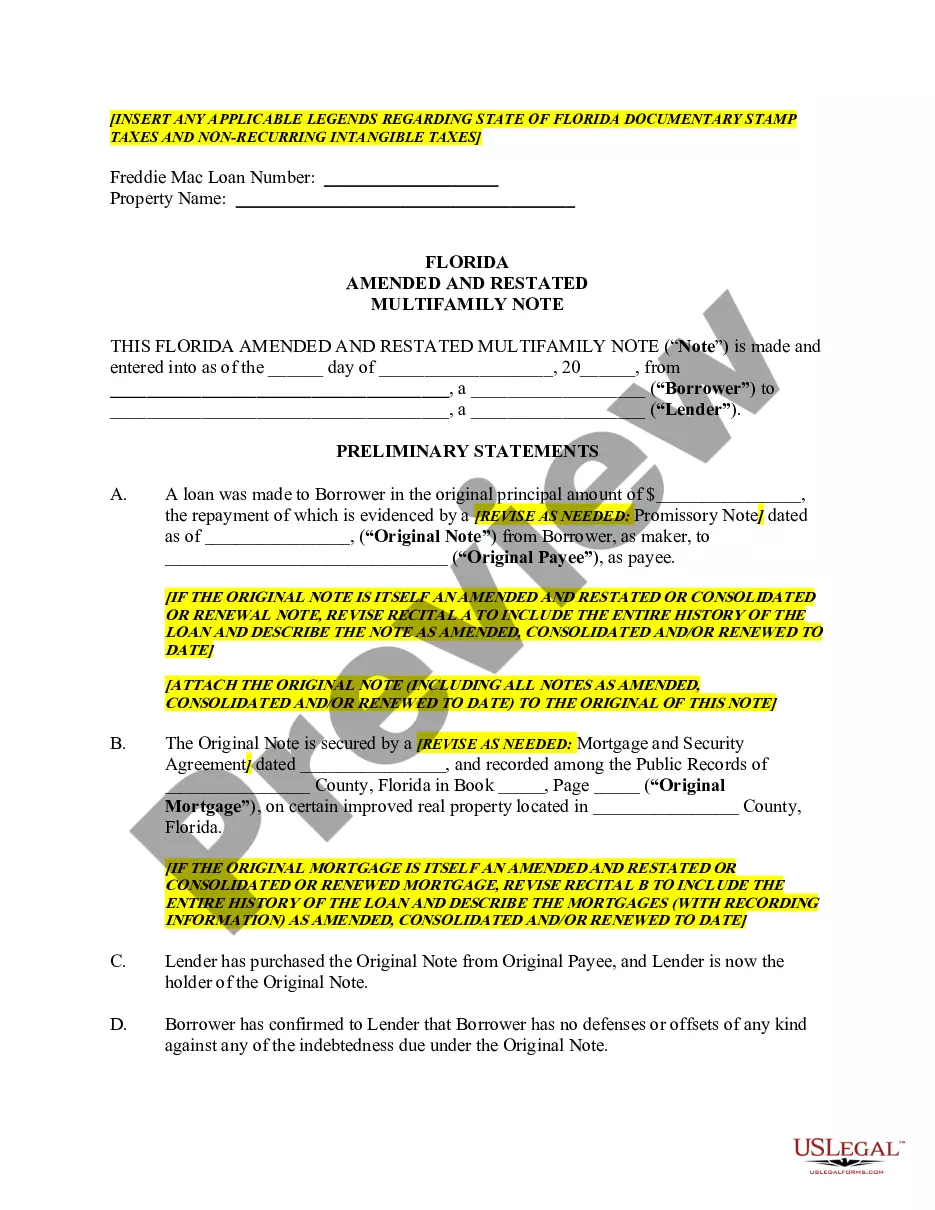

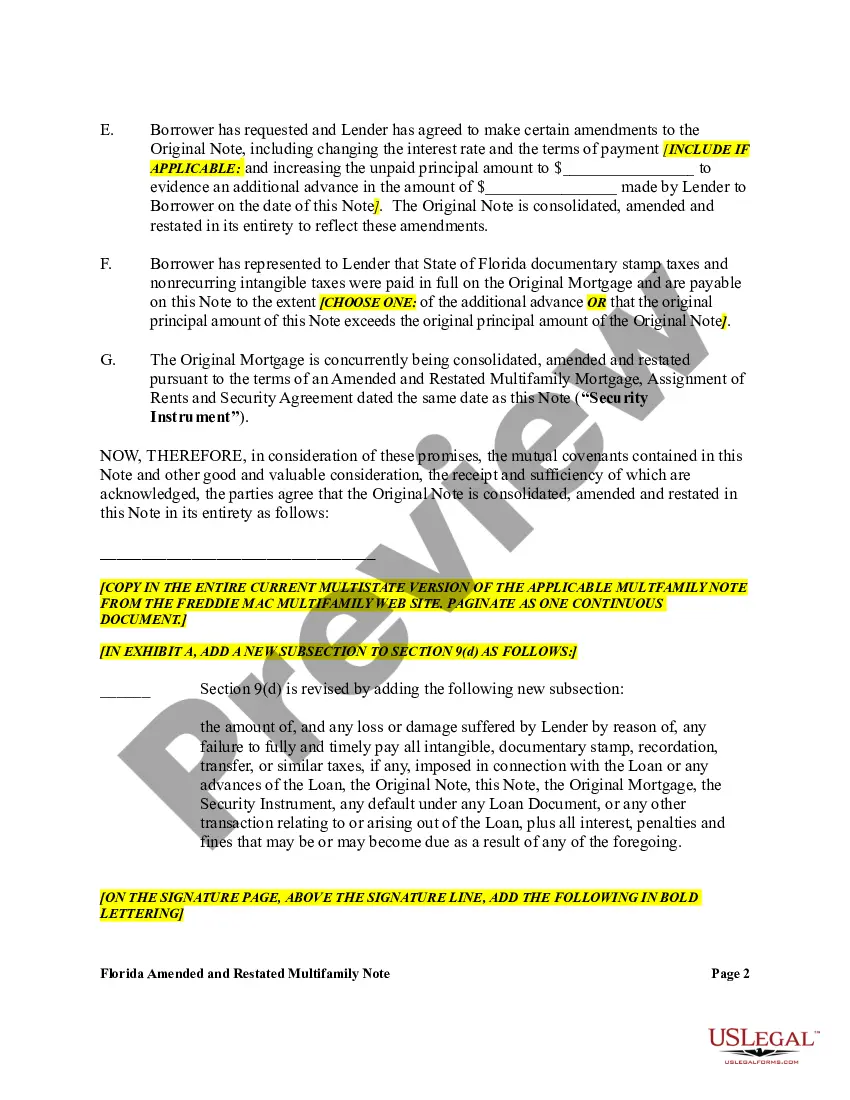

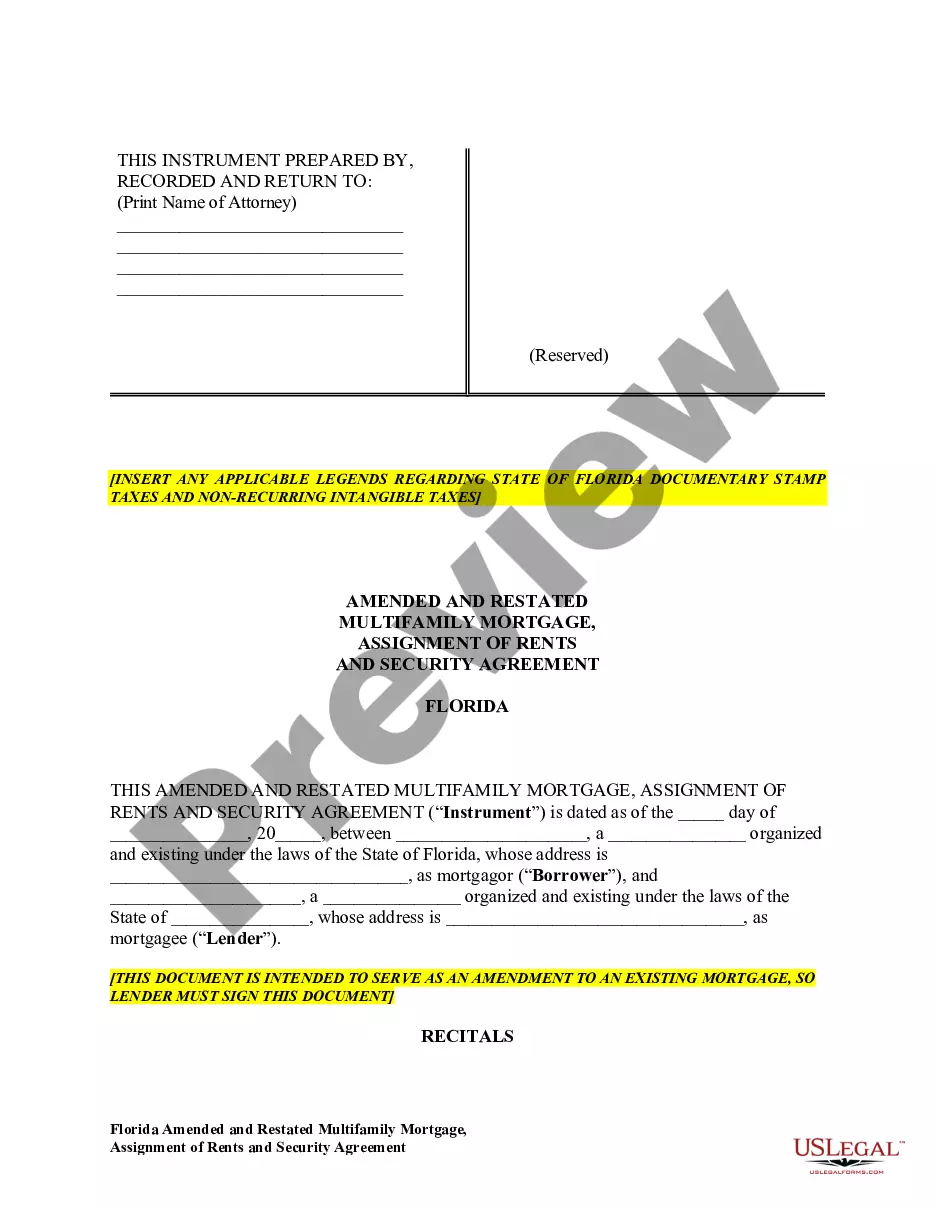

A Florida Amended and Restated Multifamily Promissory Note is a legal document used to document a loan agreement between a lender and borrower. This document is used when the terms of a loan are amended and/or restated. It typically includes the original loan amount, interest rate, repayment terms, due dates, and other pertinent information. The note is secured by a lien on the property that is the subject of the loan and is typically signed by both parties. There are three types of Florida Amended and Restated Multifamily Promissory Notes: Standard, Simultaneous Close, and Bridge. A Standard Florida Amended and Restated Multifamily Promissory Note is the most common type and is used when an existing loan is being amended and/or restated to reflect new terms or conditions. A Simultaneous Close Florida Amended and Restated Multifamily Promissory Note is used when a new loan is being taken out to replace an existing loan. A Bridge Florida Amended and Restated Multifamily Promissory Note is used when a borrower needs to borrow additional funds to bridge the gap between the existing loan and the new loan.

Florida Amended and Restated Multifamily Promissory Note

Description

How to fill out Florida Amended And Restated Multifamily Promissory Note?

If you’re seeking a method to properly finalize the Florida Amended and Restated Multifamily Promissory Note without enlisting a legal professional, then you’ve arrived at the perfect location.

