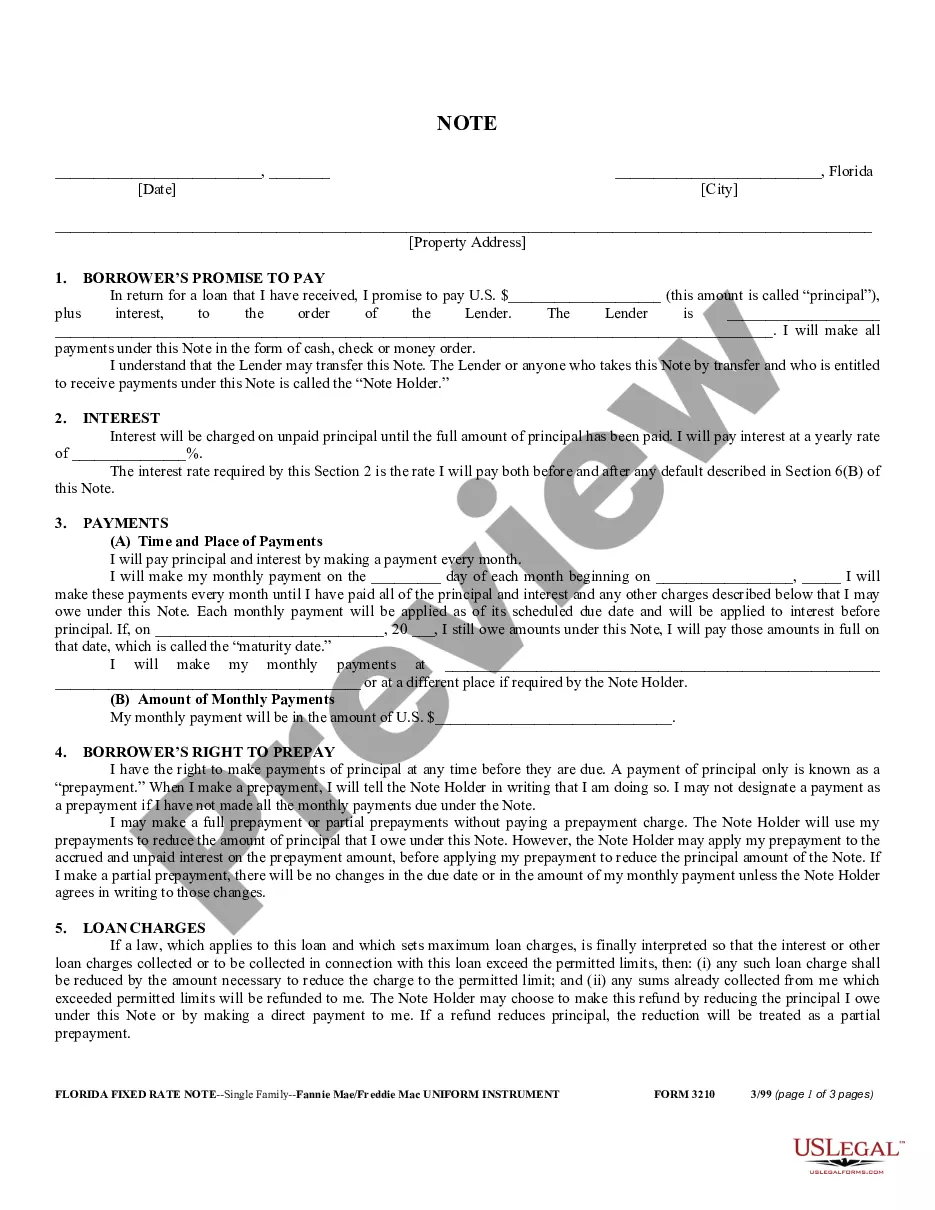

Florida Secured Promissory Note

Description

How to fill out Florida Secured Promissory Note?

Obtain the most extensive collection of approved forms.

US Legal Forms serves as a resource to locate any state-specific document with just a few clicks, including examples of Florida Secured Promissory Notes.

No need to squander hours searching for a court-acceptable template. Our expert professionals ensure that you receive the most recent documents at all times.

If everything is in order, click Buy Now. After selecting a pricing plan, create your account. Make payment via credit card or PayPal. Download the document by clicking the Download button. That’s it! You should complete the Florida Secured Promissory Note template and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and easily explore over 85,000 useful templates.

- To utilize the forms library, select a subscription and create your account.

- If you've set it up, simply Log In and then click Download.

