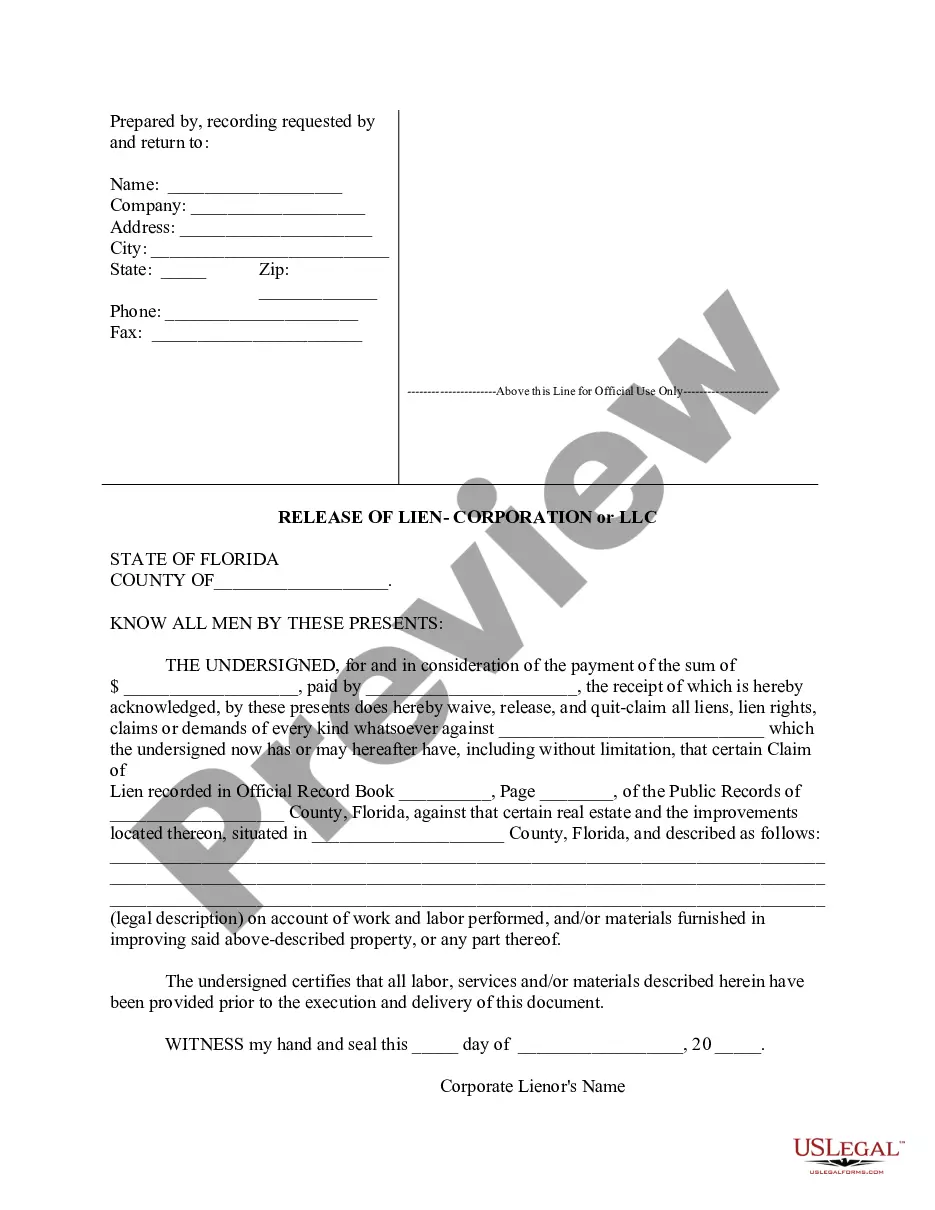

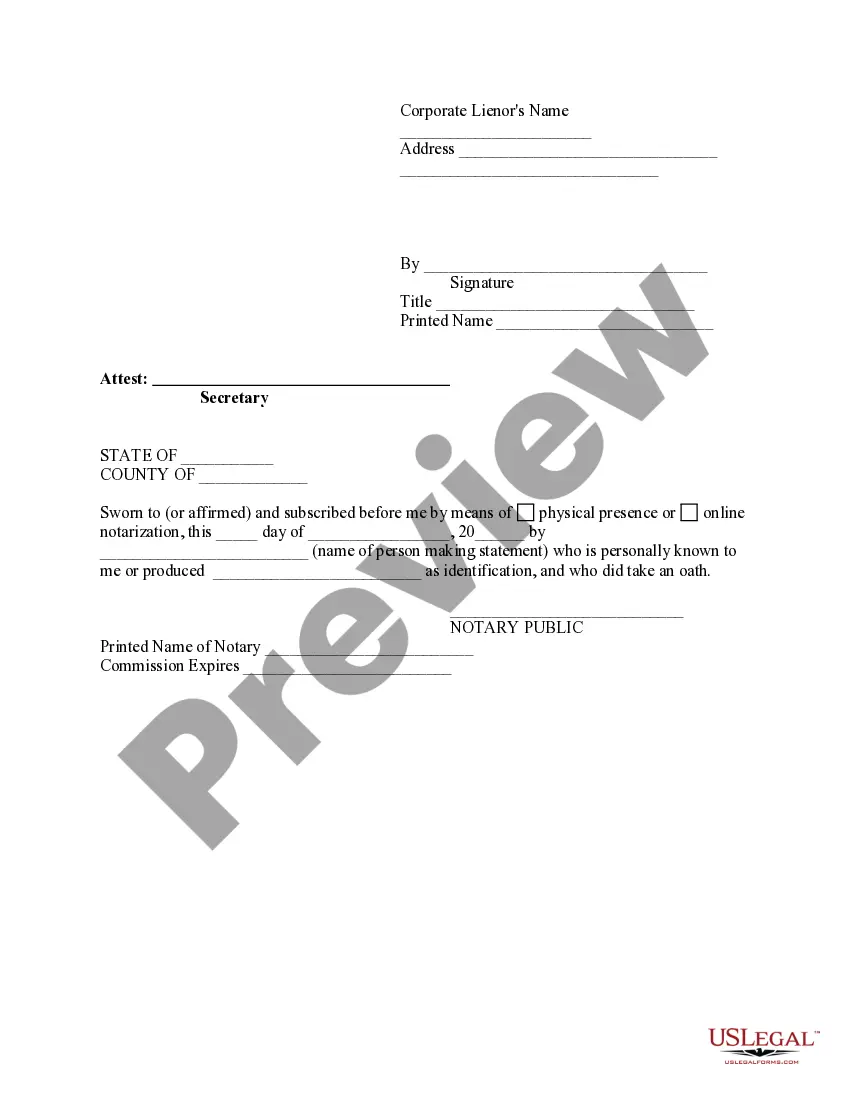

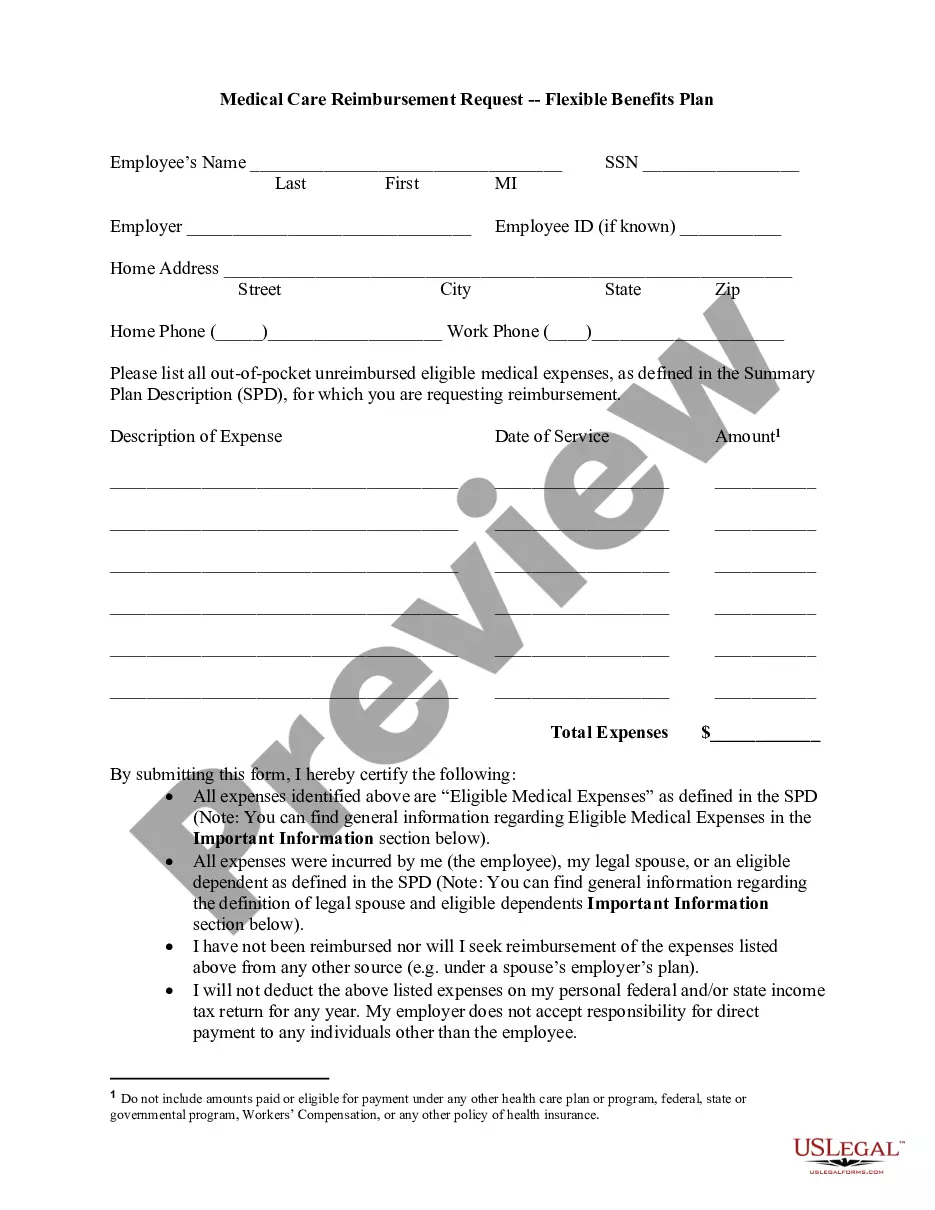

Release Of Lien Form - Construction - Mechanic Liens - Corporation or LLC

Release of Lien

#FL-03206

713.21 Discharge of lien.--A lien properly perfected under

this chapter may be discharged by any of the following methods:

(2) By the satisfaction of the lienor, duly acknowledged and

recorded in the clerk's office. Any person who executes a claim of lien

shall have authority to execute a satisfaction in the absence of actual

notice of lack of authority to any person relying on the same.

How to Order: To complete your order of the

form you have located, close this window and click on the order icon, or

Member Download link if you are a Registered User.

Help: If you need help locating a form, please use the Helpline

link on the main forms page.

Note: All Information and Previews are subject to the

Disclaimer located on the main forms page, and also linked at the bottom

of all search results.