters confidence in property transactions.

A trustee's deed in Florida is a specific type of deed used when a trustee, acting under a trust, transfers property to a beneficiary or another party. This deed adheres to Florida laws regarding trust management and ensures the transfer is executed legally. It is essential to have proper documentation, including a Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, to facilitate these transactions smoothly.

The safest type of deed is usually the warranty deed, as it provides the grantee with guarantees regarding the property's title. However, in terms of fiduciary responsibilities, a Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is designed to protect both the fiduciary and the beneficiary. It offers a well-defined legal framework that helps minimize disputes or claims over the property.

In Massachusetts, a fiduciary deed serves a similar purpose as in Florida, facilitating property transfers by someone who is acting in a fiduciary capacity. It allows Executors or Administrators to manage and distribute a deceased person's estate legitimately. Understanding the rules surrounding fiduciary deeds in different states, including Florida Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, is important for ensuring compliance with local laws.