- The Florida Secured Promissory Note template will be automatically saved in the My documents section (a section for every form you download from US Legal Forms).

- To establish a new profile, follow the straightforward instructions provided below.

- If you're planning to use a state-specific template, make sure you specify the correct state.

- If possible, examine the description to comprehend all the specifics of the form.

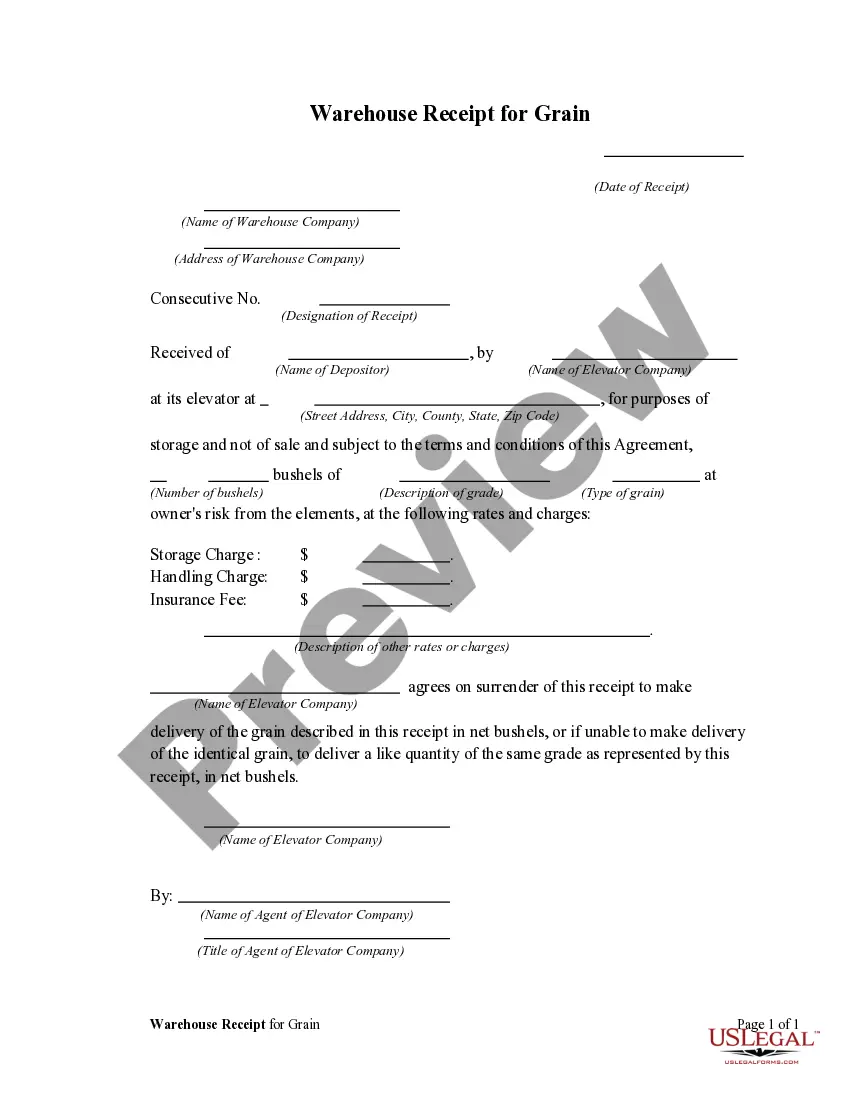

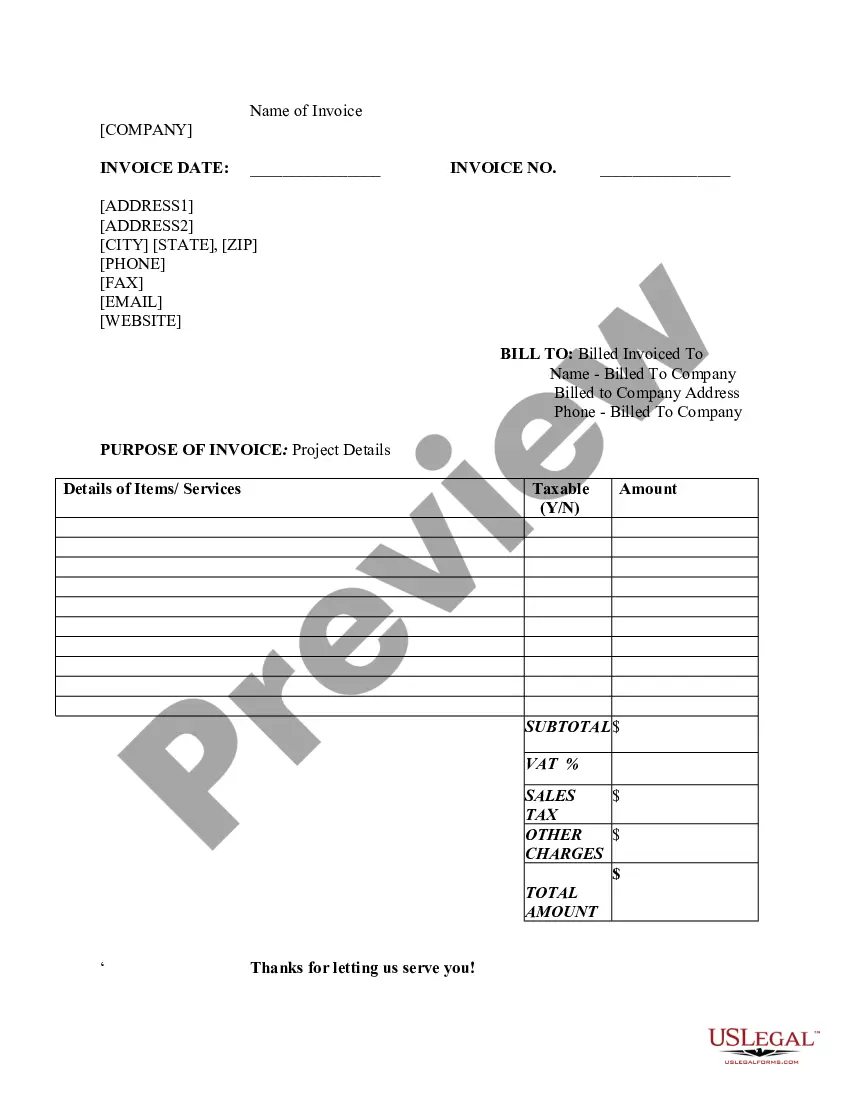

- Utilize the Preview feature if available to review the information in the document.

