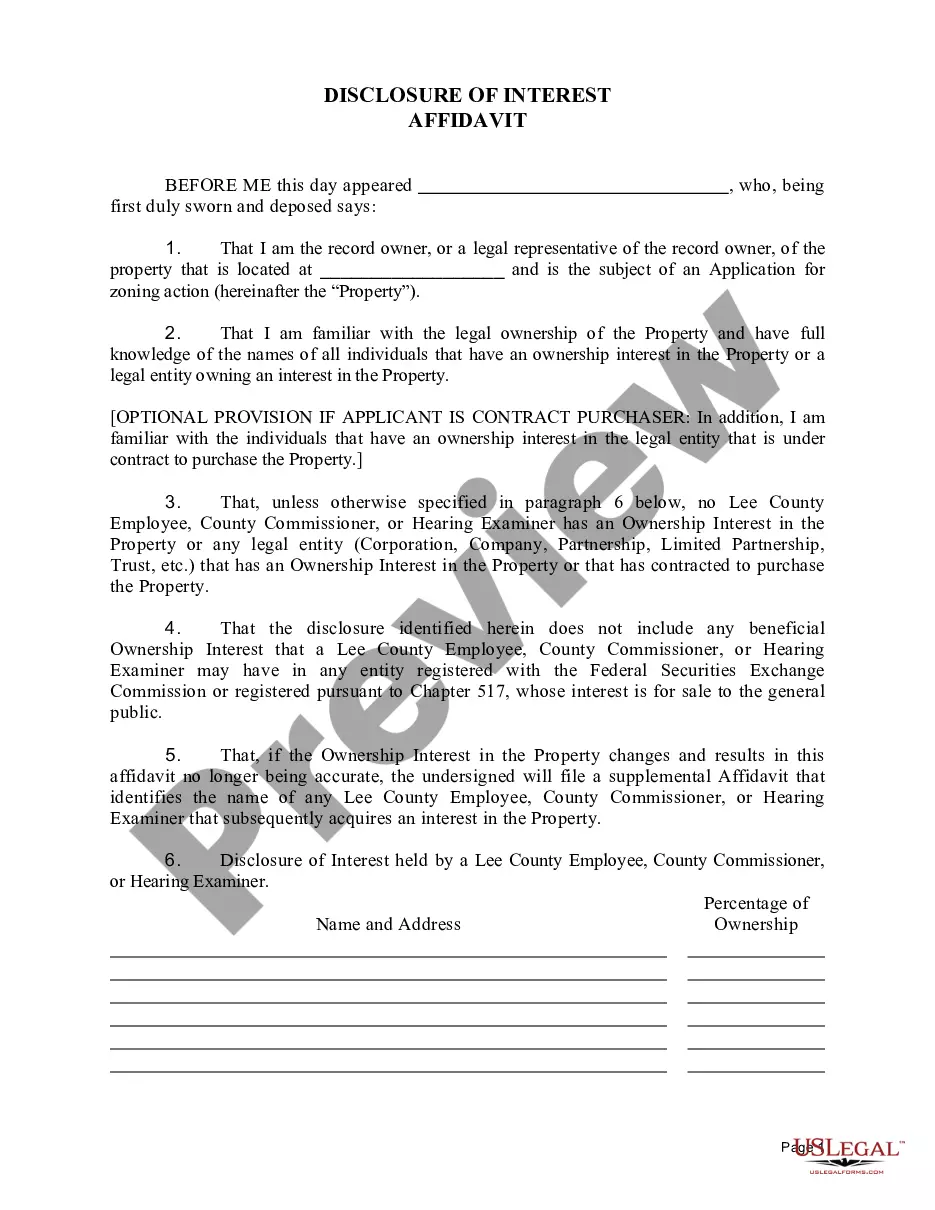

The Florida Disclosure of Interest Affidavit is a form that is used to disclose any conflicts of interest that may arise between a company and its officers, directors, shareholders, or other individuals in a business or financial transaction. The affidavit is filed with the Florida Secretary of State. It is used to ensure proper disclosure of any conflicts of interest that may arise from the transaction, and to ensure that all parties involved are aware of the potential risks and rewards associated with the transaction. There are two types of Florida Disclosure of Interest Affidavit: the Initial Disclosure of Interest Affidavit and the Amended Disclosure of Interest Affidavit. The Initial Disclosure of Interest Affidavit is used when a new transaction is being entered into, and it must be filed with the Secretary of State within 10 days of the transaction. The Amended Disclosure of Interest Affidavit is used to update the information in the Initial Disclosure of Interest Affidavit, and to report on any changes in the transaction that have occurred since the initial filing. This affidavit must be filed with the Secretary of State within 10 days of any such changes.

Florida Disclosure of Interest Affidavit

Description

Key Concepts & Definitions

Disclosure of Interest Affidavit: A legal document used to formally declare a party's financial and personal interest in a particular transaction to avoid conflicts of interest. Commonly used in real estate development and small business operations, particularly when transactions may affect property values in regions like Lee County, Florida.

Financial Penalty Document: Refers to documents that impose penalties on a party due to financial misconduct or breaches, often used in situations involving landlord tenant information discrepancies or violations.

Step-by-Step Guide

- Identifying the Need: Determine if a Disclosure of Interest Affidavit is required due to personal or financial interest in a transaction, based on state or local laws in places like Lee County.

- Gathering Information: Compile necessary information regarding the interest, including details about real estate holdings, small business interests, or any other relevant investments.