US Legal Forms has established itself as the most comprehensive and esteemed collection of official templates for every personal and business scenario. Every document you discover on our online platform is crafted in accordance with federal and state laws, ensuring that your paperwork is accurate.

Another excellent feature of US Legal Forms is that you will never lose the documents you obtained - you can access any of your downloaded forms in the My documents section of your profile whenever you need them.

- Verify that the document displayed on the page aligns with your legal circumstances and state statutes by reviewing its text description or exploring the Preview mode.

- Input the document name into the Search tab at the top of the page and select your state from the dropdown menu to locate a different template if any discrepancies exist.

- Recheck the content and click Buy now when you are assured that the paperwork meets all the required standards.

- Log in to your account and hit Download. If you don’t already have one, sign up for the service and select a subscription plan.

- Utilize your credit card or the PayPal option to settle the payment for your US Legal Forms subscription. The document will be ready for download immediately afterward.

- Select the format in which you wish to save your Florida Amended and Restated Multifamily Promissory Note and download it by clicking on the corresponding button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

In Florida, the duration of a promissory note is typically governed by the terms specified within the document itself. Generally, a Florida Amended and Restated Multifamily Promissory Note can have a term of several years, depending on the agreement between the parties involved. It’s essential to keep in mind that the statute of limitations for enforcing a promissory note in Florida is typically five years. To ensure compliance with laws and terms, consider utilizing resources like the USLegalForms platform to create or review your Florida Amended and Restated Multifamily Promissory Note.

In Florida, a promissory note itself does not typically need to be recorded. However, if it is secured by a mortgage or other interest in property, recording the related security document is essential. Using the Florida Amended and Restated Multifamily Promissory Note ensures compliance with state requirements, and USLegalForms offers resources to help you navigate these legalities.

A restated promissory note is a document that incorporates all previous modifications into a new, clear format. It allows all parties to understand the current obligations without referring back to older versions. When dealing with a Florida Amended and Restated Multifamily Promissory Note, it becomes easier to navigate your financial responsibilities.

A restated agreement consolidates all previous amendments and clarifications into a single document. This helps clarify the current terms and conditions and eliminates confusion regarding past changes. For instance, a Florida Amended and Restated Multifamily Promissory Note provides a clear and updated reference point for all parties involved.

Yes, a promissory note can be amended. When you need to change terms or update conditions, you can create an amendment to reflect these changes. This flexibility is particularly important in financial agreements like the Florida Amended and Restated Multifamily Promissory Note, as it allows you to adapt to new circumstances without starting from scratch.

To ensure the validity of a promissory note in Florida, it must contain essential details like the names of both parties, the amount borrowed, and the repayment terms. A Florida Amended and Restated Multifamily Promissory Note should also include the lender's and borrower's signatures. Clarity and completeness are crucial in avoiding disputes later on. You can rely on platforms like uslegalforms to get customizable templates that include all necessary components.

A promissory note is enforceable in Florida, including the Florida Amended and Restated Multifamily Promissory Note, provided it meets specific legal requirements. This includes the signature of the borrower, a clear repayment plan, and the amount borrowed. If these conditions are satisfied, it may be presented in court if necessary. Using a comprehensive template can simplify this process.

In Florida, a promissory note may be considered invalid if it lacks critical elements such as signatures, specific terms, or clear identification of the parties involved. Additionally, failure to adhere to Florida’s legal requirements can also invalidate the note. To avoid these issues, ensure your Florida Amended and Restated Multifamily Promissory Note meets all legal standards.

To change a promissory note, both the lender and borrower must agree to the proposed adjustments. Start by documenting the changes in an amendment and ensure that both parties sign this new document. By utilizing a Florida Amended and Restated Multifamily Promissory Note template, you can simplify this process and ensure all necessary details are included.

A promissory note can be changed, provided both parties agree to the modifications. This usually involves drafting an amendment that specifies the alterations, which both parties must sign. It’s advisable to use a Florida Amended and Restated Multifamily Promissory Note template to help navigate this process seamlessly.