Form popularity

FAQ

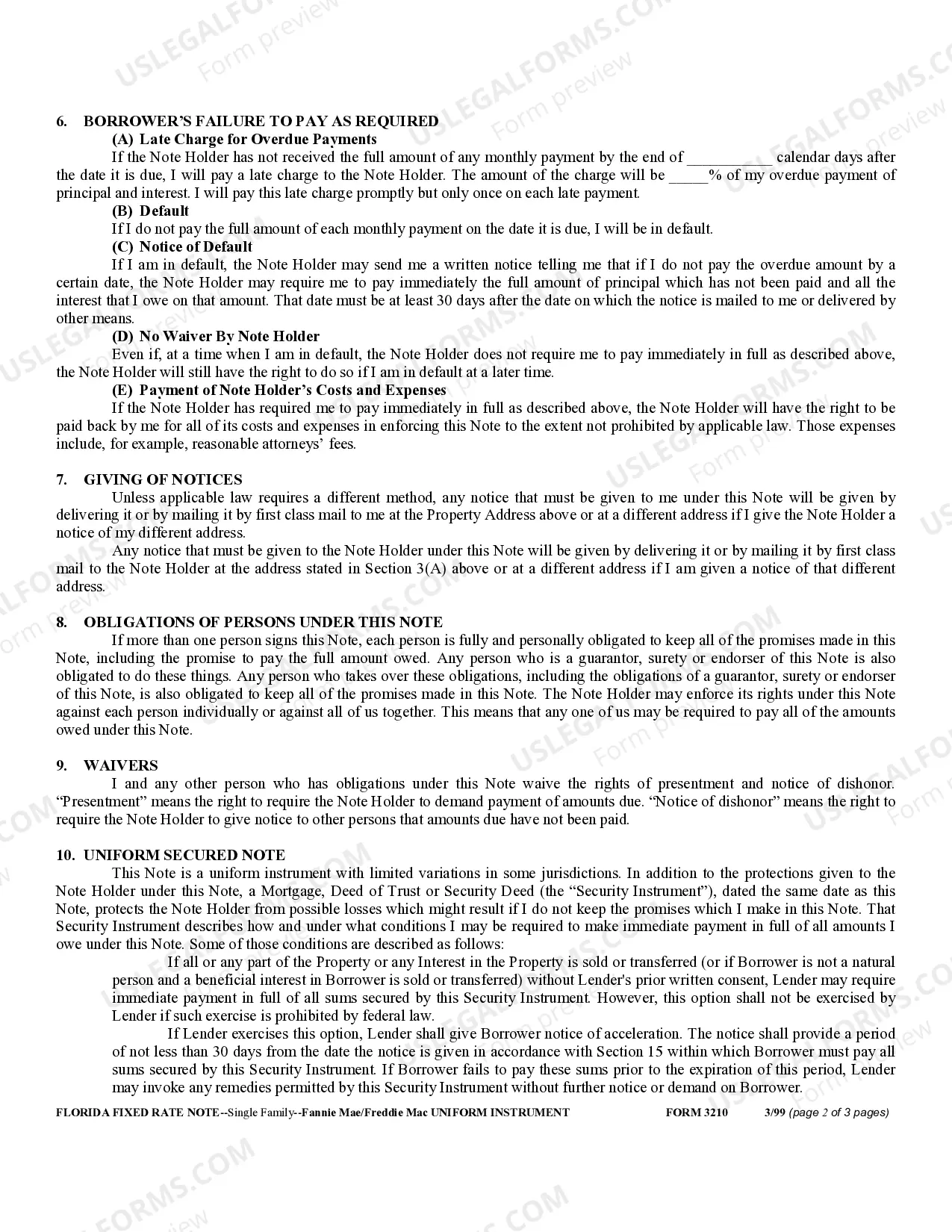

Notarization of a promissory note is not required by law, but it is highly recommended for added protection. A Florida Secured Promissory Note benefits from notarization, as it verifies the identities of the parties and confirms their willingness to enter into the agreement. This added layer can help prevent disputes and enhance the enforceability of the document. Consulting legal forms from US Legal Forms can guide you through the notarization process.

To create a legally binding promissory note, it must be signed by both the borrower and lender. In addition, for a Florida Secured Promissory Note to hold up in court, it should outline the terms clearly and should be in writing. Adding witnesses or having the document notarized can further strengthen its validity. Always ensure that both parties retain signed copies for their records.

To fill out a promissory note, you should include relevant details such as the names of the borrower and lender, the principal amount, interest rate, and repayment schedule. When preparing a Florida Secured Promissory Note, ensure all information is accurate and clearly stated. Review the document to confirm that it reflects the terms agreed upon by both parties. A well-prepared note sets a sound foundation for your financial agreement.

Yes, a handwritten promissory note can be legal as long as it meets essential legal requirements. A Florida Secured Promissory Note does not always need to be typed to be valid; however, it should include key elements such as the names of the parties, amount, and repayment terms. It is important, though, to ensure that the document is clear and unambiguous to avoid disputes in the future.

Recording a promissory note is not a legal requirement in most states, including Florida. However, it is advisable to record the note if it is secured by real estate or another significant asset. This action helps establish priority over potential claims from other creditors. With USLegalForms, you can efficiently create and record a Florida Secured Promissory Note that meets your specific needs.