- Completing the Affidavit: Use a professional legal form designed for the specific state, such as Florida, to assure all legal criteria are met.

- Submission: Submit the affidavit to the relevant legal or governmental bodies and involved parties.

- Continued Compliance: Keep records of all disclosed interests and update the affidavit as required.

Risk Analysis

- Legal Risks: Failing to submit a Disclosure of Interest Affidavit can lead to legal repercussions, including financial penalties.

- Financial Risks: Undisclosed interests can impact personal investment decisions and credit score, potentially derailing important financial operations like credit score improvement.

- Reputation Risks: Non-compliance can harm one's reputation, significantly affecting future business and personal dealings in tight-knit communities like those in Lee County, Florida.

Best Practices

- Use Professional Legal Forms: Always use up-to-date, professionally prepared documents like those for a 'name change pdf' or 'online document convert' tools to ensure legal validity.

- Regular Updates: Consistently update your disclosure affidavit to reflect any changes in interests, especially critical in rapidly developing regions like Lee County, Florida.

- Thorough Documentation: Maintain meticulous records of all disclosures and relevant documents to aid in legal or financial audits.

How to fill out Florida Disclosure Of Interest Affidavit?

Handling official documentation necessitates focus, accuracy, and utilizing correctly-formulated templates. US Legal Forms has been assisting individuals across the country for a quarter of a century, so when you select your Florida Disclosure of Interest Affidavit template from our platform, you can be confident it adheres to federal and state regulations.

Interacting with our platform is straightforward and efficient. To acquire the required document, all you’ll need is an account with an active subscription. Here’s a concise guide for you to secure your Florida Disclosure of Interest Affidavit in just minutes.

All documents are created for multiple uses, like the Florida Disclosure of Interest Affidavit you see on this page. If you require them in the future, you can complete them without repaying - simply access the My documents tab in your profile and finish your document whenever you need it. Try US Legal Forms and prepare your business and personal documents swiftly and in full legal compliance!

- Ensure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or reading its overview.

- Seek an alternative official template if the one you initially accessed does not meet your circumstances or state regulations (the option for this is located in the corner at the top of the page).

- Log in to your account and download the Florida Disclosure of Interest Affidavit in your desired format. If it’s your initial experience with our service, click Buy now to continue.

- Sign up for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Determine in which format you wish to receive your form and click Download. Print the template or upload it to a professional PDF editor to submit it without paper.

Form popularity

FAQ

Florida Form 6 must be filed by property owners who hold homestead exemptions or certain other exemptions on their real property. This form gathers essential information about the property and confirms the eligibility for continued exemption. Failure to file could lead to losing those valuable exemptions. Incorporating your Florida Disclosure of Interest Affidavit can provide clarity on your property interests.

Form 6 is designed for certain property owners, primarily those who have received a tax exemption and need to submit the appropriate documentation to maintain it. Filing this form is crucial for documenting any changes in ownership or changes in the use of the property. Properly managing your filings aids in transparency and compliance. Your Florida Disclosure of Interest Affidavit may support your claims related to property ownership.

All property owners in Florida must file a property tax return if they own, maintain, and use property within the state. This return helps assess the value of your property for tax purposes. Filing accurately ensures you comply with local tax laws and can prevent unexpected liabilities. Don't forget the importance of your Florida Disclosure of Interest Affidavit in this process.

Form 1 in Florida is primarily filed by individuals who are claiming a homestead exemption on their property tax. This form assists property owners in reducing their tax burden by providing the necessary details of their residence. It’s crucial to file accurately to benefit from the exemption. Consider including your Florida Disclosure of Interest Affidavit to affirm your ownership interests.

Florida partnerships are required to file a partnership return if they earn income from Florida sources. This return provides important financial information about the partnership’s income, deductions, and distributions. Filing ensures accurate reporting and compliance with state regulations. Utilizing resources like the Florida Disclosure of Interest Affidavit can help clarify ownership interests within your partnership.

In Florida, every business entity, including corporations and limited liability companies, must file an Annual Report. This report keeps your business's information up-to-date in the state's records. It is essential to stay compliant and ensure your business maintains its active status. Filing your Florida Disclosure of Interest Affidavit alongside other required documents can streamline your compliance process.

The Florida Commission on Ethics oversees ethical standards for public officials within the state. Its role includes enforcing compliance with disclosure laws and investigating violations. By promoting adherence to the Florida Disclosure of Interest Affidavit requirements, the Commission helps ensure public trust in government actions. Their efforts contribute significantly to maintaining integrity within Florida's political landscape.

Form 6 in Florida is used by specified individuals to disclose their financial interests, including all assets and liabilities exceeding a certain value. This form is part of the Florida Disclosure of Interest Affidavit and is essential for accountability in government. Completing Form 6 accurately helps to ensure public officials maintain transparency in their financial dealings. It is crucial for any public servant to understand their obligations regarding this form.

Florida Commission on Ethics Disclosure Forms are essential documents designed to promote transparency among public officials. These forms include various disclosures that cover financial interests, potential conflicts, and other relevant information. By utilizing the Florida Disclosure of Interest Affidavit and similar forms, officials ensure compliance with ethics laws. Understanding these forms is crucial for maintaining public trust.

The new financial disclosure law in Florida enhances transparency requirements for public officials. This law mandates more detailed reporting of financial interests, helping to identify potential conflicts more effectively. As part of this development, the Florida Disclosure of Interest Affidavit remains a critical tool for compliance. Staying informed about these changes can aid officials in fulfilling their obligations.