While Florida law does not require the recording of a promissory note, recording it can provide legal advantages. Recording offers public notice which can protect your interests, especially if there are multiple claims on the property securing the note. To streamline this process, you might want to draft a Florida Secured Promissory Note using USLegalForms' tools, ensuring you cover all necessary steps.

When you hold a promissory note, you must report any interest income it generates on your tax return. The IRS considers this interest as taxable income, and you should receive a Form 1099-INT if you earn more than $10 in interest. To navigate the complexities of tax reporting, consider using resources like those available at USLegalForms to ensure compliance with tax regulations regarding your Florida Secured Promissory Note.

In Florida, it is not mandatory to record a secured promissory note, but doing so can provide additional legal protection. Recording creates a public record that establishes your rights and interests. This can be advantageous in case of disputes or if you need to enforce the note later. Consider using USLegalForms to help you draft and record a Florida Secured Promissory Note effectively.

Yes, a promissory note is enforceable in Florida as long as it meets specific legal requirements. Properly drafted notes with clear terms can be upheld in disputes. Using resources like USLegalForms can guide you through creating an enforceable Florida Secured Promissory Note, ensuring that your rights as a lender or borrower are protected.

Generally, a properly drafted Florida Secured Promissory Note is enforceable and can hold up in a court of law. Courts often uphold these agreements because they represent written evidence of a debt. However, having well-structured documentation, such as that available through USLegalForms, can enhance your chances of a favorable outcome.